Where To File Form 5472

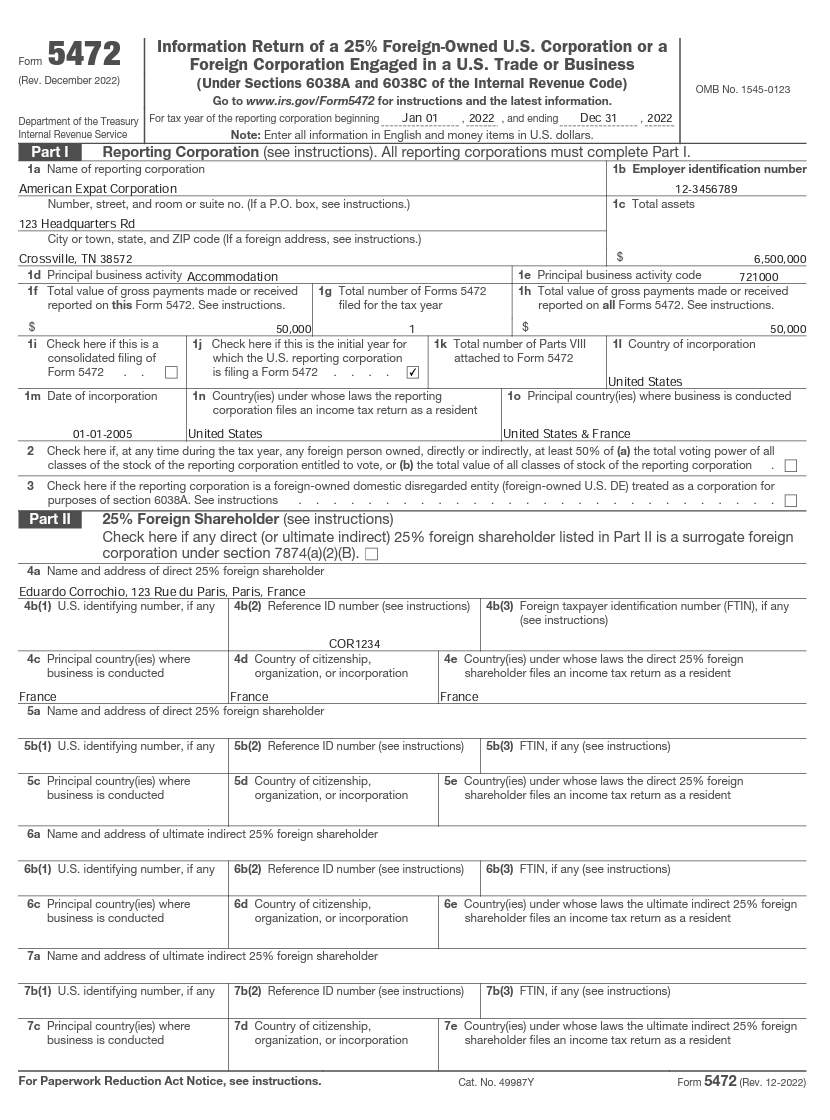

Where To File Form 5472 - If your business was organized in the u.s. A separate form 5472 filing is required for each related party with whom the us taxpayer has transactions during the taxable year. If you file your income tax return electronically, see the instructions for your income tax return for general information about electronic filing. The de minimus exceptions from. Only reporting corporations have to file form 5472. Web information about form 5472, including recent updates, related forms, and instructions on how to file. A foreign corporation engaged in a trade or business within the united states.”. Web form 5472 reporting corporation. Persons with respect to certain foreign corporations; Web at a glance learn more about irs form 5472, a form for foreign corporations involved with the united states, with the expat tax experts h&r block.

Only reporting corporations have to file form 5472. Web at a glance learn more about irs form 5472, a form for foreign corporations involved with the united states, with the expat tax experts h&r block. Web information about form 5472, including recent updates, related forms, and instructions on how to file. It had no reportable transactions of the types listed in parts iv and vi of the form. Web form 5472 reporting corporation. Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions. Trade or business (under sections 6038a and 6038c of the internal revenue code) go to. Corporation or a foreign corporation engaged in a u.s. Corporation or a foreign corporation engaged in a u.s.

Only reporting corporations have to file form 5472. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. The de minimus exceptions from. Web electronic filing of form 5472. For instructions and the latest information. The irs requires businesses to file form 5472 if they are a us corporation with at least 25% of its stock owned by a foreign person or entity or a us disregarded entity with at least 25% of its stock owned by a foreign person or. Web form 5472 is an irs tax form used to report certain transactions of foreign corporations and foreign partnerships. Persons with respect to certain foreign corporations; If your business was organized in the u.s. And has a foreign owner, the answer is likely “yes.”

International Tax Advisors Tax Issues for Companies With Foreign

The de minimus exceptions from. A reporting corporation is not required to file form 5472 if any of the following apply. It had no reportable transactions of the types listed in parts iv and vi of the form. Web at a glance learn more about irs form 5472, a form for foreign corporations involved with the united states, with the.

How to File Form 5472 Extension Due July 15th 2020! YouTube

Web form 5472 is an irs tax form used to report certain transactions of foreign corporations and foreign partnerships. Only reporting corporations have to file form 5472. Trade or business (under sections 6038a and 6038c of the internal revenue code) go to. Web electronic filing of form 5472. The de minimus exceptions from.

What is the IRS Form 5472 in Florida? EPGD Business Law

It had no reportable transactions of the types listed in parts iv and vi of the form. If you file your income tax return electronically, see the instructions for your income tax return for general information about electronic filing. December 2022) department of the treasury internal revenue service. Web electronic filing of form 5472. Web information about form 5472, including.

Form 5472 What Is It and Do I Need to File It? WilkinGuttenplan

The de minimus exceptions from. Only reporting corporations have to file form 5472. Corporation or a foreign corporation engaged in a u.s. December 2022) department of the treasury internal revenue service. De, you cannot file form 5472 electronically.

Should You File a Form 5471 or Form 5472? Asena Advisors

Web at a glance learn more about irs form 5472, a form for foreign corporations involved with the united states, with the expat tax experts h&r block. Persons with respect to certain foreign corporations; Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Web form 5472.

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

Corporation or a foreign corporation engaged in a u.s. De, you cannot file form 5472 electronically. If your business was organized in the u.s. A separate form 5472 filing is required for each related party with whom the us taxpayer has transactions during the taxable year. Web information about form 5472, including recent updates, related forms, and instructions on how.

Form 5472 and Disregarded Entities Who Must File It?

Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. A separate form 5472 filing is required for each related party with whom the us taxpayer has transactions during the taxable year. If your business was organized in the u.s. The irs requires businesses to file form.

Form 5472 Instructions, Examples, and More

December 2022) department of the treasury internal revenue service. And has a foreign owner, the answer is likely “yes.” Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. If you file your income tax return electronically, see the instructions for your income tax return for general information.

IRS Form 5472

It had no reportable transactions of the types listed in parts iv and vi of the form. Persons with respect to certain foreign corporations; Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. The de minimus exceptions from. Web form 5472 is an irs tax form used.

Should I File Form 5472 if my LLC Owns Real Estate? YouTube

A reporting corporation is not required to file form 5472 if any of the following apply. December 2022) department of the treasury internal revenue service. Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions. Web form 5472 is an irs tax form used to report certain transactions of foreign corporations and foreign partnerships..

If Your Business Was Organized In The U.s.

The irs requires businesses to file form 5472 if they are a us corporation with at least 25% of its stock owned by a foreign person or entity or a us disregarded entity with at least 25% of its stock owned by a foreign person or. It had no reportable transactions of the types listed in parts iv and vi of the form. A foreign corporation engaged in a trade or business within the united states.”. Corporation or a foreign corporation engaged in a u.s.

Web Form 5472 Reporting Corporation.

Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. A separate form 5472 filing is required for each related party with whom the us taxpayer has transactions during the taxable year. Web at a glance learn more about irs form 5472, a form for foreign corporations involved with the united states, with the expat tax experts h&r block. Corporation or a foreign corporation engaged in a u.s.

Persons With Respect To Certain Foreign Corporations;

Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. And has a foreign owner, the answer is likely “yes.” Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions. Trade or business (under sections 6038a and 6038c of the internal revenue code) go to.

Web Information About Form 5472, Including Recent Updates, Related Forms, And Instructions On How To File.

The de minimus exceptions from. A reporting corporation is not required to file form 5472 if any of the following apply. Do you have to file u.s tax form 5472? Only reporting corporations have to file form 5472.

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity-768x768.jpg)