Form 8027 Due Date

Form 8027 Due Date - Part i income and deductions (all trusts complete sections a through d). Web specifications for eroniclect filing of form 8027, employer’s annual information return of tip income and allocated tips for tax year 2022 table of contents part a general. Web irs who uses form 8027? If you need more time and would. 27 by the internal revenue service. Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the. Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2. Web electronically file form 8027 to report tip income and allocated tips. Web transcript slides pdf evette davis: Web number of accompanying forms 8027.

Web irs who uses form 8027? Part i income and deductions (all trusts complete sections a through d). Upload, modify or create forms. Date the trust was created. The irs has established qualifying criteria to determine which businesses need to file form 8027: Web information about form 8027, employer's annual information return of tip income and allocated tips, including recent updates, related forms, and. Web electronically file form 8027 to report tip income and allocated tips. Web specifications for eroniclect filing of form 8027, employer’s annual information return of tip income and allocated tips for tax year 2022 table of contents part a general. If you need more time and would. •you can complete the optional worksheet.

Irs approved tax1099.com allows you to efile your 8027 with security and ease, all online. Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the. Web if you file forms 8027 electronically your due date for filing them with the irs will be extended to march 31. Also see the instructions for lines 1 and 2. The business is located in the. Web specifications for eroniclect filing of form 8027, employer’s annual information return of tip income and allocated tips for tax year 2022 table of contents part a general. Web the 2022 version of form 8027, which allows employers to report tips and receipts, was released oct. Web electronically, the due date is march 31, 2009. Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2. Upload, modify or create forms.

Payroll Forms Employers Need

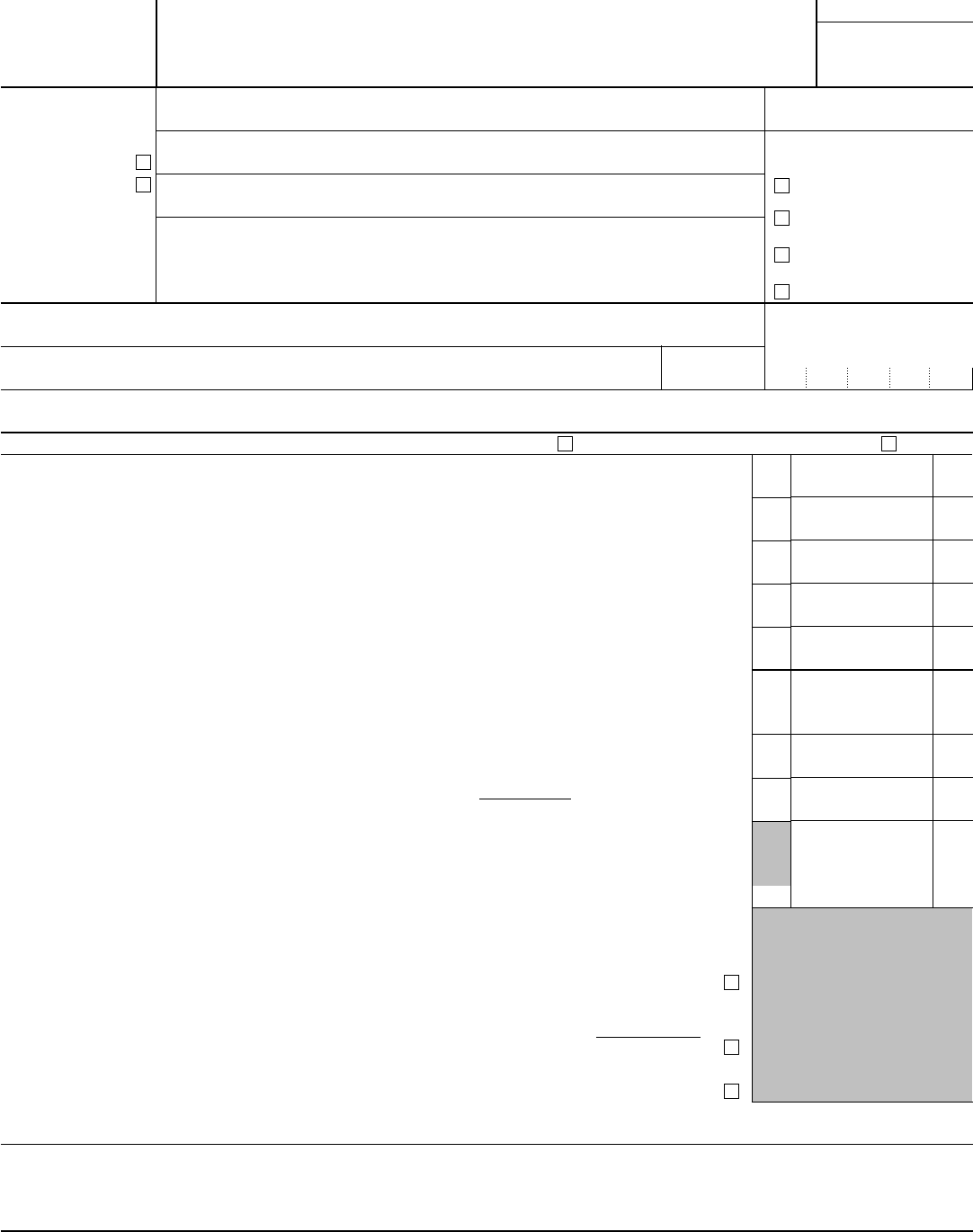

Web form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see the separate instructions. Filers of form 8027 submitted however, you would not have to include the. We're so glad you're joining us today. Web if you file forms 8027 electronically your due date for filing them with the irs.

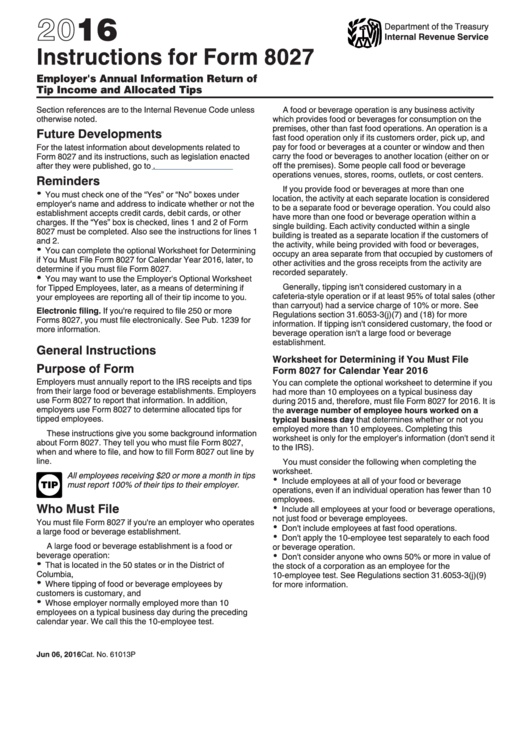

Instructions For Form 8027 2016 printable pdf download

The irs has established qualifying criteria to determine which businesses need to file form 8027: Web filing and due dates. It is strongly recommended that you file form 8027 electronically. Irs approved tax1099.com allows you to efile your 8027 with security and ease, all online. Web form 5227 department of the treasury internal revenue service.

March 2020 Business Tax Return Due Dates Business tax, tax

If you file form 8027 electronically, the due date is march 31. Try it for free now! Web form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see the separate instructions. Extension of time to file. It is strongly recommended that you file form 8027 electronically.

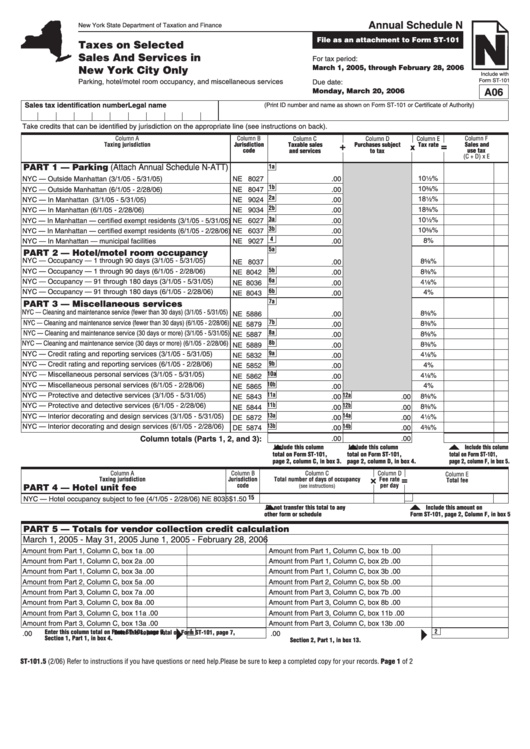

Form St101.5 Taxes On Selected Sales And Services February 2006

Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the. Web electronically, the due date is march 31, 2009. Web form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see the separate instructions. Upload, modify or.

Form 8027 Employer's Annual Information Return of Tip and

Upload, modify or create forms. We're so glad you're joining us today. Web when is the form 8027 due date? Web irs who uses form 8027? The business is located in the.

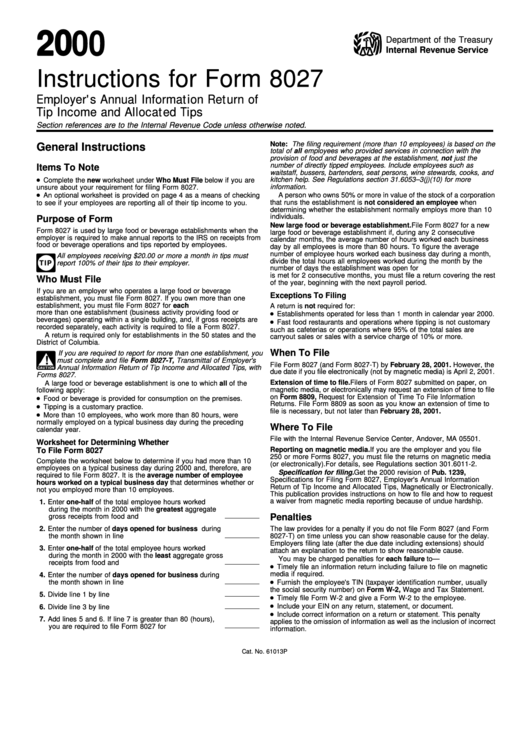

Instructions For Form 8027 printable pdf download

Web if you file forms 8027 electronically your due date for filing them with the irs will be extended to march 31. It is strongly recommended that you file form 8027 electronically. Web form 5227 department of the treasury internal revenue service. The business is located in the. Web when is the form 8027 due date?

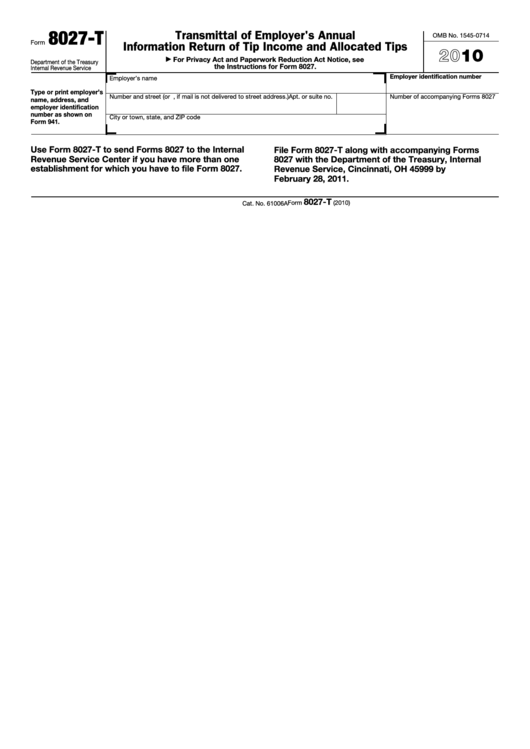

Form 8027T Transmittal of Employer's Annual Information Return (2015

Web are you looking for where to file 8027 online? If you file form 8027 electronically, the due date is march 31. Web form 5227 department of the treasury internal revenue service. Web irs who uses form 8027? Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2.

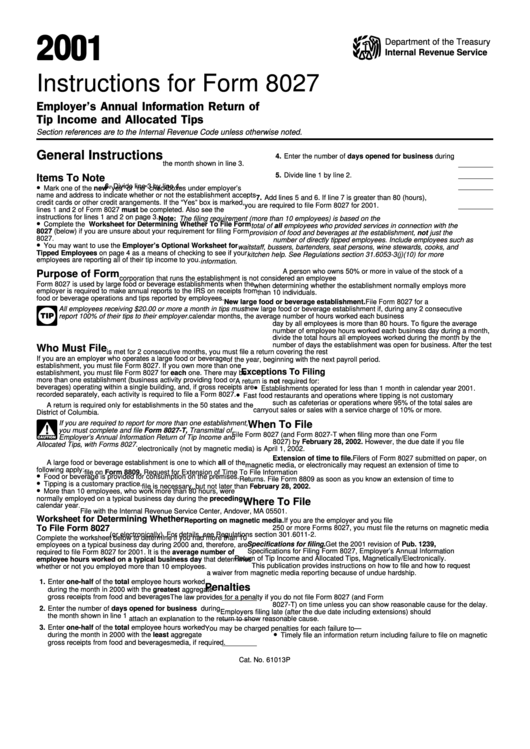

Instructions For Form 8027 printable pdf download

It is strongly recommended that you file form 8027 electronically. If you are mailing form 8027 to the irs, it is due by february 28. Web electronically, the due date is march 31, 2009. Filers of form 8027 submitted however, you would not have to include the. Web transcript slides pdf evette davis:

2017 Form 8027 Edit, Fill, Sign Online Handypdf

Web are you looking for where to file 8027 online? Irs form 8027 is used to by. If you file form 8027 electronically, the due date is march 31. Web number of accompanying forms 8027. •you can complete the optional worksheet.

Fillable Form 8027T Transmittal Of Employer'S Annual Information

Web electronically, the due date is march 31, 2009. Web information about form 8027, employer's annual information return of tip income and allocated tips, including recent updates, related forms, and. Irs approved tax1099.com allows you to efile your 8027 with security and ease, all online. Welcome to today's webinar, form 8027 and large food and beverage establishments. The irs has.

Date The Trust Was Created.

Web form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see the separate instructions. Part i income and deductions (all trusts complete sections a through d). Web form 5227 department of the treasury internal revenue service. Web information about form 8027, employer's annual information return of tip income and allocated tips, including recent updates, related forms, and.

Also See The Instructions For Lines 1 And 2.

Web if you file forms 8027 electronically your due date for filing them with the irs will be extended to march 31. Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the. Web are you looking for where to file 8027 online? Web specifications for eroniclect filing of form 8027, employer’s annual information return of tip income and allocated tips for tax year 2022 table of contents part a general.

Filers Of Form 8027 Submitted However, You Would Not Have To Include The.

27 by the internal revenue service. Irs approved tax1099.com allows you to efile your 8027 with security and ease, all online. If you are mailing form 8027 to the irs, it is due by february 28. If you need more time and would.

The Irs Has Established Qualifying Criteria To Determine Which Businesses Need To File Form 8027:

Complete, edit or print tax forms instantly. Welcome to today's webinar, form 8027 and large food and beverage establishments. Upload, modify or create forms. The business is located in the.