Amended 1120S Form

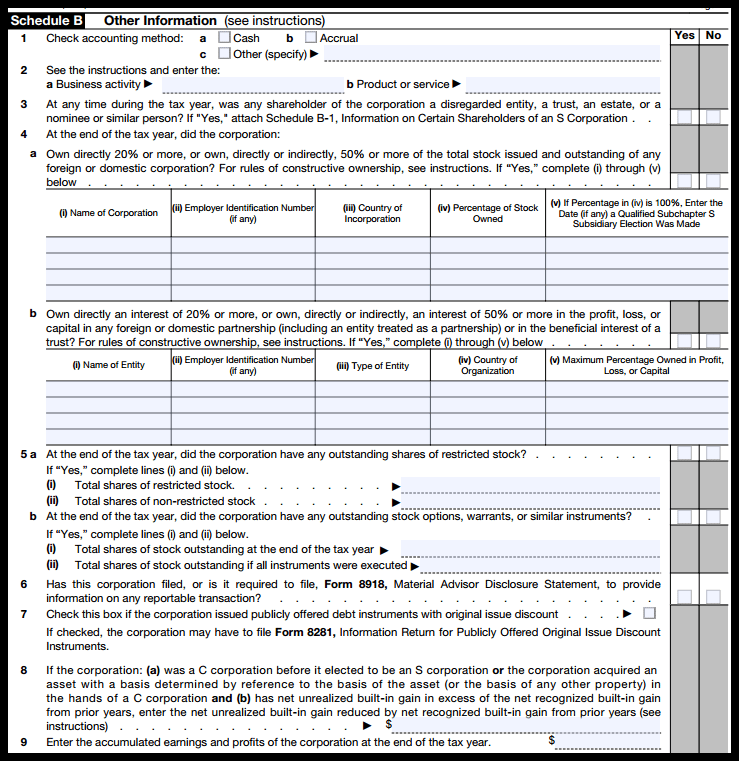

Amended 1120S Form - Web consolidated returns being amended for a specific tax authority (federal or state (s)) require that same tax authority to be amended in each separate client return in the return group for electronic filing. Information about form 1120x and its instructions is at. Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation of. Web amended and superseding corporate returns. To access this checkbox through the q&a: Amended returns can be amended additional times. This is why you need to save the previous version as a different file, so that you may keep a data copy of the originally filed return. Go to www.irs.gov/form1120s for instructions and the latest information. Make an additional tax payment. Say you omitted revenue or deductions when you.

Web amended and superseding corporate returns. Go to www.irs.gov/form1120s for instructions and the latest information. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Amended returns can be amended additional times. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Web consolidated returns being amended for a specific tax authority (federal or state (s)) require that same tax authority to be amended in each separate client return in the return group for electronic filing. This is why you need to save the previous version as a different file, so that you may keep a data copy of the originally filed return. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. November 2016) department of the treasury internal revenue service.

Make an additional tax payment. Web consolidated returns being amended for a specific tax authority (federal or state (s)) require that same tax authority to be amended in each separate client return in the return group for electronic filing. Amended returns can be amended additional times. Web amended and superseding corporate returns. (enter month and year.) please type or print. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Corporation income tax return, including recent updates, related forms, and instructions on how to file. This is why you need to save the previous version as a different file, so that you may keep a data copy of the originally filed return. Information about form 1120x and its instructions is at. November 2016) department of the treasury internal revenue service.

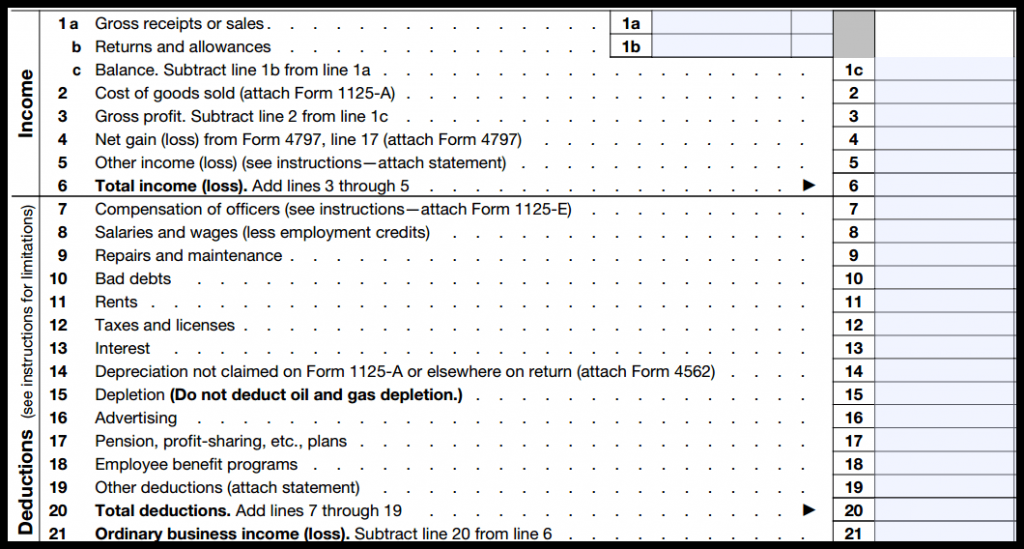

Form 1120 Amended Return Overview & Instructions

Web amended and superseding corporate returns. Say you omitted revenue or deductions when you. To access this checkbox through the q&a: Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Corporation income tax return, including recent updates, related forms, and instructions on how to.

IRS Form 1120S Definition, Download, & 1120S Instructions

Web consolidated returns being amended for a specific tax authority (federal or state (s)) require that same tax authority to be amended in each separate client return in the return group for electronic filing. Web amended and superseding corporate returns. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s.

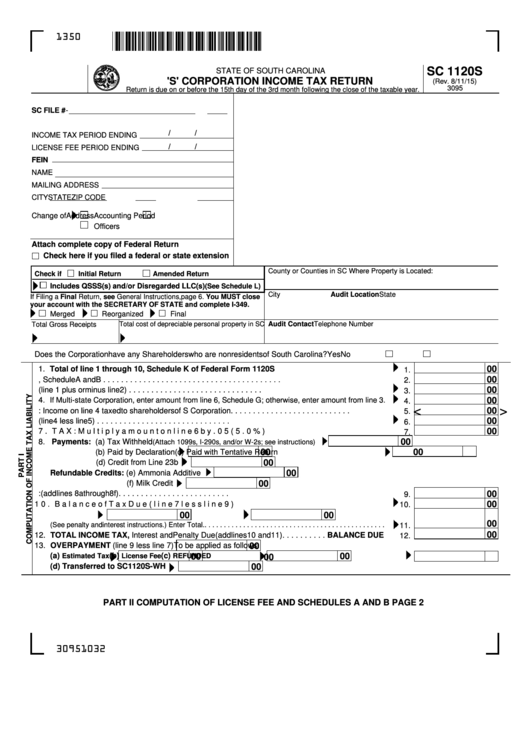

Form Sc 1120s 'S' Corporation Tax Return printable pdf download

Corporation income tax return, including recent updates, related forms, and instructions on how to file. Amended returns can be amended additional times. November 2016) department of the treasury internal revenue service. This is why you need to save the previous version as a different file, so that you may keep a data copy of the originally filed return. Web amended.

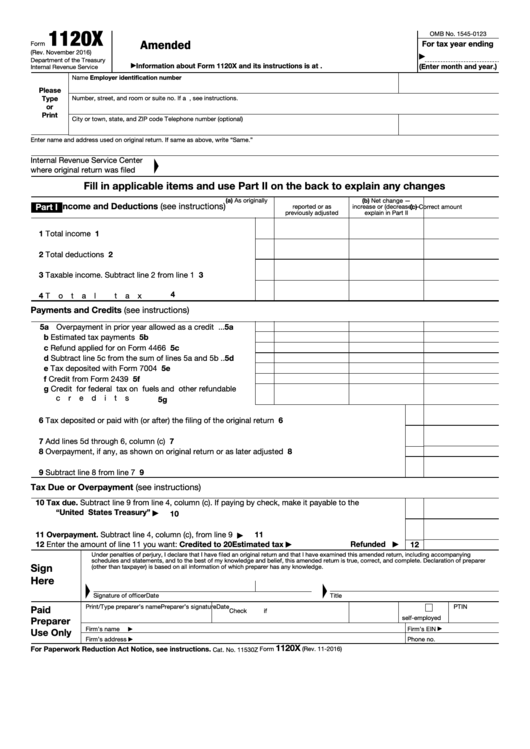

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Web consolidated returns being amended for a specific tax authority (federal or state (s)) require that same tax authority to be amended in each separate client return in the return group for electronic filing. November.

Federal Gift Tax Form 709 Gift Ftempo ED4

To access this checkbox through the q&a: (enter month and year.) please type or print. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. This is why you need.

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

To access this checkbox through the q&a: (enter month and year.) please type or print. Information about form 1120x and its instructions is at. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. Say you omitted revenue or deductions when you.

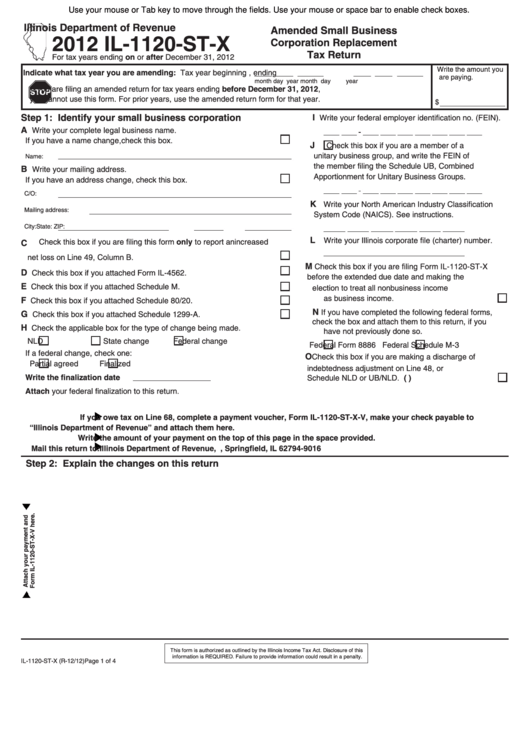

Fillable Form Il1120StX Amended Small Business Corporation

Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. To access this checkbox through the q&a: Say you omitted revenue or deductions when you. Information about form 1120x and its instructions is at. (enter month and year.) please type or print.

Fillable Form 1120X Amended U.s. Corporation Tax Return

Say you omitted revenue or deductions when you. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation of. Corporation income tax return, including recent.

How to Complete Form 1120S Tax Return for an S Corp

November 2016) department of the treasury internal revenue service. Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation of. Web consolidated returns being amended for a specific tax authority (federal or state (s)) require that same tax authority to be amended in each separate client return.

Download Instructions for Form IL1120 Schedule INS Tax for Foreign

Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. To access this checkbox through the q&a: Make an additional tax payment. November 2016) department of the treasury internal revenue service. Go to www.irs.gov/form1120s for instructions and the latest information.

(Enter Month And Year.) Please Type Or Print.

Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation of. Go to www.irs.gov/form1120s for instructions and the latest information. Make an additional tax payment. Web consolidated returns being amended for a specific tax authority (federal or state (s)) require that same tax authority to be amended in each separate client return in the return group for electronic filing.

Income Tax Return For An S Corporation Is Amended By Checking The Amended Return Box Located At The Top Of Page 1.

Amended returns can be amended additional times. Web amended and superseding corporate returns. Information about form 1120x and its instructions is at. Corporation income tax return, including recent updates, related forms, and instructions on how to file.

November 2016) Department Of The Treasury Internal Revenue Service.

This is why you need to save the previous version as a different file, so that you may keep a data copy of the originally filed return. To access this checkbox through the q&a: Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Say you omitted revenue or deductions when you.