Where To Send Form 3520

Where To Send Form 3520 - Web form 3520 is an information return for a u.s. Web american citizens and resident aliens who receive a foreign inheritance valued at over $100,000 must report it using irs form 3520. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web at a glance not sure if you need to file form 3520? Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Do i need to file irs form 3520? Decedents) file form 3520 to report: Person from a foreign person that the recipient treats as a gift or bequest and. Box 409101, ogden, ut 84409. More specifically, form 3520 is required to be filed in the following four loosely related contexts (the first.

About our international tax law firm Decedents) file form 3520 to report: The form provides information about the foreign trust, its u.s. Web form 3520 is an information return for a u.s. Web if you are a u.s. Web send form 3520 to the following address. Our expat tax experts are a few clicks away. Since turbotax does not have the form in the software, what shall i do? Many americans who interact with a foreign trust are required to file form 3520. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s.

Web the irs form 3520 reports annually information about us persons’ (a) ownership of foreign trusts, (b) contributions to foreign trusts, (c) distributions from foreign trusts and (d) major (usd $100,000+) gifts or inheritances from foreign individuals or foreign estates. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Box 409101, ogden, ut 84409, by the 15th day of the 3rd month after the end of the trust's tax year. Owner (under section 6048 (b)) internal revenue service. Certain transactions with foreign trusts. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701 (a) (31)] or to report the receipt of certain foreign gifts or bequests. More specifically, form 3520 is required to be filed in the following four loosely related contexts (the first. Web at a glance not sure if you need to file form 3520? Box 409101 ogden, ut 84409. Persons (and executors of estates of u.s.

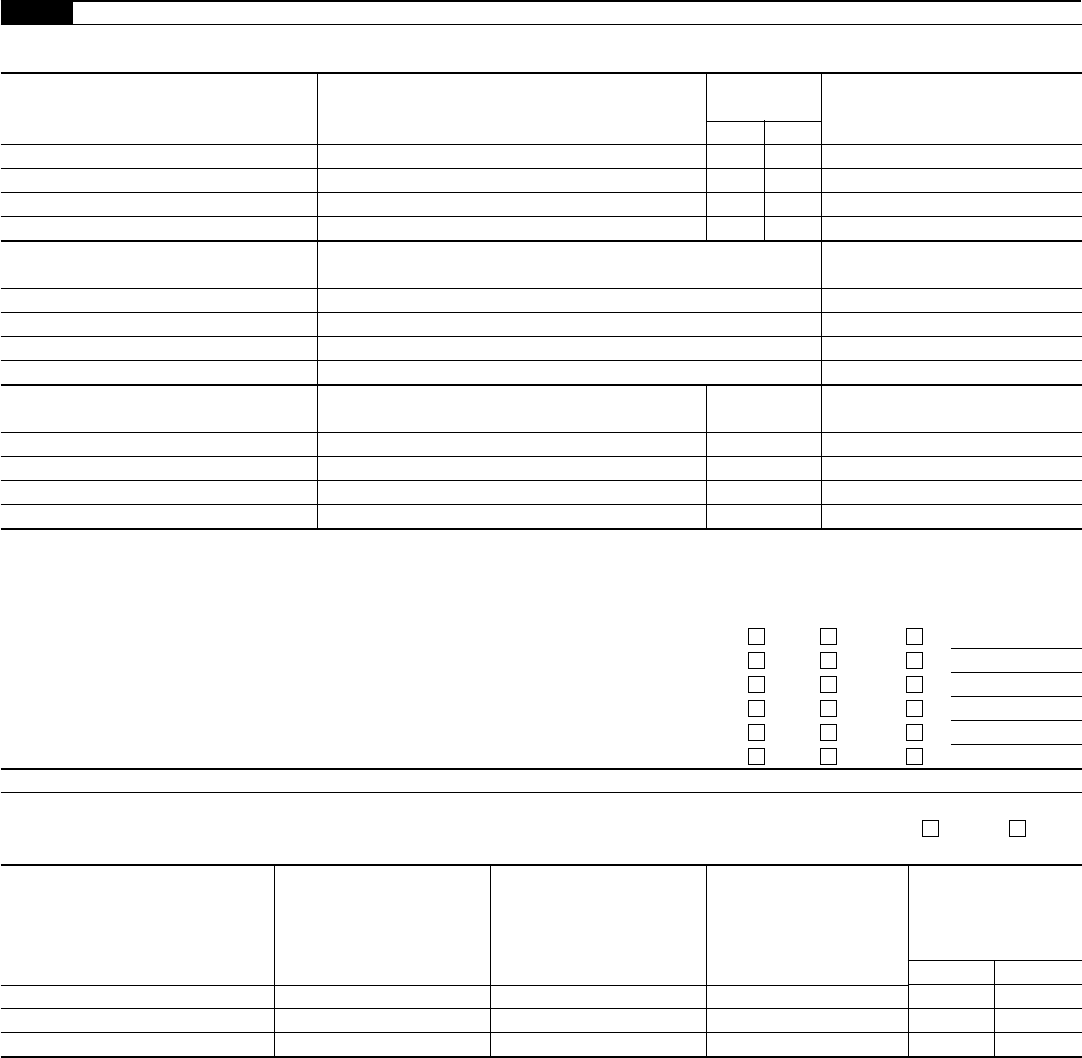

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web having ownership in a foreign trust and/or receiving a distribution from a foreign trust may require that the u.s. Web at a glance not sure if you need to file form 3520? Internal revenue service center p.o. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15).

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Receipt of certain large gifts or bequests from certain foreign persons. Web form 3520 is an information return for a u.s. Box 409101, ogden, ut 84409. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to persuade the irs to even. How can.

Fillable Form 3520 Annual Return To Report Transactions With Foreign

Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Completing this form requires the determining the fair market value of inherited foreign assets and property, which can be complicated. Web send form 3520 to the following address. Do i need to.

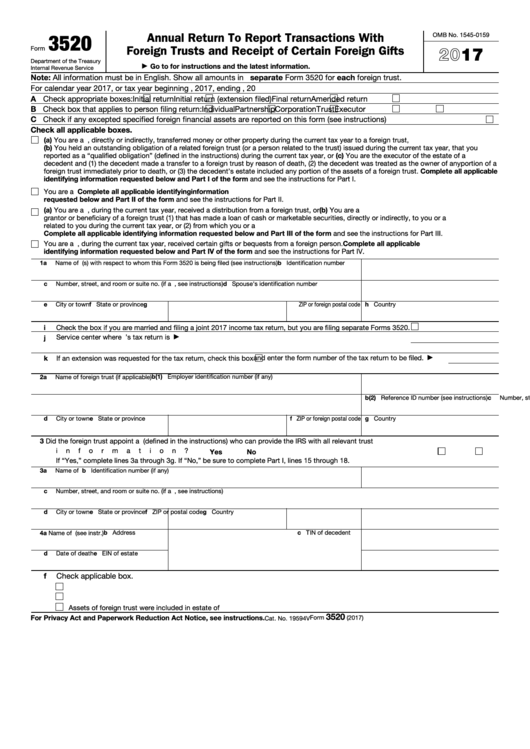

Top Epa Form 35201 Templates free to download in PDF format

Internal revenue service center p.o. Persons (and executors of estates of u.s. Box 409101, ogden, ut 84409. Web form 3520 is a tax form used to report certain transactions involving foreign trusts. Many americans who interact with a foreign trust are required to file form 3520.

US Taxes and Offshore Trusts Understanding Form 3520

How can i obtain a copy of irs form 3520? Box 409101 ogden, ut 84409 form 3520 must have all required attachments to be considered complete. Since turbotax does not have the form in the software, what shall i do? Send form 3520 to the internal revenue service center, p.o. Box 409101, ogden, ut 84409.

US Taxes and Offshore Trusts Understanding Form 3520

Learn everything you should know about reporting foreign trusts, inheritances, or gifts as an american abroad. I found out that i need to send form 3520 after finishing e filing. Web at a glance not sure if you need to file form 3520? Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and.

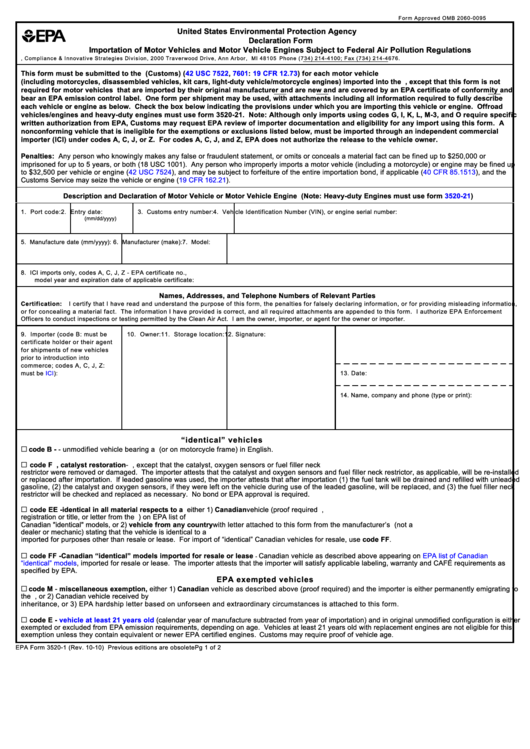

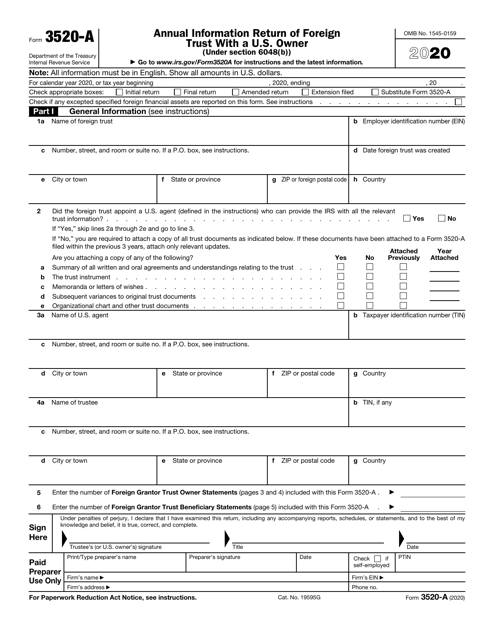

Fillable Form 3520A Annual Information Return Of Foreign Trust With

How can i obtain a copy of irs form 3520? Web form 3520 is a tax form used to report certain transactions involving foreign trusts. Do i need to file irs form 3520? More specifically, form 3520 is required to be filed in the following four loosely related contexts (the first. Web send form 3520 to the following address.

Form 3520A Annual Information Return of Foreign Trust with a U.S

Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. For more information, go to ftb.ca.gov/poa. Do i need to file irs form 3520? A foreign gift is money or other property received by.

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Many americans who interact with a foreign trust are required to file form 3520. Depending on where you hold your foreign inheritance, you may have. A foreign gift is money or other property received by a u.s. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from.

Form 3520A Annual Information Return of Foreign Trust with a U.S

Internal revenue service center p.o. Decedents) file form 3520 to report: Web having ownership in a foreign trust and/or receiving a distribution from a foreign trust may require that the u.s. Box 409101 ogden, ut 84409 form 3520 must have all required attachments to be considered complete. For faster processing, submit electronically.

Person Who Is Treated As An Owner Of Any Portion Of The Foreign Trust Under The Grantor Trust Rules (Sections 671 Through 679).

Web form 3520 is a tax form used to report certain transactions involving foreign trusts. Owner (under section 6048 (b)) internal revenue service. Web what is form 3520? The form provides information about the foreign trust, its u.s.

Receipt Of Certain Large Gifts Or Bequests From Certain Foreign Persons.

Since turbotax does not have the form in the software, what shall i do? How do i file form 3520 after i e filed. Completing this form requires the determining the fair market value of inherited foreign assets and property, which can be complicated. Form 3520 must have all required attachments to be considered complete.

Citizen Or Resident And Live Outside The United States And Puerto Rico Or If You Are In The Military Or Naval Service On Duty Outside The United States And Puerto Rico, Your Form 3520 Is Due June 15, 2023.

About our international tax law firm Internal revenue service center p.o. Shall i send the irs with the amendment tax return as paper with form 3520 or can i just send form 3520 only to the irs? More specifically, form 3520 is required to be filed in the following four loosely related contexts (the first.

Web The Irs Form 3520 Reports Annually Information About Us Persons’ (A) Ownership Of Foreign Trusts, (B) Contributions To Foreign Trusts, (C) Distributions From Foreign Trusts And (D) Major (Usd $100,000+) Gifts Or Inheritances From Foreign Individuals Or Foreign Estates.

Learn everything you should know about reporting foreign trusts, inheritances, or gifts as an american abroad. Web form 3520 is an information return for a u.s. Many americans who interact with a foreign trust are required to file form 3520. Box 409101 ogden, ut 84409.