Form 593 Pdf

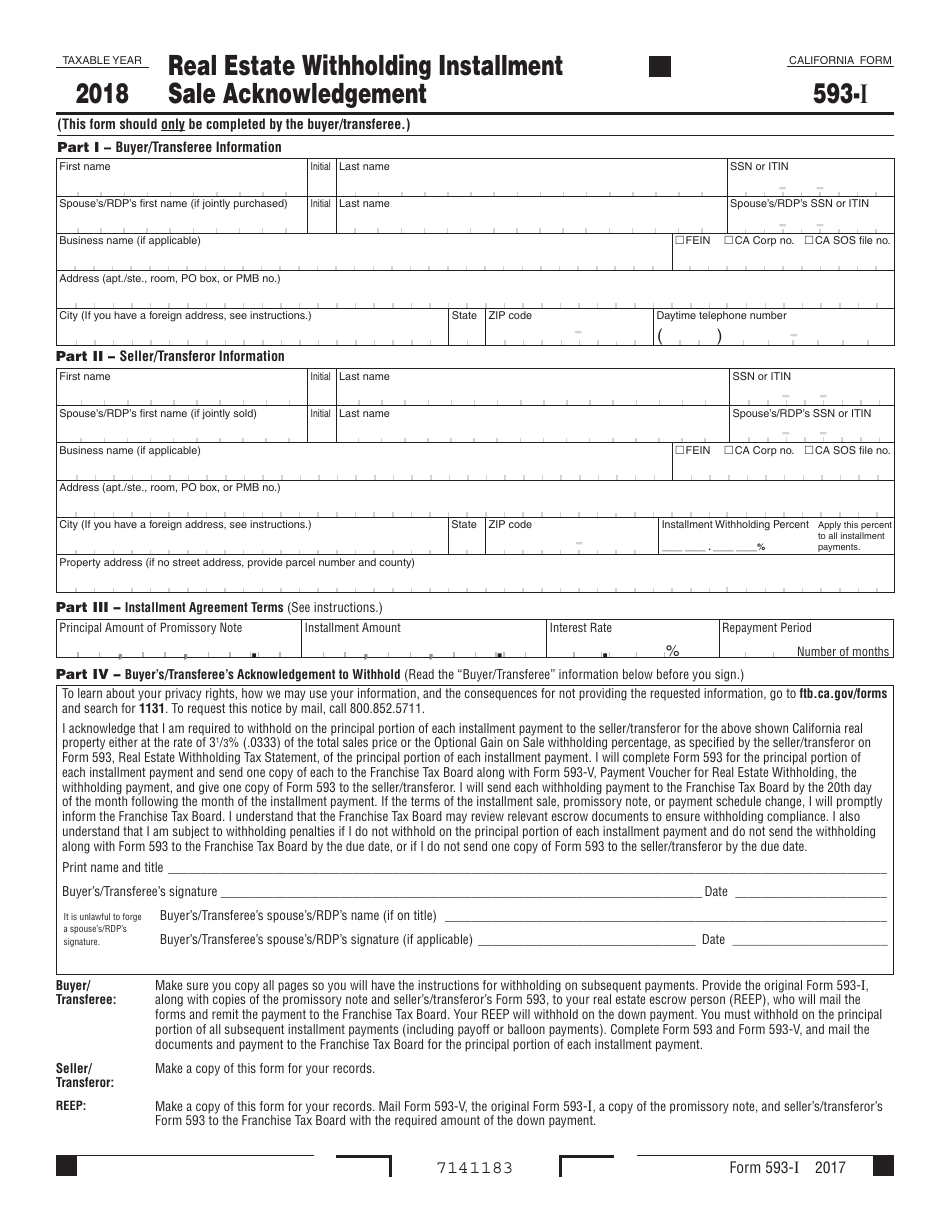

Form 593 Pdf - I will complete form 593 for the principal portion of each installment payment. Web payment and do not send the withholding along with form 593 to the ftb by the due date, or if i do not send one copy of form 593 to the seller/transferor by the due date. Web california real property must file form 593 to report the amount withheld. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Web california real estate withholding. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2019, installment payments made in 2019, or exchanges. Recordkeeping 6 hr., 13 min. Typically this is a real estate escrow person (reep). Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. Web form 593, real estate withholding statement, of the principal portion of each installment payment.

Recordkeeping 6 hr., 13 min. Learning about the law or the form 2 hr., 59 min. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. Web california real estate withholding. If this is an installment sale payment after escrow. Citizensand residentsgoing abroad get forms and other informationfaster and easier. Web as of january 1, 2020, california real estate withholding changed. Enter the names of a petitioner, respondent, and another. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2019, installment payments made in 2019, or exchanges.

Learning about the law or the form 2 hr., 59 min. Web california real estate withholding. Typically this is a real estate escrow person (reep). Web form will vary depending on individual circumstances. Web as of january 1, 2020, california real estate withholding changed. If this is an installment sale payment after escrow. Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. Citizensand residentsgoing abroad get forms and other informationfaster and easier. Sign it in a few clicks draw your signature, type it,. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2019, installment payments made in 2019, or exchanges.

Form 593I Download Printable PDF or Fill Online Real Estate

We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Web as of january 1, 2020, california real estate withholding changed. Typically this is a real estate escrow person (reep). Real estate withholding is a prepayment of income (or franchise) tax due. Web form will vary depending on individual circumstances.

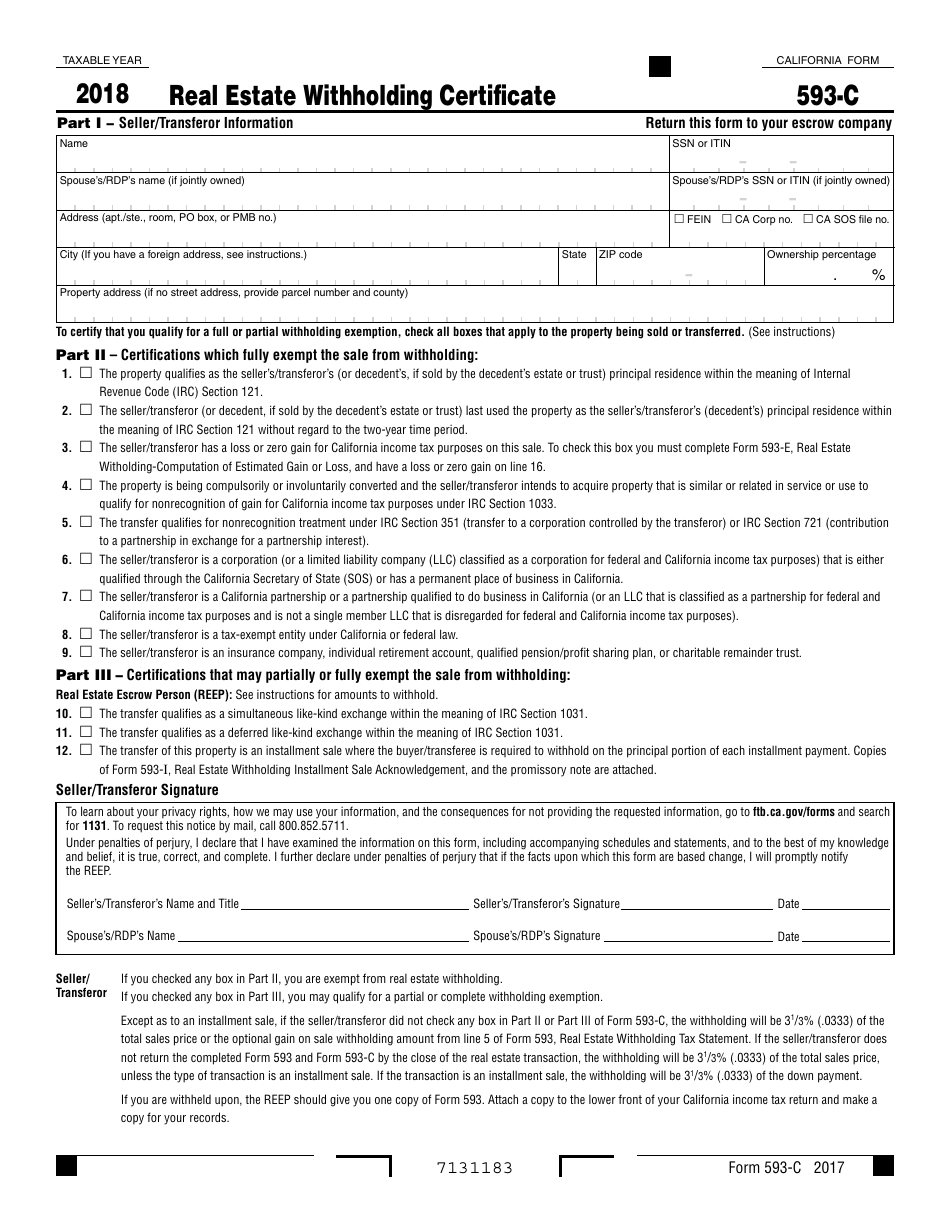

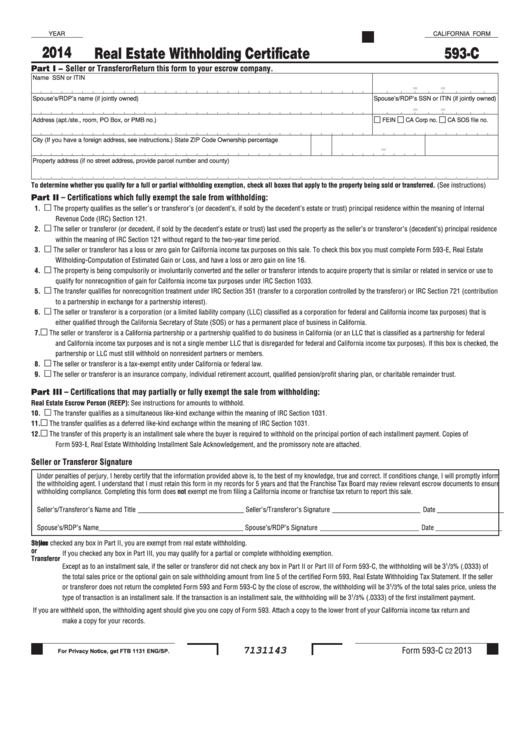

Form 593c Download Fillable PDF or Fill Online Real Estate Withholding

We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2019, installment payments made in 2019, or exchanges. Citizensand residentsgoing abroad get forms and other informationfaster and easier. Recordkeeping 6 hr., 13 min. Sign.

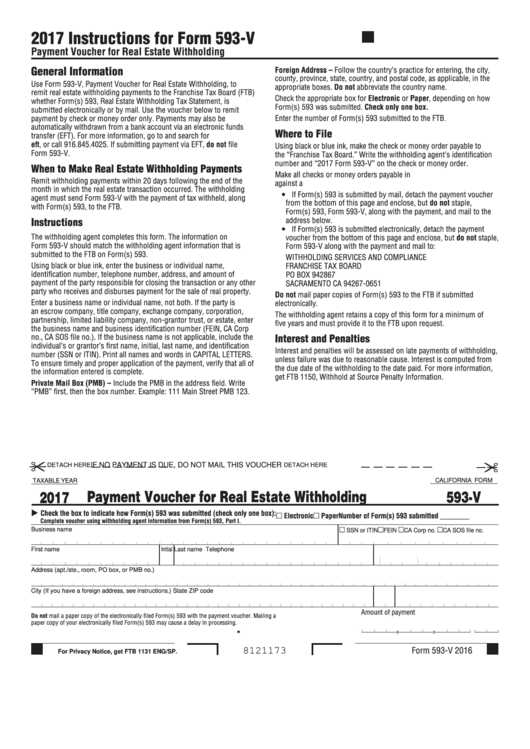

Fillable Form 593V Payment Voucher For Real Estate Withholding

Web form 593, real estate withholding statement, of the principal portion of each installment payment. Download this form print this form more about the. Web form will vary depending on individual circumstances. Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. Real estate withholding is a prepayment of income (or franchise).

Form 5695 2021 2022 IRS Forms TaxUni

If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Learning about the law or the form 2 hr., 59 min. If this is an installment sale payment after escrow. Web form 593, real estate withholding statement, of the principal portion of each installment payment. Recordkeeping.

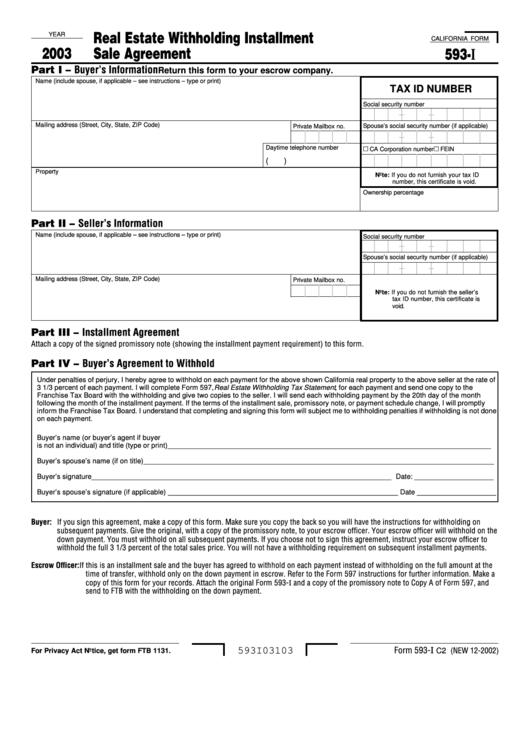

Form 593I Real Estate Withholding Installment Sale Agreement

Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2019, installment payments made in 2019, or exchanges. Typically this is a real estate escrow person (reep). Web as of january 1, 2020, california real estate withholding changed. Edit your calif form593 e online type text, add images, blackout confidential details, add comments,.

Fillable California Form 593C Real Estate Withholding Certificate

Web payment and do not send the withholding along with form 593 to the ftb by the due date, or if i do not send one copy of form 593 to the seller/transferor by the due date. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form.

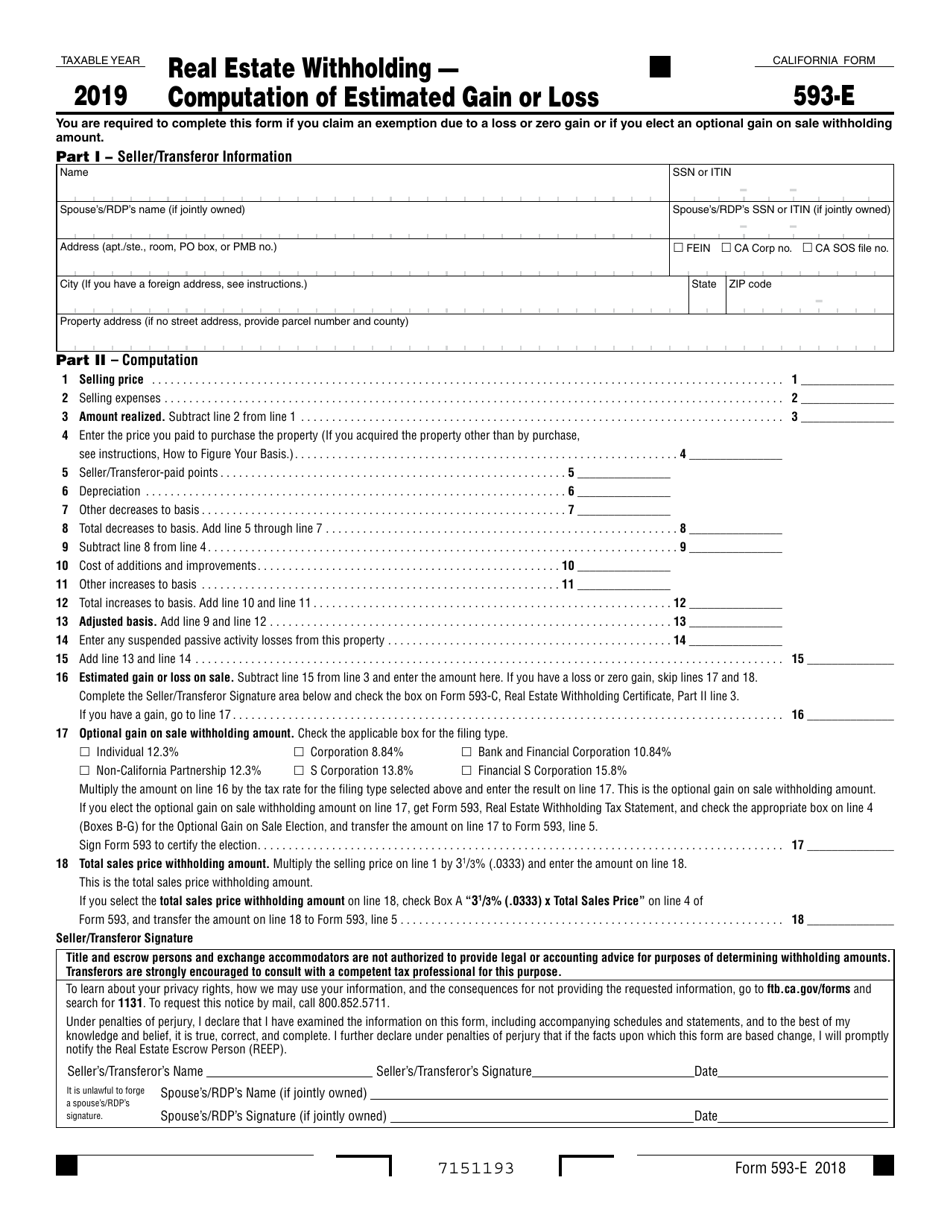

Form 593E Download Fillable PDF or Fill Online Real Estate Withholding

Web 593 escrow or exchange no. Web payment and do not send the withholding along with form 593 to the ftb by the due date, or if i do not send one copy of form 593 to the seller/transferor by the due date. Citizensand residentsgoing abroad get forms and other informationfaster and easier. The estimated average time is: Web california.

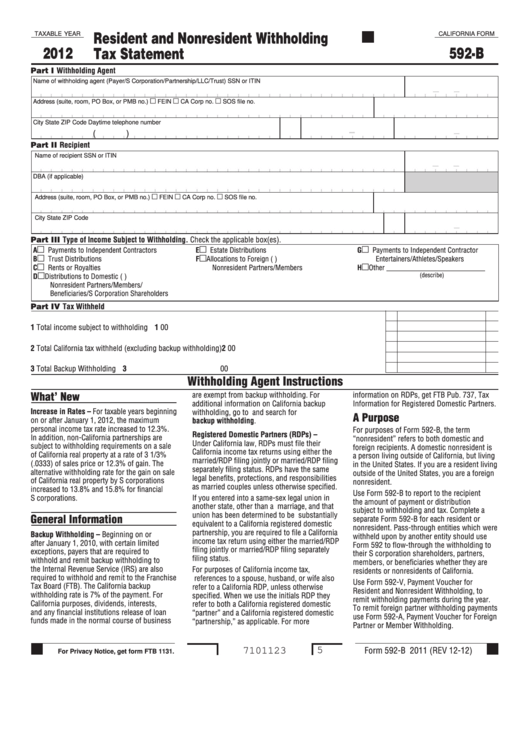

Fillable Form 592B Resident And Nonresident Withholding Tax

Download this form print this form more about the. Web california real estate withholding. Web california real property must file form 593 to report the amount withheld. Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. Citizensand residentsgoing abroad get forms and other informationfaster and easier.

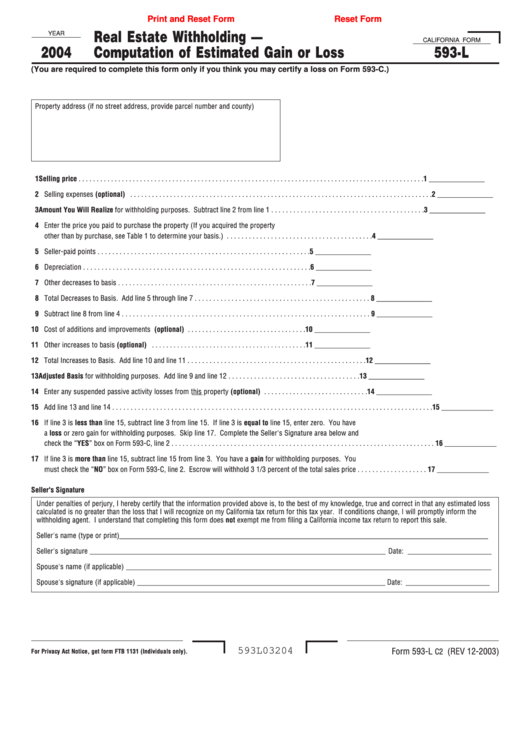

Fillable California Form 593L Real Estate Withholding Computation

Real estate withholding is a prepayment of income (or franchise) tax due. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges. Download this form print this form more about the. Web payment and do not send the withholding along with form 593 to the.

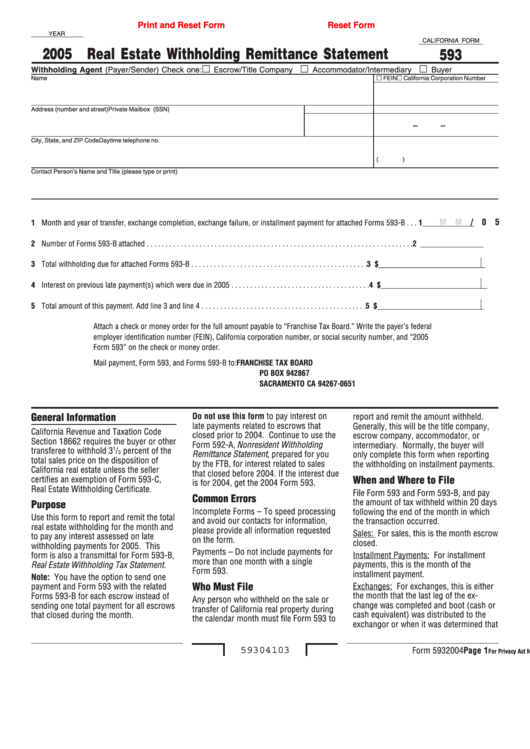

Fillable Form 593 Real Estate Withholding Remittance Statement 2005

Real estate withholding is a prepayment of income (or franchise) tax due. I will complete form 593 for the principal portion of each installment payment. The estimated average time is: If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. _________________________ part i remitter information •.

Web California Real Property Must File Form 593 To Report The Amount Withheld.

Web 593 escrow or exchange no. If this is an installment sale payment after escrow. Enter the names of a petitioner, respondent, and another. Web as of january 1, 2020, california real estate withholding changed.

Real Estate Withholding Is A Prepayment Of Income (Or Franchise) Tax Due.

Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. Web payment and do not send the withholding along with form 593 to the ftb by the due date, or if i do not send one copy of form 593 to the seller/transferor by the due date. I will complete form 593 for the principal portion of each installment payment. Citizensand residentsgoing abroad get forms and other informationfaster and easier.

Learning About The Law Or The Form 2 Hr., 59 Min.

Web form will vary depending on individual circumstances. Sign it in a few clicks draw your signature, type it,. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Web form 593, real estate withholding statement, of the principal portion of each installment payment.

Use Form 593, Real Estate Withholding Tax Statement, To Report Real Estate Withholding On Sales Closing In 2018, Installment Payments Made In 2018, Or Exchanges.

We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Download this form print this form more about the. Typically this is a real estate escrow person (reep). Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2019, installment payments made in 2019, or exchanges.