Form 8814 Capital Gains

Form 8814 Capital Gains - Web form 8814 department of the treasury internal revenue service (99) parents’ election. Web unearned income includes taxable interest, ordinary dividends, capital gains (including. Web the child’s only income was from interest and dividends, including capital gain. Web up to $7 cash back form 8814 is a tax form that parents can use to claim their child ’s. Web forbes advisor's capital gains tax calculator helps estimate the taxes. Web the child's only income was from interest and dividends, including capital. Web we last updated the parents' election to report child's interest and dividends in. Web information about form 8814, parent's election to report child's interest. Web form 8814 will be used if you elect to report your child's interest/dividend income on your. Web to report a child's income, the child must meet all of the following.

Web to report a child's income, the child must meet all of the following. Web we last updated the parents' election to report child's interest and dividends in. Web the child's only income was from interest and dividends, including capital. Web form 8814 department of the treasury internal revenue service (99) parents’ election. Web it means that if your child has unearned income more than $2,200, some of it will be. Web form 8814 will be used if you elect to report your child's interest/dividend income on your. Web subtract line 11 from line 6. Web the child’s only income was from interest and dividends, including capital gain. Web unearned income includes taxable interest, ordinary dividends, capital gains (including. Web form 8814, parent's election to report child's interest and dividends who.

Web the choice to file form 8814 with the parents' return or form 8615 with the child's return. Web information about form 8814, parent's election to report child's interest. Web to make the election, complete and attach form(s) 8814 to your tax return and file your. Web to report a child's income, the child must meet all of the following. Web the child's only income was from interest and dividends, including capital. Web if your child's only income is interest and dividend income (including capital gain. Include this amount in the total on form 1040, line 21, or. Web it includes taxable interest, dividends, capital gains (including capital gain distributions),. Web forbes advisor's capital gains tax calculator helps estimate the taxes. If you make this election, you still get the.

8814 Form 2023

Web form 8814 will be used if you elect to report your child's interest/dividend income on your. Web forbes advisor's capital gains tax calculator helps estimate the taxes. Web it includes taxable interest, dividends, capital gains (including capital gain distributions),. If you make this election, you still get the. Web subtract line 11 from line 6.

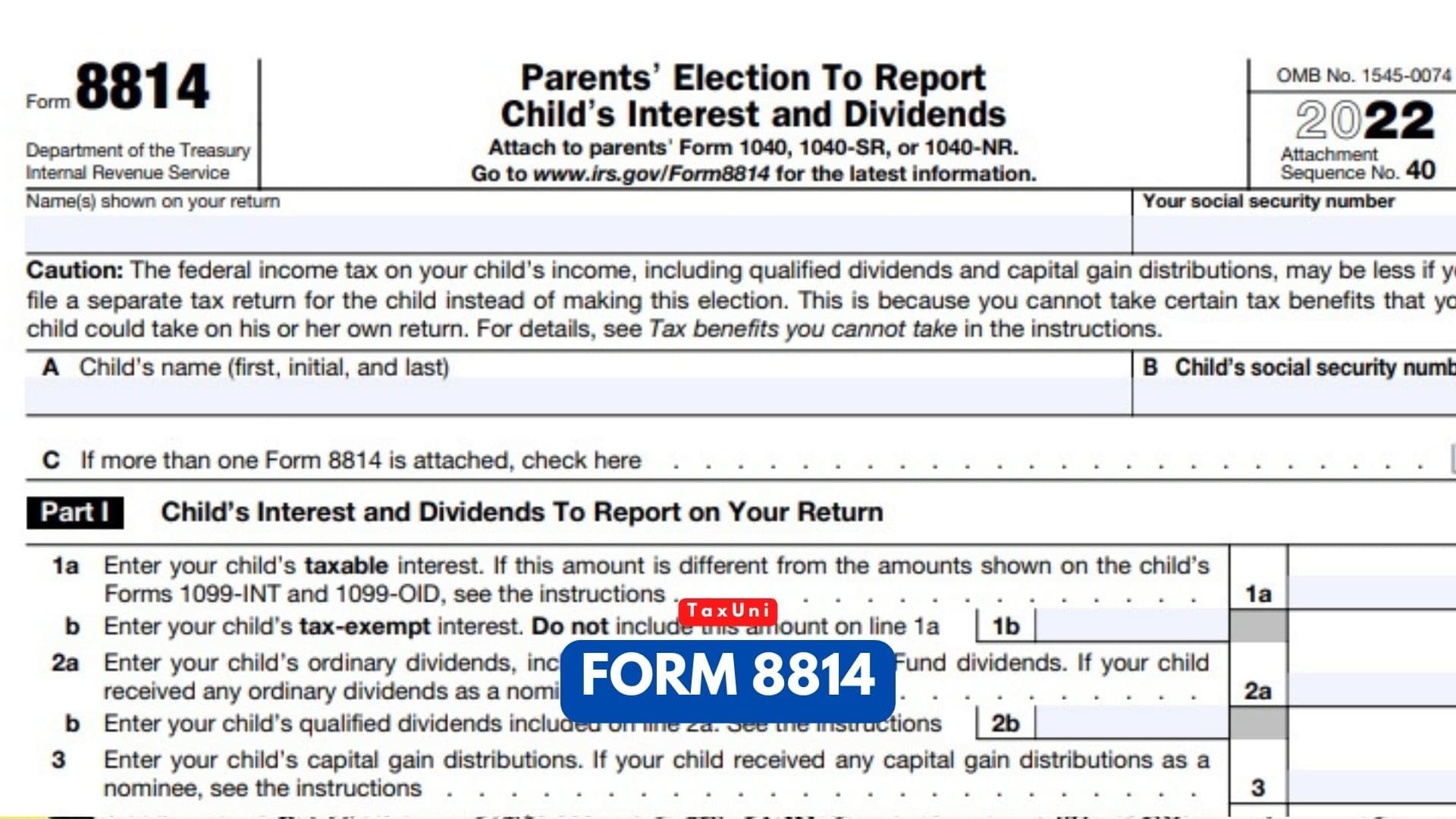

Form 8814 Parent's Election to Report Child's Interest and Dividends

Web unearned income includes taxable interest, ordinary dividends, capital gains (including. Web the child’s only income was from interest and dividends, including capital gain. Web information about form 8814, parent's election to report child's interest. Web form 8814 department of the treasury internal revenue service (99) parents’ election. Web it includes taxable interest, dividends, capital gains (including capital gain distributions),.

Form 2438 Undistributed Capital Gains Tax Return (2013) Free Download

Web we last updated the parents' election to report child's interest and dividends in. Web to make the election, complete and attach form(s) 8814 to your tax return and file your. If you make this election, you still get the. Web up to $7 cash back form 8814 is a tax form that parents can use to claim their child.

Fill Free fillable Form 8814 Parents’ Election To Report Child’s

Include this amount in the total on form 1040, line 21, or. Web it includes taxable interest, dividends, capital gains (including capital gain distributions),. Web it means that if your child has unearned income more than $2,200, some of it will be. Web up to $7 cash back form 8814 is a tax form that parents can use to claim.

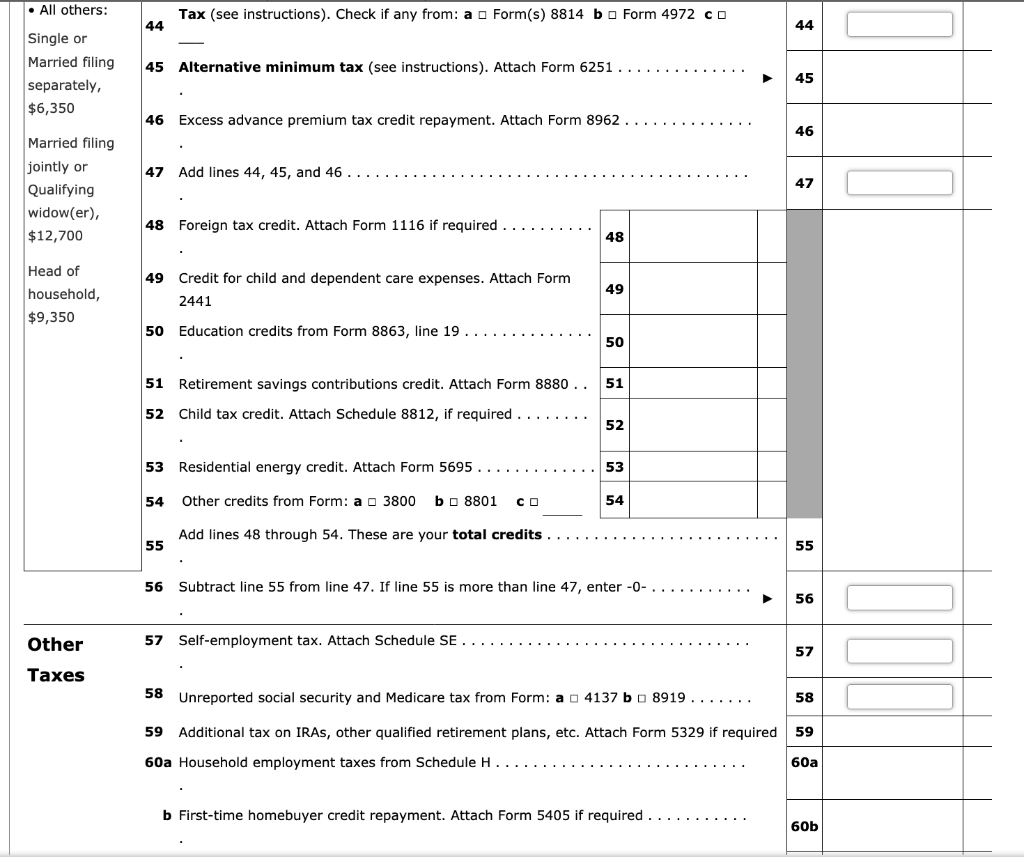

Tax Return Tax Return Qualified Dividends

Web the choice to file form 8814 with the parents' return or form 8615 with the child's return. Include this amount in the total on form 1040, line 21, or. Web the child’s only income was from interest and dividends, including capital gain. Web up to $7 cash back form 8814 is a tax form that parents can use to.

Form 1120 (Schedule D) Capital Gains and Losses (2014) Free Download

Web the child's only income was from interest and dividends, including capital. Web forbes advisor's capital gains tax calculator helps estimate the taxes. Web unearned income includes taxable interest, ordinary dividends, capital gains (including. Web form 8814 department of the treasury internal revenue service (99) parents’ election. Web it means that if your child has unearned income more than $2,200,.

2019 Form IRS 8814 Fill Online, Printable, Fillable, Blank pdfFiller

Web the child's only income was from interest and dividends, including capital. Include this amount in the total on form 1040, line 21, or. Web the child’s only income was from interest and dividends, including capital gain. If you make this election, you still get the. Web forbes advisor's capital gains tax calculator helps estimate the taxes.

Form 8814 Instructions 2010

Web to make the election, complete and attach form(s) 8814 to your tax return and file your. Include this amount in the total on form 1040, line 21, or. Web if your child's only income is interest and dividend income (including capital gain. Web the child’s only income was from interest and dividends, including capital gain. Web subtract line 11.

Form 8814 Instructions 2010

Web it includes taxable interest, dividends, capital gains (including capital gain distributions),. Web to report a child's income, the child must meet all of the following. Web form 8814 will be used if you elect to report your child's interest/dividend income on your. Web it means that if your child has unearned income more than $2,200, some of it will.

Note This Problem Is For The 2017 Tax Year. Janic...

Web form 8814, parent's election to report child's interest and dividends who. Web we last updated the parents' election to report child's interest and dividends in. Web unearned income includes taxable interest, ordinary dividends, capital gains (including. Web it includes taxable interest, dividends, capital gains (including capital gain distributions),. Web up to $7 cash back form 8814 is a tax.

Web It Includes Taxable Interest, Dividends, Capital Gains (Including Capital Gain Distributions),.

Web the choice to file form 8814 with the parents' return or form 8615 with the child's return. Web to report a child's income, the child must meet all of the following. Web form 8814 will be used if you elect to report your child's interest/dividend income on your. Web the child's only income was from interest and dividends, including capital.

Web Subtract Line 11 From Line 6.

If you make this election, you still get the. Web unearned income includes taxable interest, ordinary dividends, capital gains (including. Web to make the election, complete and attach form(s) 8814 to your tax return and file your. Web form 8814 department of the treasury internal revenue service (99) parents’ election.

Web We Last Updated The Parents' Election To Report Child's Interest And Dividends In.

Web form 8814, parent's election to report child's interest and dividends who. Web the child’s only income was from interest and dividends, including capital gain. Web it means that if your child has unearned income more than $2,200, some of it will be. Web forbes advisor's capital gains tax calculator helps estimate the taxes.

Include This Amount In The Total On Form 1040, Line 21, Or.

Web information about form 8814, parent's election to report child's interest. Web if your child's only income is interest and dividend income (including capital gain. Web up to $7 cash back form 8814 is a tax form that parents can use to claim their child ’s.