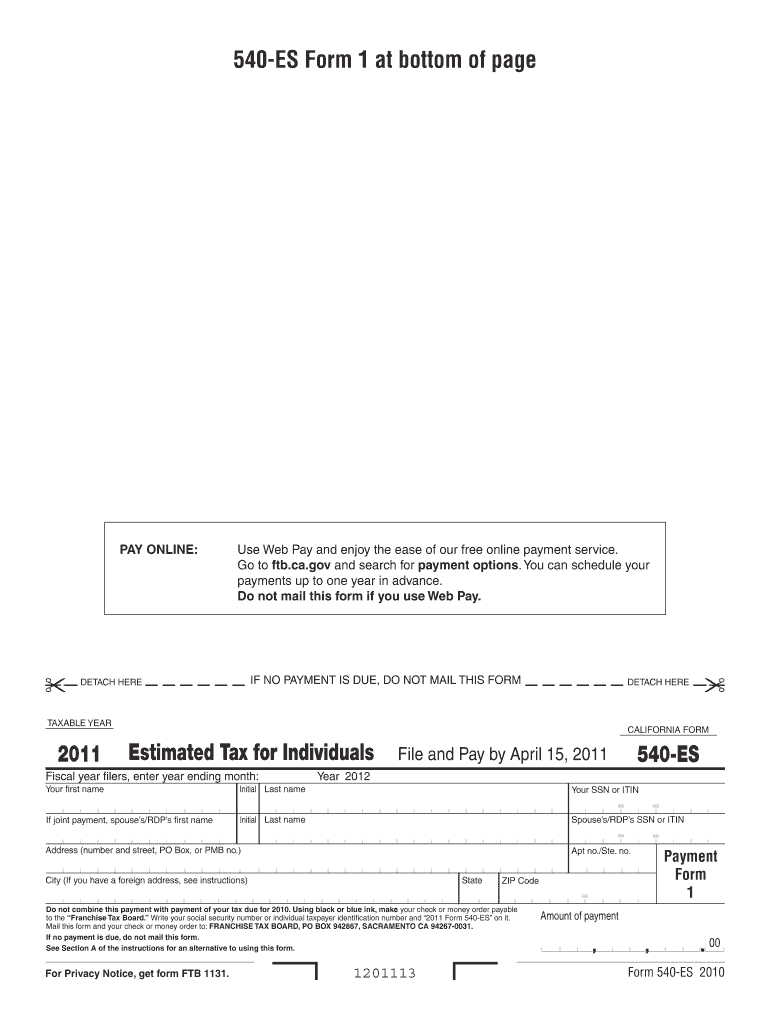

2023 Form 540-Es

2023 Form 540-Es - Web sn s n ns 2023 or calendar year or scal year endin s year ddress canes and estimated ta payments can be made at reeueouo. This is directly tied to your state income tax bill and each payment should be. Who must make estimated tax. Web 2023estimated tax for individuals file and pay by june 15, 2023 fiscal year filers, enter year ending month: Web video instructions and help with filling out and completing form 540 es 2023. This form is for income earned in tax year 2022, with tax returns due in april. Web 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet 540 es estimated. Web subtract line 20 from line 3 (rents) and/or 4 (royalties). Using black or blue ink, make your check or money order payable to the. O ensure proper credit please n old or staple ail tis.

Web subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (loss), see instructions to find out if you must file Open the document in our online editing. Use the 2021 form ftb. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) 540nr form (pdf) | 540nr booklet (instructions. Using black or blue ink, make your check or money order payable to the. In this case, you need not make estimated tax payments for 2022. Web video instructions and help with filling out and completing form 540 es 2023. Get the document you want in our library of legal forms. You can download or print.

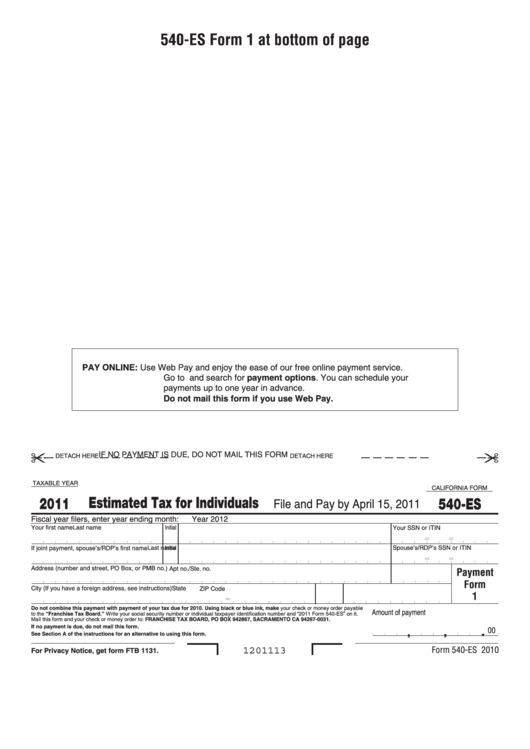

Form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax. This is directly tied to your state income tax bill and each payment should be. Use the 2021 form ftb. This form is for income earned in tax year 2022, with tax returns due in april. O ensure proper credit please n old or staple ail tis. Web printable california income tax form 540es. Web solved • by turbotax • 2200 • updated 1 month ago. Web subtract line 20 from line 3 (rents) and/or 4 (royalties). In this case, you need not make estimated tax payments for 2022. Who must make estimated tax.

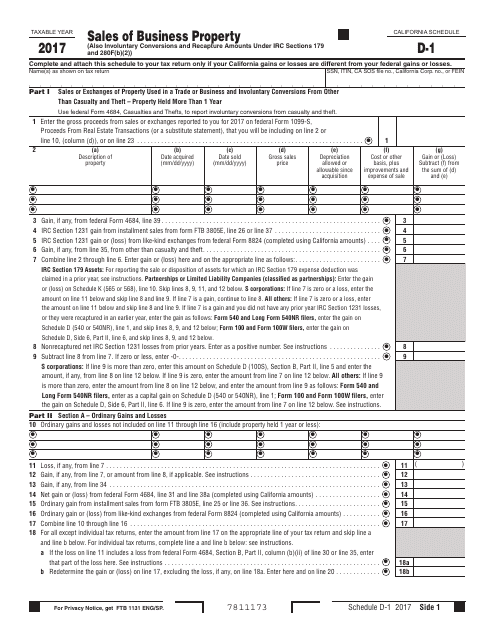

Form 540 Schedule D1 Download Printable PDF or Fill Online Sales of

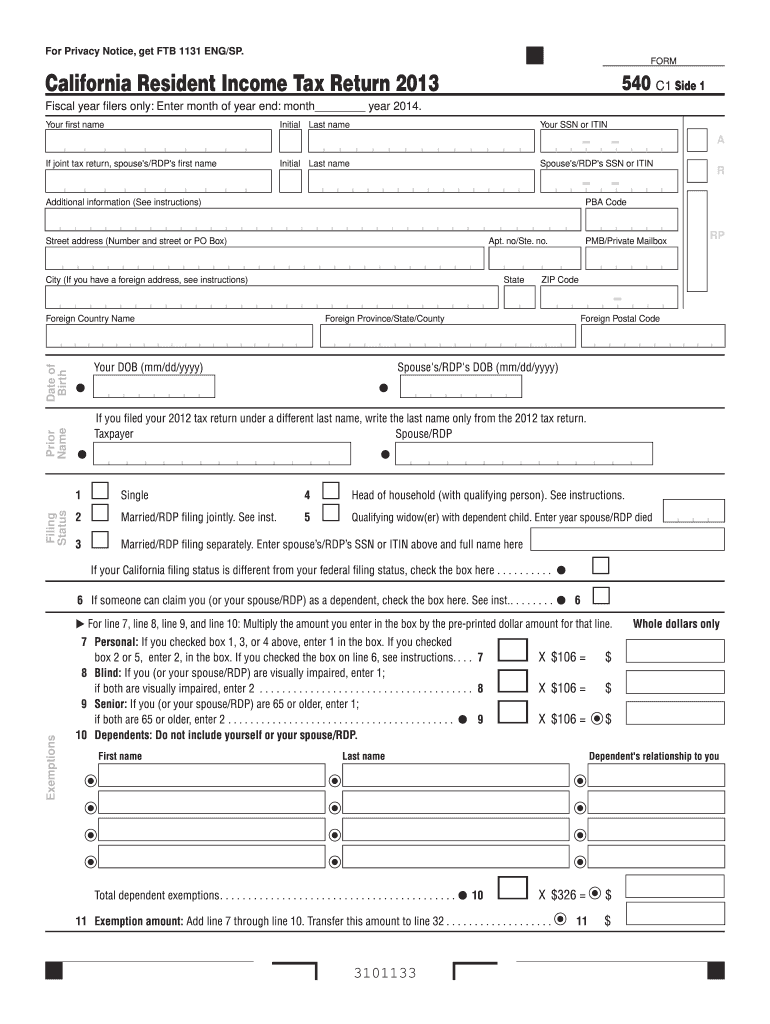

This form is for income earned in tax year 2022, with tax returns due in april. Web 2023estimated tax for individuals file and pay by june 15, 2023 fiscal year filers, enter year ending month: Web solved • by turbotax • 2200 • updated 1 month ago. Web 540 california resident income tax return form 540 form 540 booklet 540.

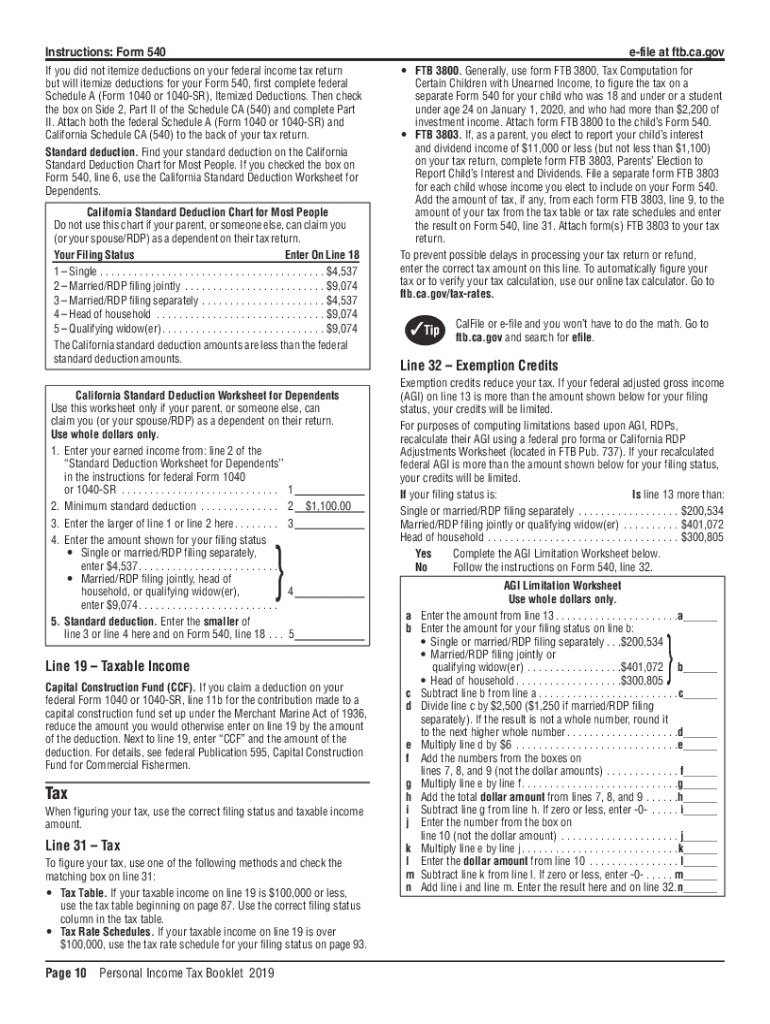

2019 2021 Form Ca Ftb 540 540a Bk Fill Online Printable Free Nude

You can download or print. Web subtract line 20 from line 3 (rents) and/or 4 (royalties). Web 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet 540 es estimated. This is directly tied to your state income tax bill and each payment should be..

Fillable form 540 Fill out & sign online DocHub

Web video instructions and help with filling out and completing form 540 es 2023. Open the document in our online editing. Get the document you want in our library of legal forms. Use the 2021 form ftb. Estimated tax is the method used to pay tax on income that isn’t subject to withholding.

540Es Fill Out and Sign Printable PDF Template signNow

Who must make estimated tax. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) 540nr form (pdf) | 540nr booklet (instructions. Form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax. This form is for income earned in tax year 2022, with tax.

What Is Form 540 Fill Out and Sign Printable PDF Template signNow

Web subtract line 20 from line 3 (rents) and/or 4 (royalties). 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) 540nr form (pdf) | 540nr booklet (instructions. Using black or blue ink, make your check or money order payable to the. Year 2023 do not combine this payment. Web file your.

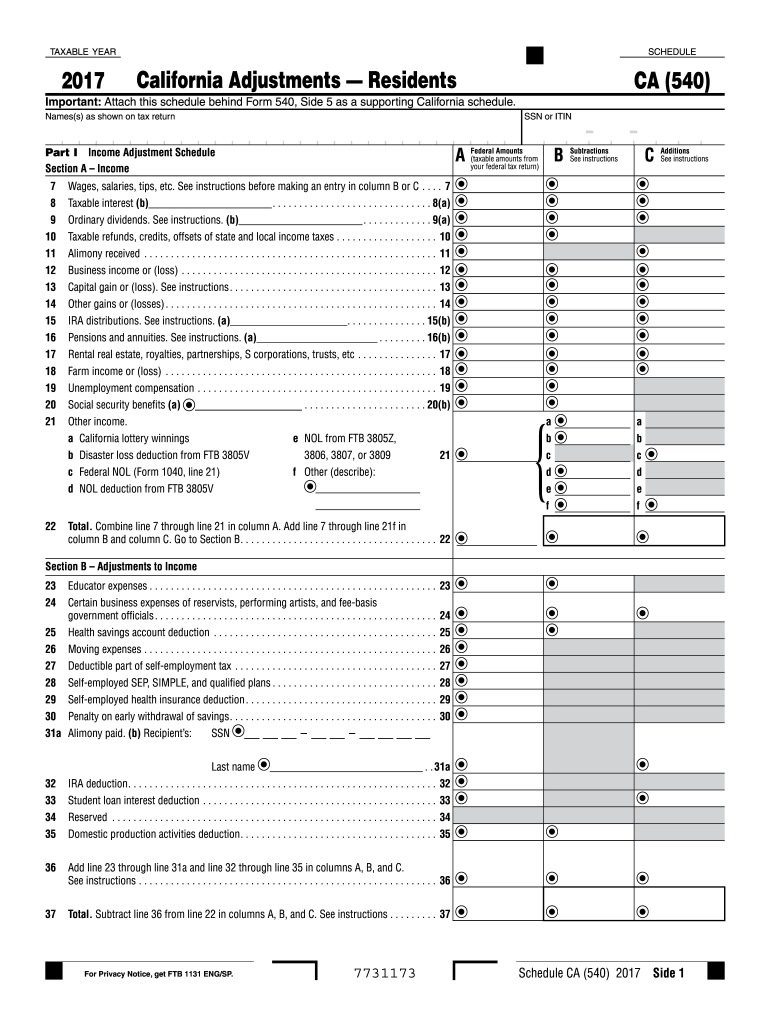

Louisiana state 2012 it 540 form online 2017 Fill out & sign online

This form is for income earned in tax year 2022, with tax returns due in april. Web video instructions and help with filling out and completing form 540 es 2023. O ensure proper credit please n old or staple ail tis. Open the document in our online editing. Use the 2021 form ftb.

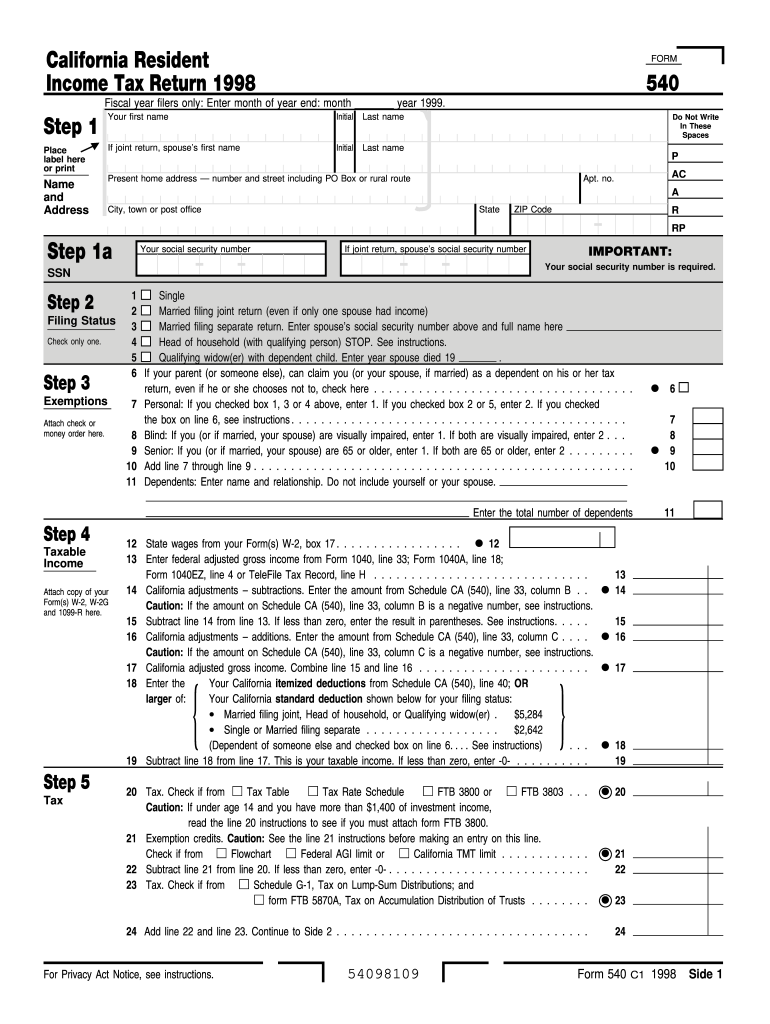

1998 Form 540 California Resident Tax Return Fill out & sign

O ensure proper credit please n old or staple ail tis. This form is for income earned in tax year 2022, with tax returns due in april. Who must make estimated tax. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) 540nr form (pdf) | 540nr booklet (instructions. Web file your.

Print Ca Form 1032 / Ftb Pub 1032 Tax Information For Military

This form is for income earned in tax year 2022, with tax returns due in april. You can download or print. Web solved • by turbotax • 2200 • updated 1 month ago. Form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax. Estimated tax is the method used to pay tax.

Form 540 Fill Out and Sign Printable PDF Template signNow

Form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax. Estimated tax is the method used to pay tax on income that isn’t subject to withholding. Web 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet.

20202022 Form CA 540 2EZ Tax Booklet Fill Online, Printable, Fillable

Web printable california income tax form 540es. Web subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (loss), see instructions to find out if you must file Year 2023 do not combine this payment. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) 540nr form (pdf).

Using Black Or Blue Ink, Make Your Check Or Money Order Payable To The.

If your address has changed, file form 8822 to update your record. You can download or print. Form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax. Web 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet 540 es estimated.

Web Video Instructions And Help With Filling Out And Completing Form 540 Es 2023.

O ensure proper credit please n old or staple ail tis. Use the 2021 form ftb. Web file your tax return for 2022 on or before march 1, 2023, and pay the total tax due. Web subtract line 20 from line 3 (rents) and/or 4 (royalties).

Web Sn S N Ns 2023 Or Calendar Year Or Scal Year Endin S Year Ddress Canes And Estimated Ta Payments Can Be Made At Reeueouo.

Who must make estimated tax. Web 2023estimated tax for individuals file and pay by june 15, 2023 fiscal year filers, enter year ending month: Year 2023 do not combine this payment. If result is a (loss), see instructions to find out if you must file

Estimated Tax Is The Method Used To Pay Tax On Income That Isn’t Subject To Withholding.

Get the document you want in our library of legal forms. Open the document in our online editing. In this case, you need not make estimated tax payments for 2022. This is directly tied to your state income tax bill and each payment should be.