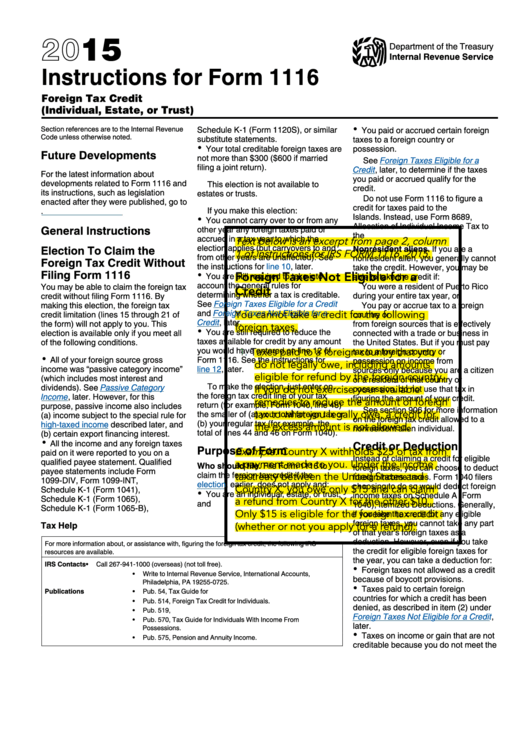

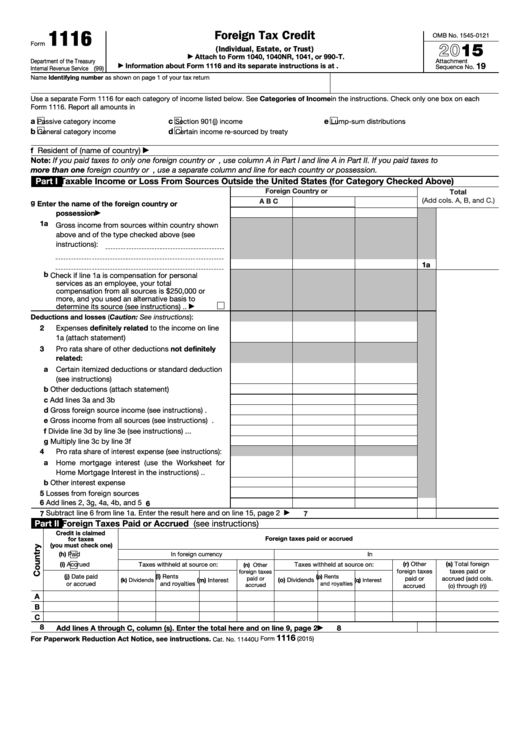

Federal Form 1116 Instructions

Federal Form 1116 Instructions - There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they. Deduct their foreign taxes on schedule a, like other common deductions. You must also still file form 1116 to claim the credit for other foreign taxes you paid or accrued. As shown on page 1 of your tax return. Taxpayers are therefore reporting running. Web per irs instructions for form 1116, on page 16: Lines 3d and 3e for lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Web to avoid double taxation on americans living abroad, the irs gives them a choice: Foreign taxes eligible for a credit.

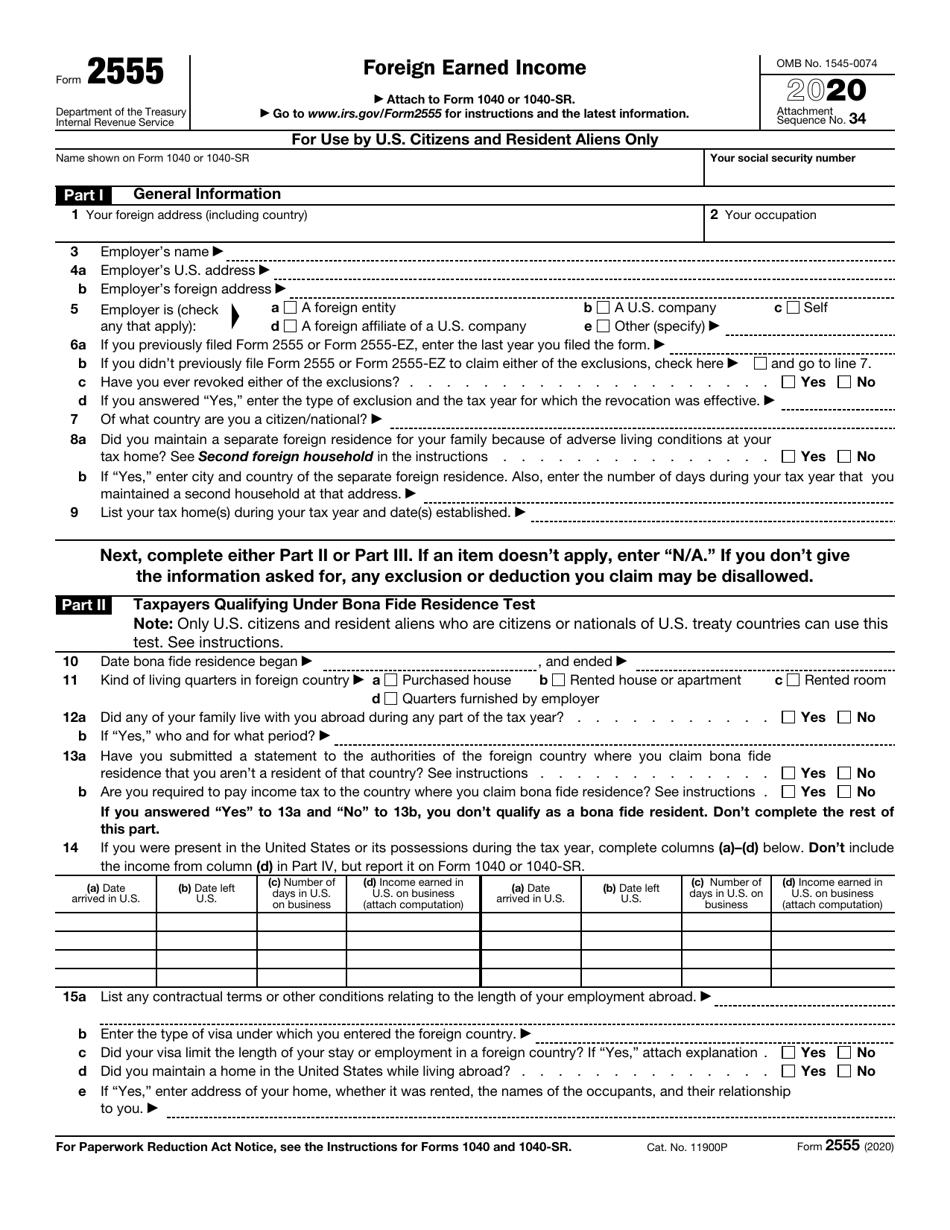

Expat should learn to love, because it’s one of two ways americans working overseas can lower their u.s. Foreign taxes eligible for a credit. Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this is the latest version of form 1116, fully updated for tax year 2022. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web form 1116 is used to claim the foreign tax credit to reduce your us income tax liability, dollar for dollar for income tax paid to a foreign country. Federal section>deductions>credits menu>foreign tax credit; In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive. Taxpayers are therefore reporting running. Web we last updated federal form 1116 in december 2022 from the federal internal revenue service. Election to claim the foreign tax credit without filing form 1116.

Election to claim the foreign tax credit without filing form 1116. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1116. Web for instructions and the latest information. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web per irs instructions for form 1116, on page 16: Taxpayers are therefore reporting running. Web we last updated federal form 1116 in december 2022 from the federal internal revenue service. Federal section>deductions>credits menu>foreign tax credit; Web form 1116 is used to claim the foreign tax credit to reduce your us income tax liability, dollar for dollar for income tax paid to a foreign country. This form is for income earned in tax year 2022, with tax returns due in april.

Form 1116 Instructions 2022 2023 IRS Forms Zrivo

In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive. Foreign taxes eligible for a credit. Web per irs instructions for form 1116, on page 16: Deduct their foreign taxes on schedule a, like other common deductions. A credit for foreign taxes can be claimed only for foreign tax.

Irs Fillable Form 1040 / 1040 2020 Internal Revenue Service Robert

This form is for income earned in tax year 2022, with tax returns due in april. Web for instructions and the latest information. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1116. The ftc of $150 in the above example is subject to further..

3.21.3 Individual Tax Returns Internal Revenue Service

Foreign taxes eligible for a credit. For more information on how to complete your form 1116 and form 1118 when. Web the form 1116 instructions provide the mechanics of how the reclassification is done. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to.

Publication 514, Foreign Tax Credit for Individuals; Simple Example

Deduct their foreign taxes on schedule a, like other common deductions. Taxpayers are therefore reporting running. As shown on page 1 of your tax return. Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this is the latest version of form 1116, fully updated for tax year 2022. Lines 3d and 3e for.

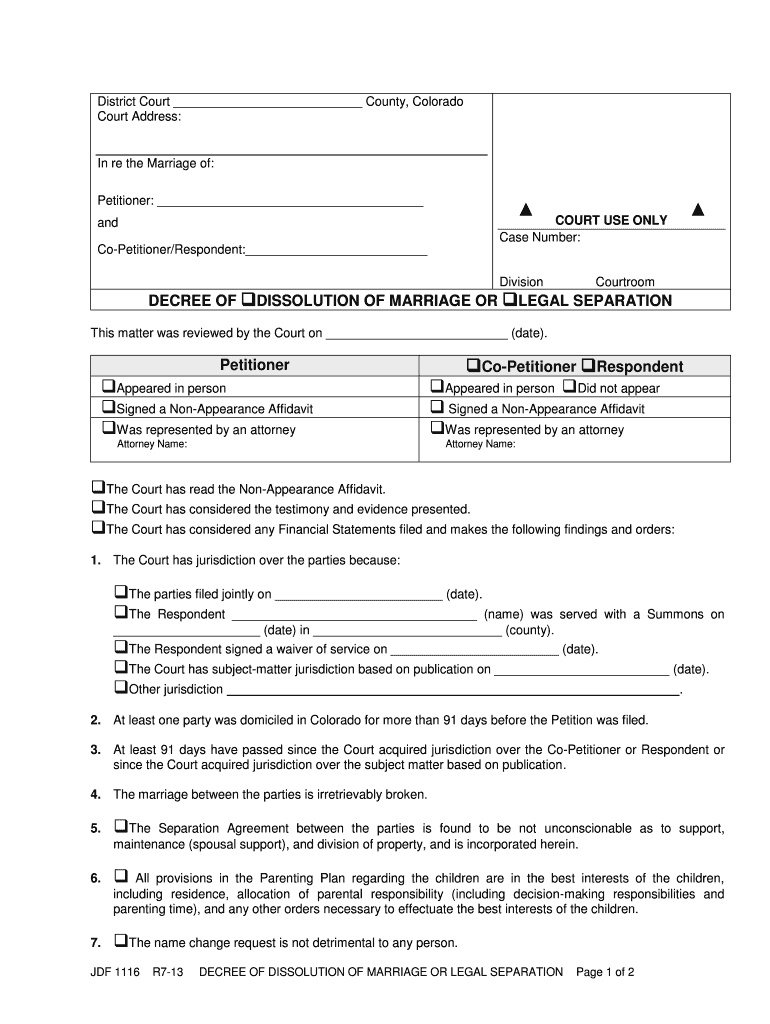

20132021 Form CO JDF 1116 Fill Online, Printable, Fillable, Blank

Federal section>deductions>credits menu>foreign tax credit; You must also still file form 1116 to claim the credit for other foreign taxes you paid or accrued. Expat should learn to love, because it’s one of two ways americans working overseas can lower their u.s. Web to avoid double taxation on americans living abroad, the irs gives them a choice: Deduct their foreign.

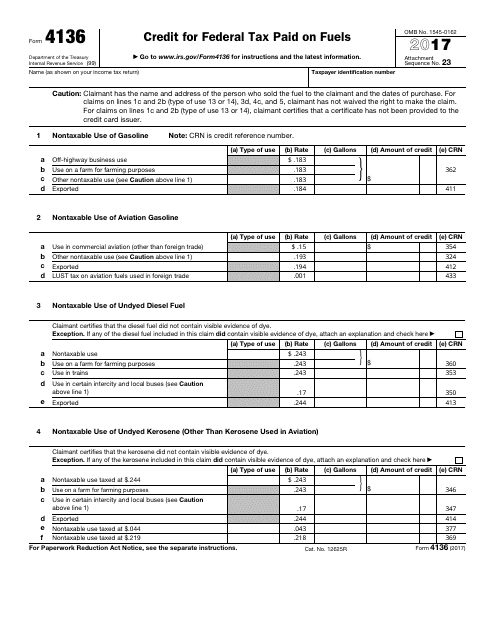

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. Web form 1116 is one tax form every u.s. Web the form 1116.

Form 1116 part 1 instructions

Web per irs instructions for form 1116, on page 16: Lines 3d and 3e for lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. Taxpayers are therefore reporting running. Web we.

Are capital loss deductions included on Form 1116 for Deductions and

The ftc of $150 in the above example is subject to further. For more information on how to complete your form 1116 and form 1118 when. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur.

2015 Instructions For Form 1116 printable pdf download

Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this is the latest version of form 1116, fully updated for tax year 2022. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they. The ftc.

Fillable Form 1116 Foreign Tax Credit printable pdf download

Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1116. Web for instructions and the latest information. A credit for foreign taxes can be claimed only for foreign tax. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations.

A Credit For Foreign Taxes Can Be Claimed Only For Foreign Tax.

Web form 1116 is one tax form every u.s. Taxpayers are therefore reporting running. Web for instructions and the latest information. Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this is the latest version of form 1116, fully updated for tax year 2022.

The Ftc Of $150 In The Above Example Is Subject To Further.

In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive. Federal section>deductions>credits menu>foreign tax credit; This form is for income earned in tax year 2022, with tax returns due in april. As shown on page 1 of your tax return.

Foreign Taxes Eligible For A Credit.

Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. Election to claim the foreign tax credit without filing form 1116. Web the form 1116 instructions provide the mechanics of how the reclassification is done. Web per irs instructions for form 1116, on page 16:

Deduct Their Foreign Taxes On Schedule A, Like Other Common Deductions.

Expat should learn to love, because it’s one of two ways americans working overseas can lower their u.s. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. You must also still file form 1116 to claim the credit for other foreign taxes you paid or accrued. Web we last updated federal form 1116 in december 2022 from the federal internal revenue service.