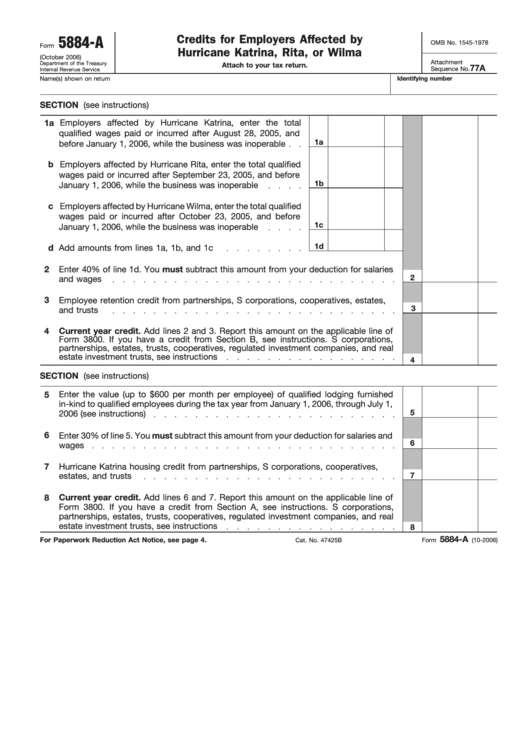

Form 5884 A

Form 5884 A - Instructions and the form itself are located here: Credits for affected disaster area employers (for employers affected by hurricane. Attach to your tax return. March 2021) department of the treasury internal revenue service. February 2018) department of the treasury internal revenue service. Form 5884, work opportunity credit, with finalized instructions. 03 export or print immediately. March 2020) department of the treasury internal revenue service employee retention credit attach to your tax return. Web the forms are: If using the software, go to forms and look for the forms on the left hand side of the screen.

Attach to your tax return. 03 export or print immediately. During the first five years of a child’s life, the brain develops by 90%, yet during this critical window in our. Web go to tax tools>tools>delete a form>look for 5884 and delete it. Web the forms are: March 2021) department of the treasury internal revenue service. March 2020) department of the treasury internal revenue service employee retention credit attach to your tax return. It wasn't a part of 2018's platform, but with. The current year employee retention credit for employers affected by qualified. Web tootris is resolving the $47 billion child care crisis in our nation today.

During the first five years of a child’s life, the brain develops by 90%, yet during this critical window in our. 03 export or print immediately. Web turbotax does not support this form, but you can get it directly from the irs website. Form 5884, work opportunity credit, with finalized instructions. March 2021) department of the treasury internal revenue service. Instructions and the form itself are located here: Credits for affected disaster area employers (for employers affected by hurricane. The current year employee retention credit for employers affected by qualified. If using the software, go to forms and look for the forms on the left hand side of the screen. 01 fill and edit template.

Fillable Form 5884A Credits For Employers Affected By Hurricane

Attach to your tax return. February 2018) department of the treasury internal revenue service. Instructions and the form itself are located here: Credits for affected disaster area employers (for employers affected by hurricane. March 2020) department of the treasury internal revenue service employee retention credit attach to your tax return.

Fill Free fillable IRS PDF forms

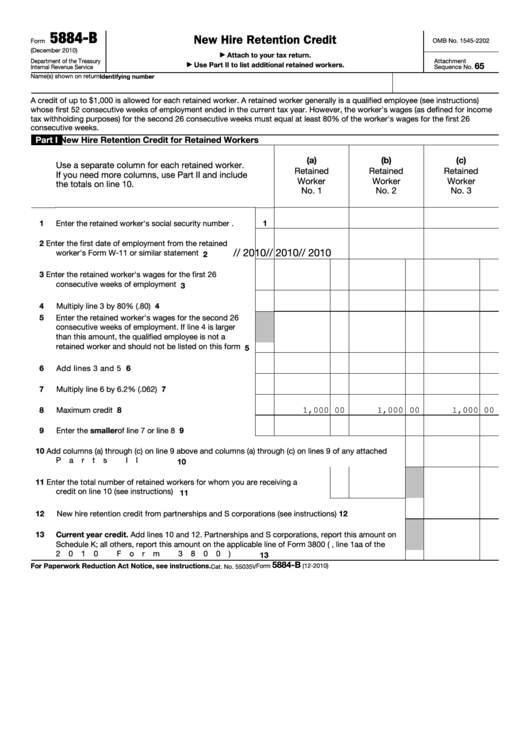

Form 5884, work opportunity credit, with finalized instructions. 03 export or print immediately. If using the software, go to forms and look for the forms on the left hand side of the screen. March 2021) department of the treasury internal revenue service. March 2020) department of the treasury internal revenue service employee retention credit attach to your tax return.

Worksheet 2 Adjusted Employee Retention Credit

Credits for affected disaster area employers (for employers affected by hurricane. Form 5884, work opportunity credit, with finalized instructions. Web turbotax does not support this form, but you can get it directly from the irs website. 03 export or print immediately. Web go to tax tools>tools>delete a form>look for 5884 and delete it.

Form 5884 Work Opportunity Credit (2014) Free Download

If using the software, go to forms and look for the forms on the left hand side of the screen. Instructions and the form itself are located here: March 2021) department of the treasury internal revenue service. The current year employee retention credit for employers affected by qualified. Web the forms are:

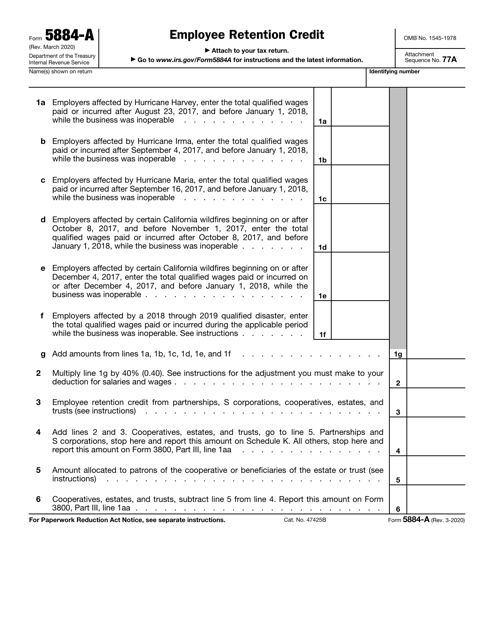

IRS Form 5884A Download Fillable PDF or Fill Online Employee Retention

Attach to your tax return. During the first five years of a child’s life, the brain develops by 90%, yet during this critical window in our. Web go to tax tools>tools>delete a form>look for 5884 and delete it. February 2018) department of the treasury internal revenue service. 03 export or print immediately.

IRS Form 5884D Employee Retention Credit for Certain TaxExempt

If using the software, go to forms and look for the forms on the left hand side of the screen. Form 5884, work opportunity credit, with finalized instructions. March 2020) department of the treasury internal revenue service employee retention credit attach to your tax return. Qualified wages do not include the following. It wasn't a part of 2018's platform, but.

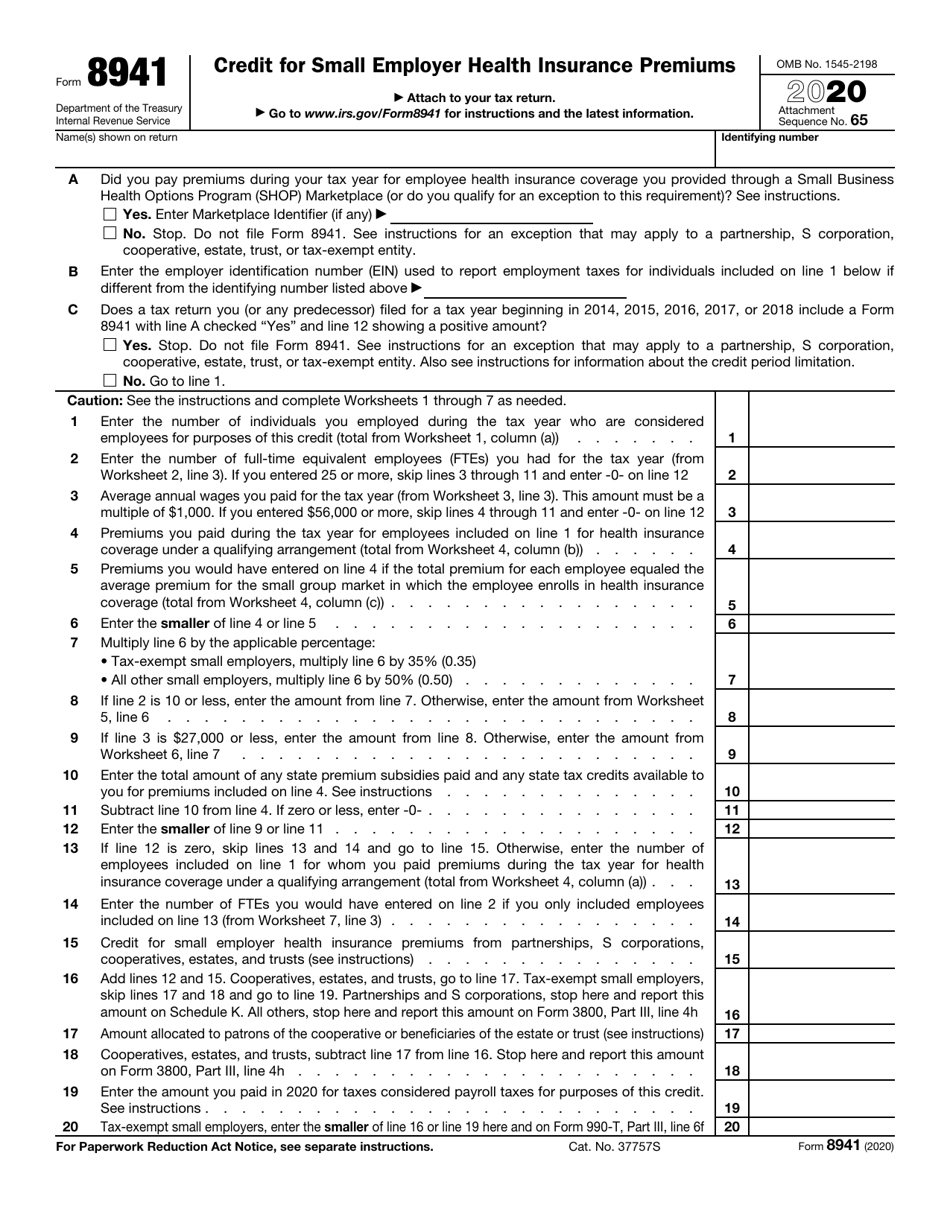

IRS Form 8941 Download Fillable PDF or Fill Online Credit for Small

Qualified wages do not include the following. Web the forms are: Web tootris is resolving the $47 billion child care crisis in our nation today. 03 export or print immediately. March 2020) department of the treasury internal revenue service employee retention credit attach to your tax return.

941 X Worksheet 1 Excel

Instructions and the form itself are located here: 01 fill and edit template. Credits for affected disaster area employers (for employers affected by hurricane. Form 5884, work opportunity credit, with finalized instructions. Web the forms are:

Form 5884a Employee Retention Credit Stock Photo Image of

Attach to your tax return. Form 5884, work opportunity credit, with finalized instructions. Web the forms are: February 2018) department of the treasury internal revenue service. Instructions and the form itself are located here:

IRS Form 5884A for the Employee Retention Credit

During the first five years of a child’s life, the brain develops by 90%, yet during this critical window in our. March 2020) department of the treasury internal revenue service employee retention credit attach to your tax return. Form 5884, work opportunity credit, with finalized instructions. February 2018) department of the treasury internal revenue service. Web tootris is resolving the.

The Current Year Employee Retention Credit For Employers Affected By Qualified.

Web go to tax tools>tools>delete a form>look for 5884 and delete it. Qualified wages do not include the following. 03 export or print immediately. Attach to your tax return.

Instructions And The Form Itself Are Located Here:

Web the forms are: During the first five years of a child’s life, the brain develops by 90%, yet during this critical window in our. Form 5884, work opportunity credit, with finalized instructions. Web tootris is resolving the $47 billion child care crisis in our nation today.

01 Fill And Edit Template.

Credits for affected disaster area employers (for employers affected by hurricane. Web turbotax does not support this form, but you can get it directly from the irs website. It wasn't a part of 2018's platform, but with. February 2018) department of the treasury internal revenue service.

March 2020) Department Of The Treasury Internal Revenue Service Employee Retention Credit Attach To Your Tax Return.

If using the software, go to forms and look for the forms on the left hand side of the screen. March 2021) department of the treasury internal revenue service.