Form 5472 Reportable Transactions

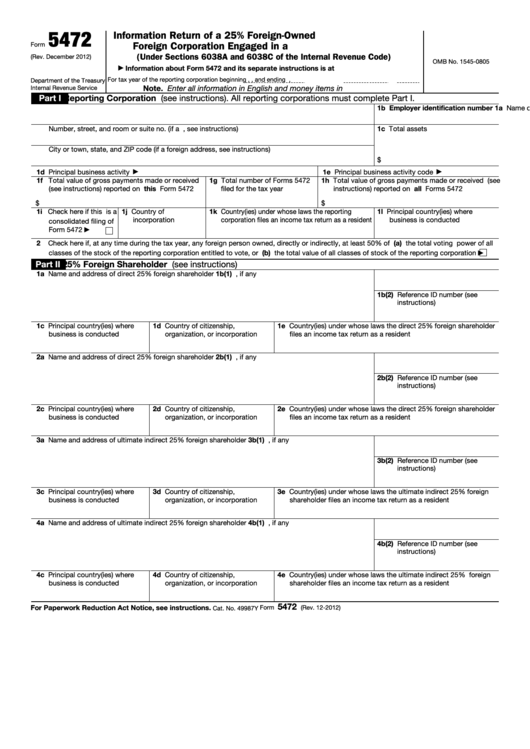

Form 5472 Reportable Transactions - What is the purpose of form 5472? Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. Web form 5472 should be used to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a. Web a “reportable transaction” includes a broad range of transactions, such as sales, rents, royalties, loans, transactions concerning intangible property rights and other. Web a separate form 5472 must be filed for each foreign or domestic related party with which the reporting llc had a reportable transaction. Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. Corporations file form 5472 to provide information. Web form 5472 is an irs tax form used to report certain transactions of foreign corporations and foreign partnerships. To start, what exactly is irs form 5472? Simply put, irs form 5472 is an information return.

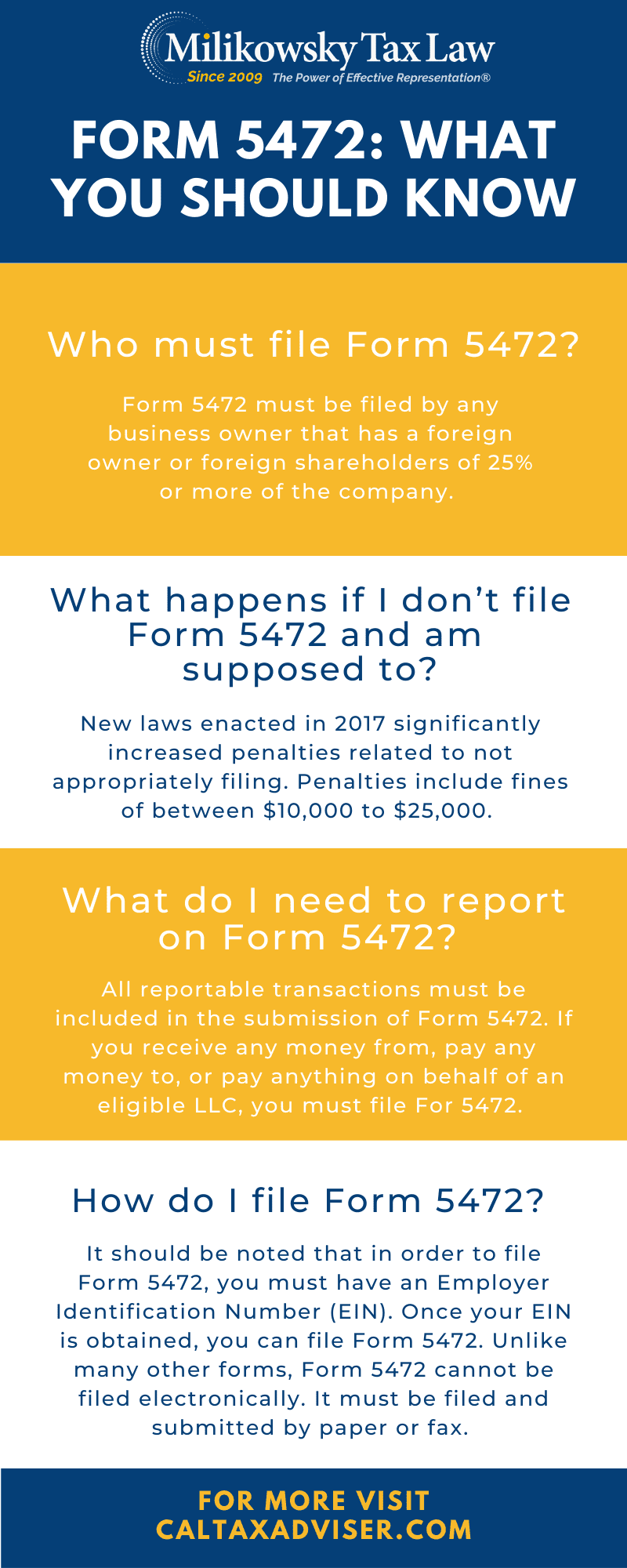

Total number of forms 5472 filed for the tax year. Corporations file form 5472 to provide information. What you need to know by josh babb march 24, 2022 share: Web internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting corporation (the us. Web a “reportable transaction” includes a broad range of transactions, such as sales, rents, royalties, loans, transactions concerning intangible property rights and other. The irs requires businesses to file form 5472 if they are a us. ⚠️you will be hit with an automatic $10,000 penalty. Web don't forget to file form 5472 and most importantly, don't file it late! Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. You use this form to report.

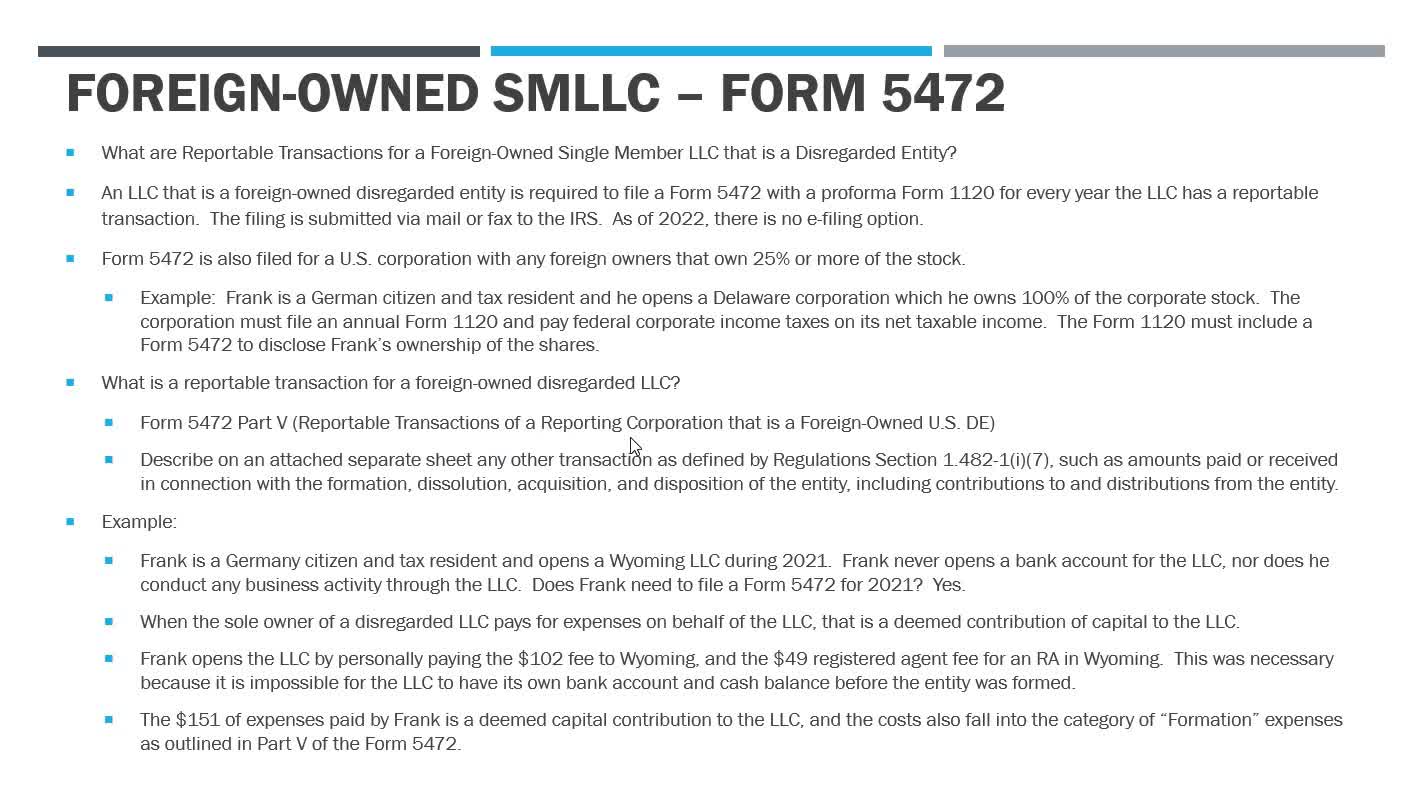

Web reportable transactions are any monetary transactions listed in part iv of form 5472 (e.g., sales, rents, commissions, interest, etc.) between reporting corporations and. To start, what exactly is irs form 5472? Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web in filing a form 5472, the reporting corporation must provide information regarding its foreign shareholder, certain other related parties, and the dollar amounts of the. Web form 5472 is an information return that must be filed by a us corporation that is 25% owned by a foreign shareholder or a foreign corporation that is involved in a. Web a “reportable transaction” includes a broad range of transactions, such as sales, rents, royalties, loans, transactions concerning intangible property rights and other. Corporations file form 5472 to provide information. Web a separate form 5472 must be filed for each foreign or domestic related party with which the reporting llc had a reportable transaction. De (see instructions) describe on an attached separate sheet any other transaction as. Web form 5472 should be used to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a.

New Requirements For IRS Form 5472 (for Foreign Shareholders

Web a separate form 5472 must be filed for each foreign or domestic related party with which the reporting llc had a reportable transaction. Web form 5472 the dollar amounts of all reportable transactions for which monetary consideration (including u.s and foreign currency) was the sole consideration paid or. The irs requires businesses to file form 5472 if they are.

Form 5472, Info. Return of a 25 ForeignOwned U.S. or Foreign Corp

Web in filing a form 5472, the reporting corporation must provide information regarding its foreign shareholder, certain other related parties, and the dollar amounts of the. To start, what exactly is irs form 5472? Corporations file form 5472 to provide information. Web internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of.

Form 5472 Information Return of Corporation Engaged in U.S. Trade

Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. Total number of forms 5472 filed for the tax year. ⚠️you will be hit with an automatic $10,000 penalty. Web don't forget to file form 5472 and most importantly, don't file it late! Web form 5472 is an.

Fillable Form 5472 Information Return Of A 25 ForeignOwned U.s

Simply put, irs form 5472 is an information return. Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. ⚠️ form 5472 can be found here. Web a “reportable transaction” includes a broad range of transactions, such as sales, rents, royalties, loans, transactions concerning intangible property rights and.

IRS Form 5472

The irs requires businesses to file form 5472 if they are a us. ⚠️you will be hit with an automatic $10,000 penalty. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web reportable transactions are any monetary transactions listed in part iv of form 5472 (e.g., sales, rents, commissions, interest, etc.) between reporting.

Form 5472 Foreign Owned Company Filings Milikowsky Tax Law

⚠️you will be hit with an automatic $10,000 penalty. ⚠️ form 5472 can be found here. Web form 5472 should be used to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a. Web a separate form 5472 must be filed for each foreign or domestic related party with which the reporting.

Should You File a Form 5471 or Form 5472? Asena Advisors

Total number of forms 5472 filed for the tax year. Web in filing a form 5472, the reporting corporation must provide information regarding its foreign shareholder, certain other related parties, and the dollar amounts of the. To start, what exactly is irs form 5472? De (see instructions) describe on an attached separate sheet any other transaction as. The irs requires.

Form 5472 Reportable Transactions for Foreign Owned LLC

Web reportable transactions are any monetary transactions listed in part iv of form 5472 (e.g., sales, rents, commissions, interest, etc.) between reporting corporations and. Web in filing a form 5472, the reporting corporation must provide information regarding its foreign shareholder, certain other related parties, and the dollar amounts of the. What is the purpose of form 5472? Web form 5472.

form 5472 instructions 2018 Fill Online, Printable, Fillable Blank

Total number of forms 5472 filed for the tax year. Web internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting corporation (the us. Total value of gross payments made or received reported on. Web a separate form 5472 must be filed for each foreign or domestic related party with.

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

Web form 5472 is an information return that must be filed by a us corporation that is 25% owned by a foreign shareholder or a foreign corporation that is involved in a. Web a “reportable transaction” includes a broad range of transactions, such as sales, rents, royalties, loans, transactions concerning intangible property rights and other. ⚠️you will be hit with.

Web A “Reportable Transaction” Includes A Broad Range Of Transactions, Such As Sales, Rents, Royalties, Loans, Transactions Concerning Intangible Property Rights And Other.

De (see instructions) describe on an attached separate sheet any other transaction as. Corporations file form 5472 to provide information. What is the purpose of form 5472? Web form 5472 is an irs tax form used to report certain transactions of foreign corporations and foreign partnerships.

Web A Separate Form 5472 Must Be Filed For Each Foreign Or Domestic Related Party With Which The Reporting Llc Had A Reportable Transaction.

Web form 5472 is an information return that must be filed by a us corporation that is 25% owned by a foreign shareholder or a foreign corporation that is involved in a. The irs requires businesses to file form 5472 if they are a us. To start, what exactly is irs form 5472? Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party.

⚠️You Will Be Hit With An Automatic $10,000 Penalty.

Web form 5472 the dollar amounts of all reportable transactions for which monetary consideration (including u.s and foreign currency) was the sole consideration paid or. Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. What you need to know by josh babb march 24, 2022 share: Web internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting corporation (the us.

You Use This Form To Report.

Web form 5472 should be used to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a. Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. Total number of forms 5472 filed for the tax year. Web about blog global business services form 5472:

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity-1024x1024.jpg)