Wisp Template For Tax Professionals

Wisp Template For Tax Professionals - Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster. For many tax professionals, knowing where to start when developing a wisp is difficult. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster. I am a sole proprietor with no employees, working from my home office. Web how to create a wispwritten information security plan for data safety with data security incidents continuing, tax professionals must have current written information security plans or wisps. Making the wisp available to employees for training purposes is encouraged. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. Making the wisp available to employees for training purposes is encouraged. No need to install software, just go to dochub, and sign up instantly and for free.

Received an offer from tech4 accountants email@office templatesonline.com, offering to prepare the plan for a fee and would need access to. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data security plan. Web taxslayer pro has drafted a data security plan template in microsoft word format you can use to prepare your own plan. Log in to your account hub here or by clicking the blue log in button at taxslayerpro.com. Web edit, sign, and share wisp template online. Not only is a wisp essential for your business and a good business practice, the law requires you to have one. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. No need to install software, just go to dochub, and sign up instantly and for free.

Select account history in the left side menu. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster. Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data security plan. Web taxslayer pro has drafted a data security plan template in microsoft word format you can use to prepare your own plan. Received an offer from tech4 accountants email@office templatesonline.com, offering to prepare the plan for a fee and would need access to. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster. Web how to create a wispwritten information security plan for data safety with data security incidents continuing, tax professionals must have current written information security plans or wisps. Making the wisp available to employees for training purposes is encouraged. For many tax professionals, knowing where to start when developing a wisp is difficult. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word.

WIP Format PDF Profit (Accounting) Cost

Law that requires financial institutions to protect customer data. Web taxslayer pro has drafted a data security plan template in microsoft word format you can use to prepare your own plan. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster. Making the wisp available to employees for training purposes.

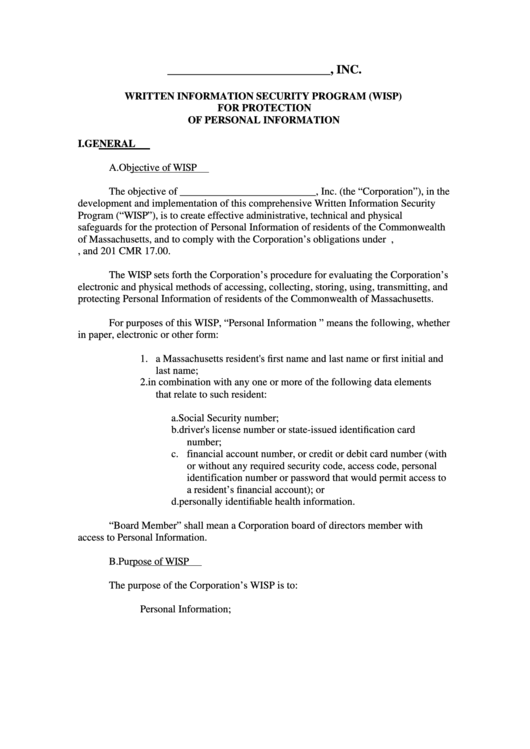

Wisp Template

Received an offer from tech4 accountants email@office templatesonline.com, offering to prepare the plan for a fee and would need access to. Making the wisp available to employees for training purposes is encouraged. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster. Web once completed, tax professionals should keep their.

payroll tax form Payroll taxes, Tax forms, Tax payment

Making the wisp available to employees for training purposes is encouraged. Click the data security plan template link to download it to your computer. No need to install software, just go to dochub, and sign up instantly and for free. Web creating a written information security plan or wisp is an often overlooked but critical component. Received an offer from.

arminodesign Massachusetts Wisp Statement Of Compliance

Making the wisp available to employees for training purposes is encouraged. Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data security plan. Click the data security plan template link to download it to your computer. Web taxslayer pro has drafted a data security plan template in microsoft word format you.

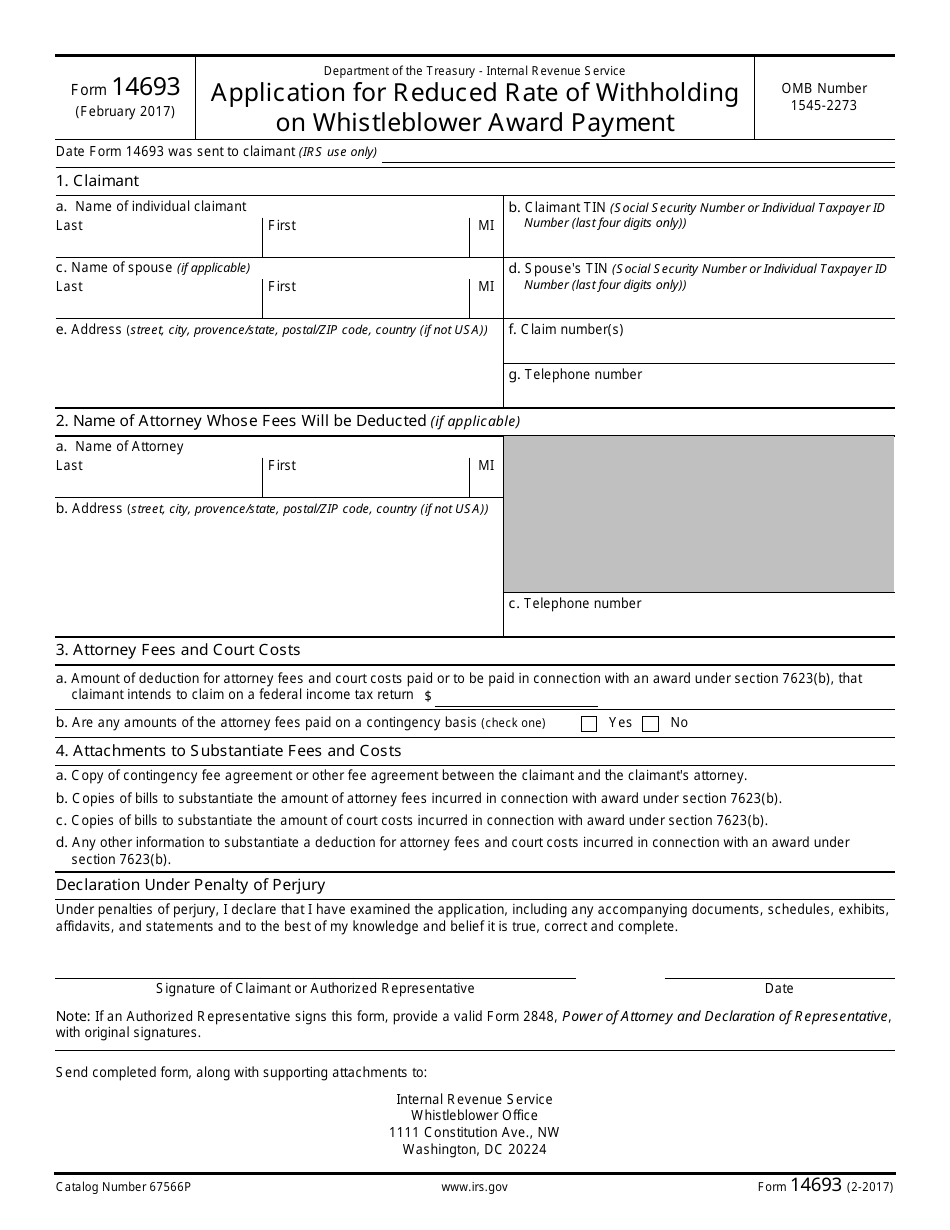

211 IRS FORM Whistleblower TEMPLATE.pdf Internal Revenue

Making the wisp available to employees for training purposes is encouraged. No need to install software, just go to dochub, and sign up instantly and for free. Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data security plan. Select account history in the left side menu. Received an offer from.

IRS releases new tax brackets for 2021 that will be used to

Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. For many tax professionals, knowing where to start when developing a wisp is difficult. Click the data security.

Wisp Template Free Printable Templates

Making the wisp available to employees for training purposes is encouraged. I am a sole proprietor with no employees, working from my home office. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster. Web a wisp is a written information security plan that is required for certain businesses, such.

Written Information Security Program (WISP) Security Waypoint

Making the wisp available to employees for training purposes is encouraged. Law that requires financial institutions to protect customer data. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster. Log in to your account hub here or by clicking the blue log in button at taxslayerpro.com. Click the data.

Wisp Template

Received an offer from tech4 accountants email@office templatesonline.com, offering to prepare the plan for a fee and would need access to. Web creating a written information security plan or wisp is an often overlooked but critical component. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Federal law, enforced by.

IRS Form 14693 Download Fillable PDF or Fill Online Application for

For many tax professionals, knowing where to start when developing a wisp is difficult. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster. Web how to create a wispwritten information security plan for data safety with data security incidents continuing, tax professionals must have current written information security plans.

Not Only Is A Wisp Essential For Your Business And A Good Business Practice, The Law Requires You To Have One.

Received an offer from tech4 accountants email@office templatesonline.com, offering to prepare the plan for a fee and would need access to. Log in to your account hub here or by clicking the blue log in button at taxslayerpro.com. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word.

Web Edit, Sign, And Share Wisp Template Online.

Law that requires financial institutions to protect customer data. No need to install software, just go to dochub, and sign up instantly and for free. Web taxslayer pro has drafted a data security plan template in microsoft word format you can use to prepare your own plan. Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data security plan.

For Many Tax Professionals, Knowing Where To Start When Developing A Wisp Is Difficult.

Web how to create a wispwritten information security plan for data safety with data security incidents continuing, tax professionals must have current written information security plans or wisps. I am a sole proprietor with no employees, working from my home office. Click the data security plan template link to download it to your computer. Making the wisp available to employees for training purposes is encouraged.

Web Once Completed, Tax Professionals Should Keep Their Wisp In A Format That Others Can Easily Read, Such As Pdf Or Word.

Select account history in the left side menu. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Web creating a written information security plan or wisp is an often overlooked but critical component. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster.