When To File Form 3520

When To File Form 3520 - Person to file a form 3520 to report the transactions. Person receives a gift from a foreign person, the irs may require the u.s. For calendar year 2022, or tax year beginning , 2022,. Web file form 3520 by the 15th day of the fourth month following the end of the u.s. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. The form provides information about the foreign trust, its u.s. Send form 3520 to the. There are certain filing threshold. Web there are costly penalties for failing to file form 3520. Web the form 3520 is generally required when a u.s.

Person’s tax year, or april 15th for calendar year taxpayers, subject to any extension. Person receives a gift from a foreign person, the irs may require the u.s. Person to file a form 3520 to report the transactions. Web form 3520 is an information return for a u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web there are costly penalties for failing to file form 3520. The form provides information about the foreign trust, its u.s. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web form 3520 & instructions: Form 3520 carries severe penalties for failure to file, the first being the greater of $10,000 or 35% of the gross value of any.

Show all amounts in u.s. It does not have to be a “foreign gift.” rather, if a. The form provides information about the foreign trust, its u.s. But what happens if the taxpayer. Web form 3520 & instructions: Web there are costly penalties for failing to file form 3520. Web when a u.s. If the due date for filing the tax return is extended, the due date for filing the form 3520 is. Web all information must be in english. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000.

Your Chance of an IRS Audit is Way Down. But That’s Not Good News if

The form provides information about the foreign trust, its u.s. Web form 3520 is due at the time of a timely filing of the u.s. Web form 3520 & instructions: Form 3520 carries severe penalties for failure to file, the first being the greater of $10,000 or 35% of the gross value of any. But what happens if the taxpayer.

When to File Form 3520 Gift or Inheritance From a Foreign Person

Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Ad talk to our skilled attorneys by scheduling a free consultation today. Web all information must be in.

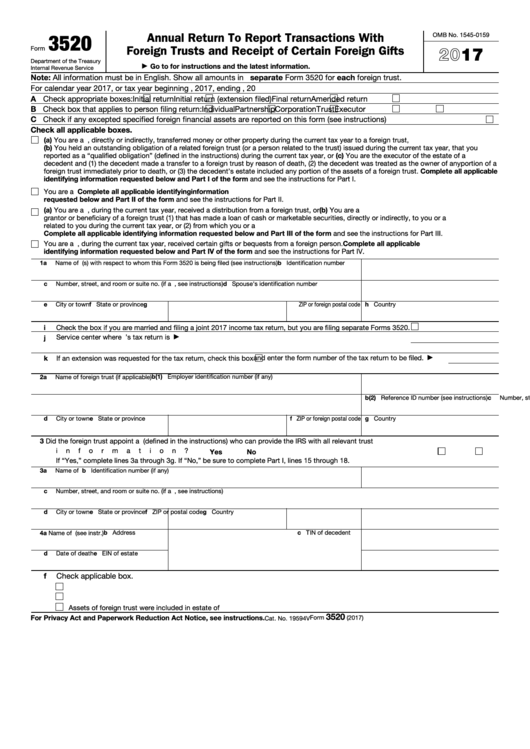

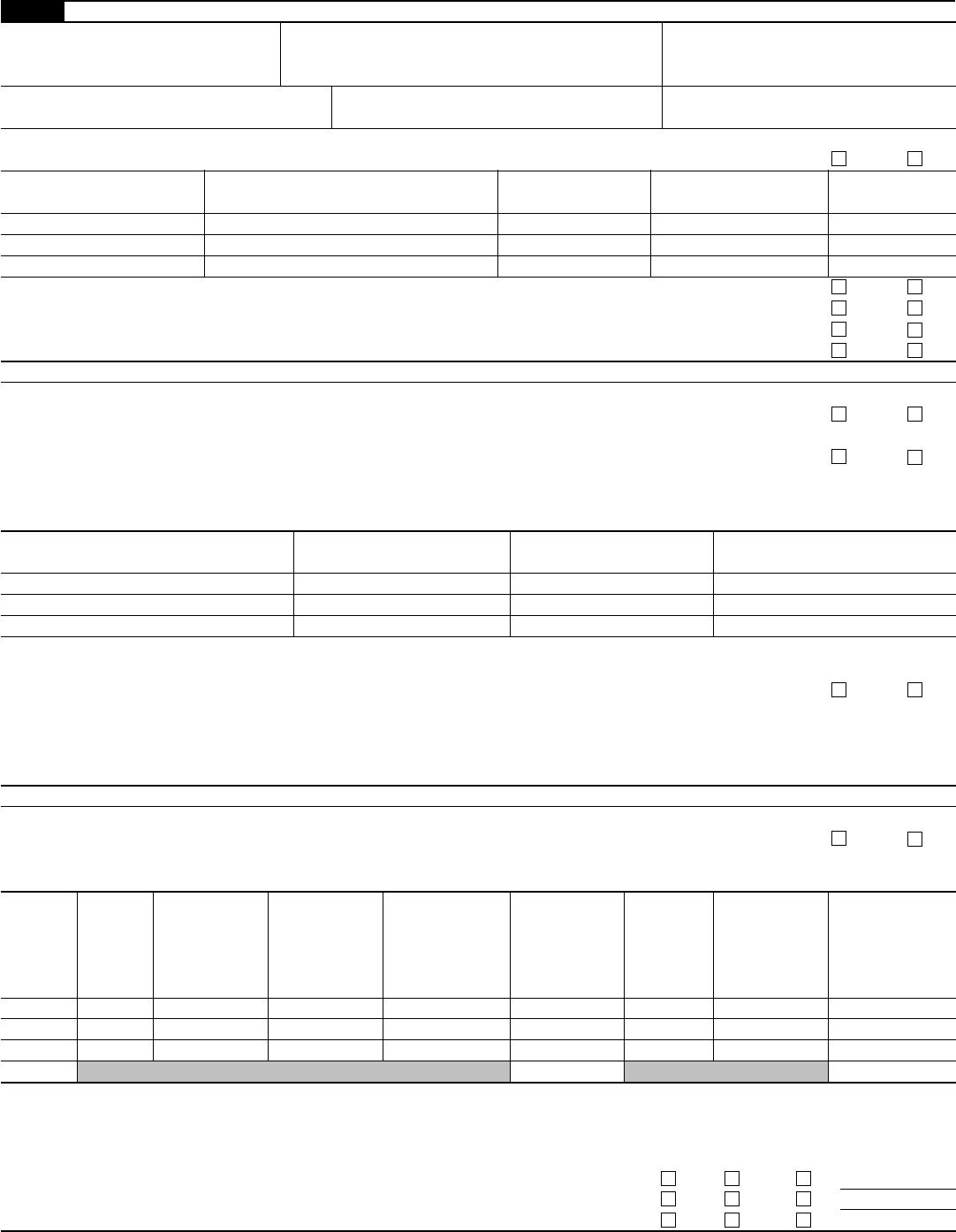

Fillable Form 3520 Annual Return To Report Transactions With Foreign

Web the form 3520 is generally required when a u.s. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Form 3520 carries severe penalties for failure to file, the first being the greater of $10,000 or 35% of the gross value of any. Person.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Send form 3520 to the. Person receives a gift from a foreign person, the irs may require the u.s. The form provides information about the foreign trust, its u.s. It does not have to be a “foreign gift.” rather, if a.

Form 3520 Edit, Fill, Sign Online Handypdf

Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Person receives a gift from a foreign person, the irs may require the u.s. Person to file a form 3520 to report the transactions. Don’t feel alone if you’re dealing with irs form 3520 penalty.

Form 3520 Edit, Fill, Sign Online Handypdf

But what happens if the taxpayer. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. If the due date for filing the tax return is extended, the due date for filing the form 3520 is. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701. Web form 3520 &.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Form 3520 carries severe penalties for failure to file, the first being the greater of $10,000 or 35% of the gross value of any. Send form 3520 to the. If the due date for filing the tax return is extended, the due date for filing the form 3520 is. Web all information must be in english. Ad talk to our.

Form 3520A Annual Information Return of Foreign Trust with a U.S

It does not have to be a “foreign gift.” rather, if a. Web when a u.s. Ad talk to our skilled attorneys by scheduling a free consultation today. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Person receives a gift from a foreign.

Do I need to file IRS Form 3520 and 3520A for my TFSA and RESP?

Web file form 3520 by the 15th day of the fourth month following the end of the u.s. Person receives a gift, inheritance (a type of “gift”) from a foreign person, or a foreign trust distribution. Ad talk to our skilled attorneys by scheduling a free consultation today. Web all information must be in english. Person to file a form.

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Ad talk to our skilled attorneys by scheduling a free consultation today. Person to file a form 3520 to report the transactions. There are certain filing threshold. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Person to report certain transactions.

Person Receives A Gift From A Foreign Person, The Irs May Require The U.s.

Web when a u.s. Person receives a gift from a foreign person, the irs may require the u.s. Person’s tax year, or april 15th for calendar year taxpayers, subject to any extension. Send form 3520 to the.

The Irs F Orm 3520 Is Used To Report A Foreign Gift, Inheritance Or Trust Distribution From A Foreign Person.

For calendar year 2022, or tax year beginning , 2022,. If the due date for filing the tax return is extended, the due date for filing the form 3520 is. Form 3520 carries severe penalties for failure to file, the first being the greater of $10,000 or 35% of the gross value of any. Owner, is march 15, and the due date for.

Web File Form 3520 By The 15Th Day Of The Fourth Month Following The End Of The U.s.

Web form 3520 is due at the time of a timely filing of the u.s. Show all amounts in u.s. Ad talk to our skilled attorneys by scheduling a free consultation today. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701.

Web An Income Tax Return, The Due Date For Filing Form 3520 Is The 15Th Day Of The 10Th Month (October 15) Following The End Of The U.s.

Web form 3520 & instructions: Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Web there are costly penalties for failing to file form 3520. Web all information must be in english.