Where To File Form 1310

Where To File Form 1310 - If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics. Web if you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. Green died on january 4 before filing his tax return. Web follow these steps to generate form 1310: If the partnership's principal business, office, or agency is located in: Web statement of person claiming refund due a deceased taxpayer (irs form 1310) legal representatives. Attach to the tax return certified copies of the: These addresses are listed in the. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Complete, edit or print tax forms instantly.

Ad fill, sign, email irs 1310 & more fillable forms, register and subscribe now! Send form 1310 to the irs office responsible for processing the decedent's federal tax return. Web where to file your taxes for form 1065. These addresses are listed in the. Attach to the tax return certified copies of the: Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. And the total assets at the end of the tax year. Go to screen 63, deceased taxpayer (1310). Web if you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. If the partnership's principal business, office, or agency is located in:

Web where to file your taxes for form 1065. Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. Web if the personal representative is filing a claim for refund on form 1040x, amended u.s. Web statement of person claiming refund due a deceased taxpayer (irs form 1310) legal representatives. Send form 1310 to the irs office responsible for processing the decedent's federal tax return. Click miscellaneous topics in the federal quick q&a topics menu to expand, then click claim. If the partnership's principal business, office, or agency is located in: Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web where do i file irs 1310? Web follow these steps to generate form 1310:

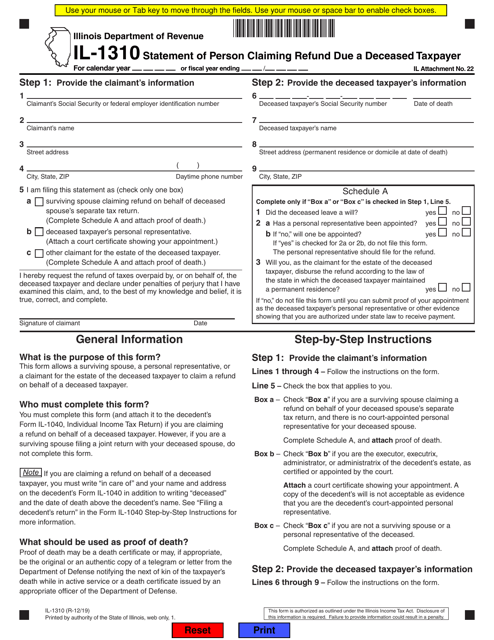

Form IL1310 Download Fillable PDF or Fill Online Statement of Person

Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Web if the personal representative is filing a claim for refund on form 1040x, amended u.s. You are a surviving spouse filing an original or. Go to screen 63, deceased.

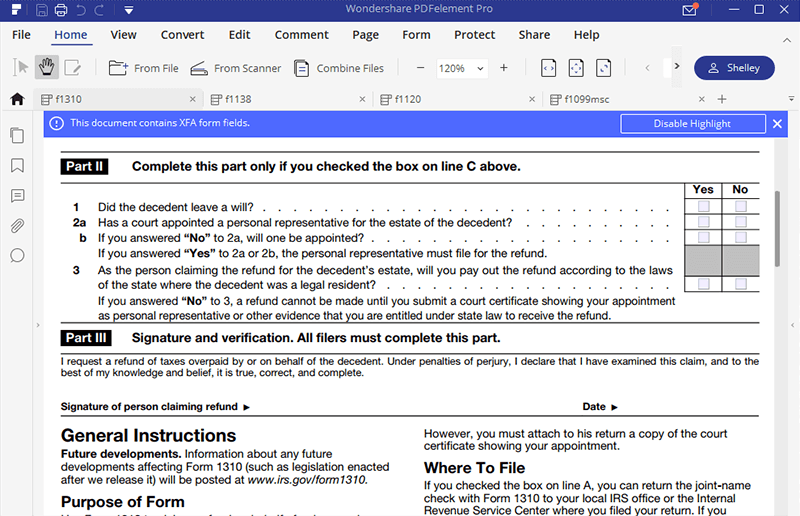

IRS Form 1310 How to Fill it Right

Web follow these steps to generate form 1310: Green died on january 4 before filing his tax return. Ad fill, sign, email irs 1310 & more fillable forms, register and subscribe now! Web this information includes name, address, and the social security number of the person who is filing the tax return. These addresses are listed in the.

Irs Form 1310 Printable Master of Documents

Web where do i file form 1310? Web statement of person claiming refund due a deceased taxpayer (irs form 1310) legal representatives. Web if you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. Go to screen 63, deceased taxpayer (1310). Web line a check the box on line a.

Form 1310 Instructions 2021 2022 IRS Forms Zrivo

If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics. You are a surviving spouse filing an original or. Web where to file your taxes for form 1065. If you aren’t the surviving spouse, then you’ll mail the. These addresses are listed in the.

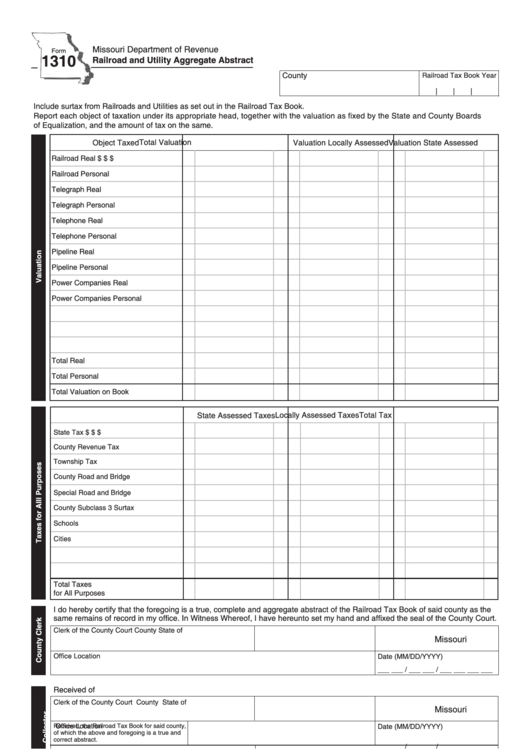

Fillable Form 1310 Railroad And Utility Aggregate Abstract printable

Ad fill, sign, email irs 1310 & more fillable forms, register and subscribe now! Web where do i file irs 1310? Web this information includes name, address, and the social security number of the person who is filing the tax return. Web taxpayer, you must file form 1310 unless either of the following applies: Web 9 rows the irs has.

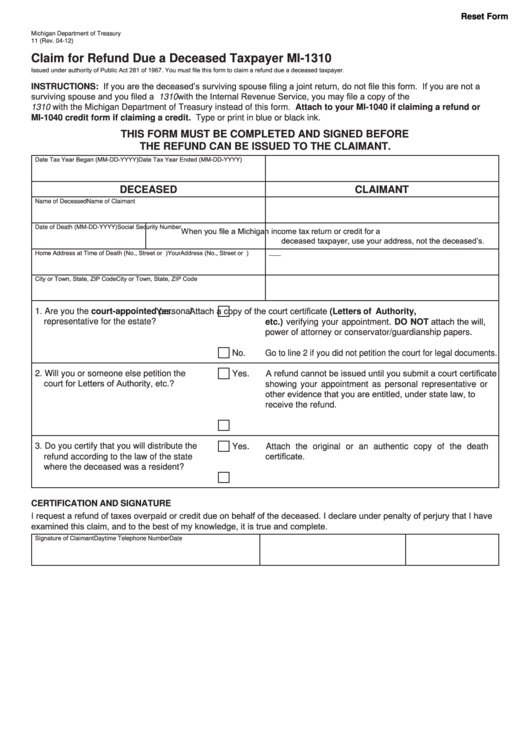

Fillable Form Mi1310 Claim For Refund Due A Deceased Taxpayer

Send form 1310 to the irs office responsible for processing the decedent's federal tax return. Web if you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. If the partnership's principal business, office, or agency is located in: Web 9 rows the irs has set specific electronic filing guidelines for.

Form 1310 2014 2019 Blank Sample to Fill out Online in PDF

Then you have to provide all other required information in the. Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint),. Web statement of person claiming refund due a deceased taxpayer (irs form 1310) legal representatives. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the.

Form 1310 Major Errors Intuit Accountants Community

If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics. On april 3 of the same year, you. If you aren’t the surviving spouse, then you’ll mail the. Then you have to provide all other required information in the. Send form 1310 to the irs office responsible for processing the decedent's.

Modelo 1310 Traders Studio

Web statement of person claiming refund due a deceased taxpayer (irs form 1310) legal representatives. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Attach to the tax return certified copies of the: Complete, edit or print tax forms.

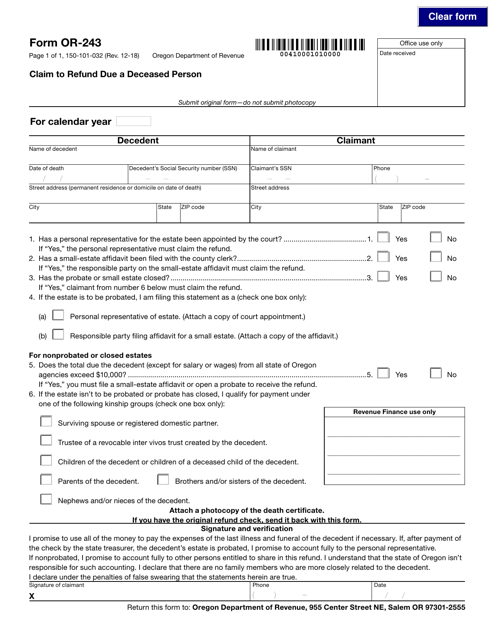

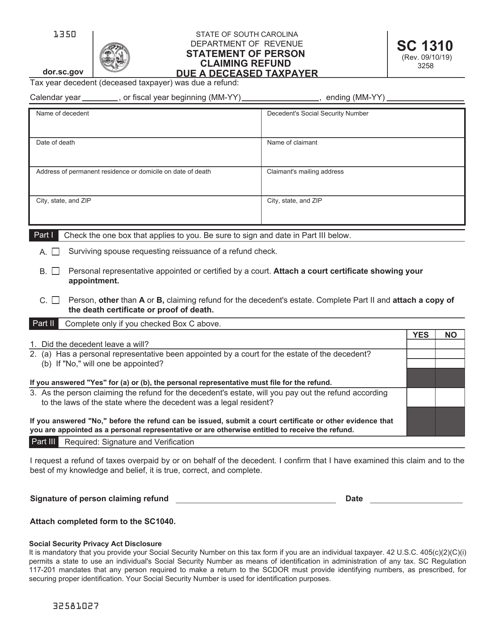

Form SC1310 Download Printable PDF or Fill Online Statement of Person

Go to screen 63, deceased taxpayer (1310). Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name..

You Are A Surviving Spouse Filing An Original Or.

Click miscellaneous topics in the federal quick q&a topics menu to expand, then click claim. If you aren’t the surviving spouse, then you’ll mail the. On april 3 of the same year, you. Ad get ready for tax season deadlines by completing any required tax forms today.

Attach To The Tax Return Certified Copies Of The:

Web if you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. Web taxpayer, you must file form 1310 unless either of the following applies: Complete, edit or print tax forms instantly. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a.

Enter A 1, 2, Or 3 In 1=Surviving Spouse (Married Filing Joint),.

Go to screen 63, deceased taxpayer (1310). Web if the personal representative is filing a claim for refund on form 1040x, amended u.s. Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Web where do i file irs 1310?

Then You Have To Provide All Other Required Information In The.

These addresses are listed in the. Send form 1310 to the irs office responsible for processing the decedent's federal tax return. If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics. Green died on january 4 before filing his tax return.