Will My Employer Know If I File Chapter 13

Will My Employer Know If I File Chapter 13 - During your bankruptcy you must continue to file, or get an extension of time to file… Doing so would be discrimination. Unlike a chapter 7 bankruptcy, which allows the debtor to discharge some debts in exchange for the sale of nonexempt property to pay creditors, chapter 13. However, it may be a good indication you may be going through a bankruptcy process. Your employer will have to know this is happening, so they could find out about your bankruptcy in this way. Web may 22, 2014 by david m. You must file all required tax returns for tax periods ending within four years of your bankruptcy filing. If the court orders that your payments be deducted from your paycheck, then of course your employer would know about the bankruptcy. Web before you consider filing a chapter 13 here are some things you should know: And it’s possible to get a chapter 13 plan confirmed based on another source of regular income.

Only individuals may file a chapter 13 bankruptcy. There are two reasons your employer might get official notice of your bankruptcy: Web there may be no direct notification to your employer specifying the reason behind stopping your wage garnishment. You don’t have to be employed to file chapter 13 bankruptcy. Web will my employer know i filed bankruptcy? Web the third scenario involves a chapter 13 repayment plan. By federal law, employers cannot discriminate or retaliate on the basis of bankruptcy,. Web may 22, 2014 by david m. But you need to first make sure that filing chapter 13 without your spouse is the right decision for your. Web if you are asking yourself, “can i file chapter 13 without my spouse?”, you now know that the answer is most likely yes.

Web do i have to tell my employer about my bankruptcy? However, it may be a good indication you may be going through a bankruptcy process. Your employer will also be notified if you miss a payment in your chapter 13 repayment plan because the trustee will send a request to have your. Web a debtor must meet chapter 13 requirements to file for bankruptcy under this chapter. Web sometimes, if you file for a chapter 13 bankruptcy, your chapter 13 payments are taken directly out of your paycheck, which would tell your employer that the deductions are a result of a bankruptcy. Or you can contact us online and schedule your free chapter 13 bankruptcy consultation. But if you don’t have regular income, the court probably won’t confirm your chapter 13. Depends on whether you district requires that plan payments be made through payroll deduction or not and if, payments are supposed to be made. There are two reasons your employer might get official notice of your bankruptcy: Web other than the people in the payroll department, no one else in the company needs to know about your bankruptcy filing.

Should I file Chapter 7 or Chapter 13? Part 1 Chapter 7 Steiner Law

Web obviously, in that case, they are treated the same as your other creditors and will be notified. Web basically, such an order would withhold part of your wages to automatically make your chapter 13 payments to creditors. There are two reasons your employer might get official notice of your bankruptcy: You must file all required tax returns for tax.

Can I File Chapter 13 To Save My Home After Filing Chapter 7? YouTube

Or you can contact us online and schedule your free chapter 13 bankruptcy consultation. Tax obligations while filing chapter 13 bankruptcy: Web obviously, in that case, they are treated the same as your other creditors and will be notified. Only individuals may file a chapter 13 bankruptcy. Web a debtor must meet chapter 13 requirements to file for bankruptcy under.

How to File Bankruptcy in Missouri StepByStep Guide

Web obviously, in that case, they are treated the same as your other creditors and will be notified. Unlike a chapter 7 bankruptcy, which allows the debtor to discharge some debts in exchange for the sale of nonexempt property to pay creditors, chapter 13. Only individuals may file a chapter 13 bankruptcy. If you owe your employer money, they’ll have.

The Pros and Cons of Filing for Chapter 13 Bankruptcy ABI

And it’s possible to get a chapter 13 plan confirmed based on another source of regular income. But you need to first make sure that filing chapter 13 without your spouse is the right decision for your. You are not required to inform your employer about bankruptcy. Your employer will have to know this is happening, so they could find.

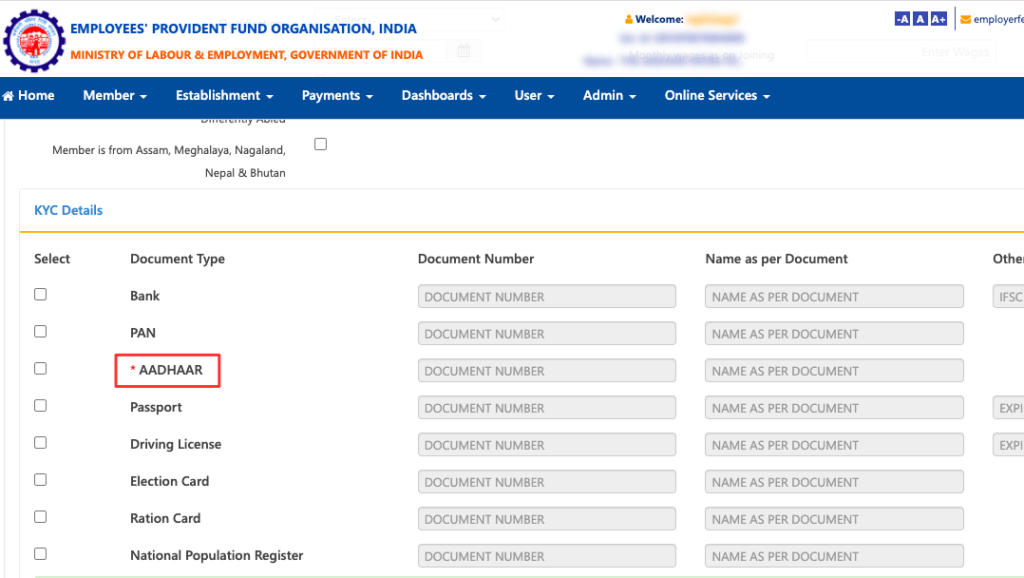

Can My New Employer Check My Previous EPF Deductions

Tax obligations while filing chapter 13 bankruptcy: Web before you consider filing a chapter 13 here are some things you should know: Web do i have to tell my employer about my bankruptcy? Web a debtor must meet chapter 13 requirements to file for bankruptcy under this chapter. By federal law, employers cannot discriminate or retaliate on the basis of.

Why Do I Have to Tell My Employer? What You Need to Know About

Or you can contact us online and schedule your free chapter 13 bankruptcy consultation. Web your employer may be notified if you file a ch13. However, it may be a good indication you may be going through a bankruptcy process. Web other than the people in the payroll department, no one else in the company needs to know about your.

Oklahoma Unemployment FAQs Unemployment Portal

Only individuals may file a chapter 13 bankruptcy. Tax obligations while filing chapter 13 bankruptcy: Web individuals in chapter 12 or 13. If the court orders that your payments be deducted from your paycheck, then of course your employer would know about the bankruptcy. Web in a chapter 13 bankruptcy, your employer usually will be notified because your monthly payment.

Comparing Chapter 7 And Chapter 13 Bankruptcy

Web the third scenario involves a chapter 13 repayment plan. Tax obligations while filing chapter 13 bankruptcy: You don’t have to be employed to file chapter 13 bankruptcy. Web may 22, 2014 by david m. Web technically, there’s no requirement that chapter 13 filers have to be employed.

What Do I Do If My Employer Won't File a Workers Comp Claim?Broke and Chic

Additionally, if you file for chapter 13 bankruptcy, the. Web obviously, in that case, they are treated the same as your other creditors and will be notified. Web a debtor must meet chapter 13 requirements to file for bankruptcy under this chapter. However, you do need a steady source of income to be able to fund the chapter 13 plan..

37+ Can I File Chapter 7 Before 8 Years KhamShunji

Web if you are asking yourself, “can i file chapter 13 without my spouse?”, you now know that the answer is most likely yes. Or you can contact us online and schedule your free chapter 13 bankruptcy consultation. Web may 22, 2014 by david m. Web before you consider filing a chapter 13 here are some things you should know:.

Web There May Be No Direct Notification To Your Employer Specifying The Reason Behind Stopping Your Wage Garnishment.

If you owe your employer money, they’ll have to be listed in your bankruptcy filing. Web in a chapter 13 bankruptcy, your employer usually will be notified because your monthly payment comes out of your paycheck. Depends on whether you district requires that plan payments be made through payroll deduction or not and if, payments are supposed to be made. Web the third scenario involves a chapter 13 repayment plan.

Your Employer Will Have To Know This Is Happening, So They Could Find Out About Your Bankruptcy In This Way.

Web individuals in chapter 12 or 13. Web obviously, in that case, they are treated the same as your other creditors and will be notified. Web technically, there’s no requirement that chapter 13 filers have to be employed. However, you do need a steady source of income to be able to fund the chapter 13 plan.

However, It May Be A Good Indication You May Be Going Through A Bankruptcy Process.

Web a debtor must meet chapter 13 requirements to file for bankruptcy under this chapter. During your bankruptcy you must continue to file, or get an extension of time to file… You must file all required tax returns for tax periods ending within four years of your bankruptcy filing. You don’t have to be employed to file chapter 13 bankruptcy.

Sometimes, This Can Be An Easier Way To Pay Your Chapter 13.

But, if you have been sued by a creditor and your wages have been garnished, your employer will know that you have a credit situation. Web your employer may be notified if you file a ch13. Unlike a chapter 7 bankruptcy, which allows the debtor to discharge some debts in exchange for the sale of nonexempt property to pay creditors, chapter 13. Doing so would be discrimination.