Form 886 H Eic

Form 886 H Eic - To claim a child as a qualifying child for eitc, you must show the child is. This tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income. This toolkit only addresses the eitc. Refer to your audit letter for any other items under audit and gather. Along with this form, you may have to. Use a new checklist for each child listed on your. Get ready for tax season deadlines by completing any required tax forms today. Contact a low income taxpayer. Documents you need to send to claim the earned income credit on the. Get ready for tax season deadlines by completing any required tax forms today.

Web fill in every fillable field. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. To claim a child as a qualifying child for eitc, you must show the child is. Documents you need to send to claim the earned income credit on the. Contact a low income taxpayer. Use this checklist as you prepare the response to your audit letter by going through the toolkit. Refer to your audit letter for any other items under audit and gather. Web most of the forms are available in both english and spanish. Along with this form, you may have to.

To claim a child as a qualifying child for eitc, you must show the child is. Refer to your audit letter for any other items under audit and gather. Contact a low income taxpayer. Indicate the date to the sample using the date tool. Use a new checklist for each child listed on your. Documents you need to send to claim the earned income credit on the. Get ready for tax season deadlines by completing any required tax forms today. This tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income. Web fill in every fillable field. Use this checklist as you prepare the response to your audit letter by going through the toolkit.

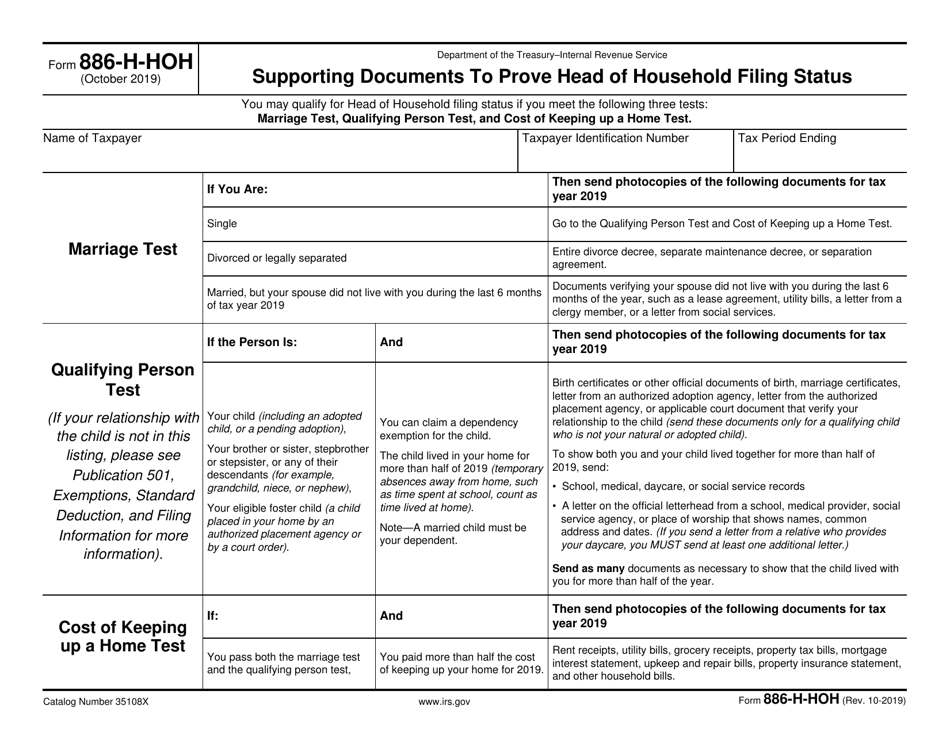

IRS Form 886HHOH Download Fillable PDF or Fill Online Supporting

Web most of the forms are available in both english and spanish. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Use a new checklist for each child listed on your. This tool is to help you identify what documents you need to.

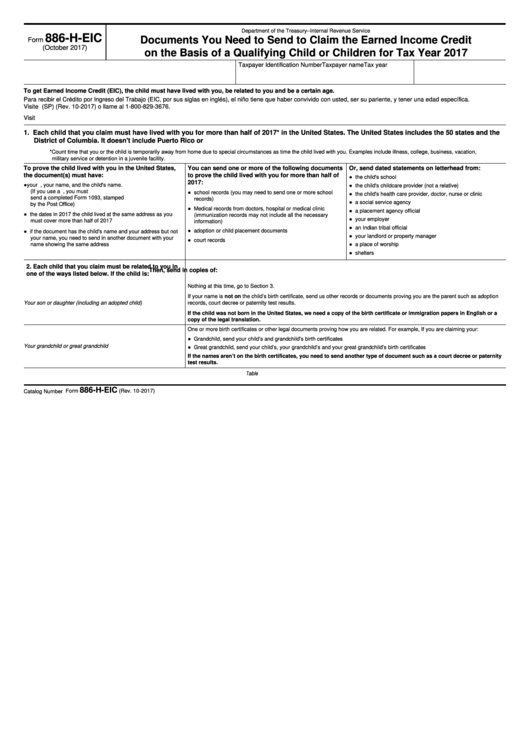

2018 IRS Form 886HEIC Fill Online, Printable, Fillable, Blank PDFfiller

To claim a child as a qualifying child for eitc, you must show the child is. Refer to your audit letter for any other items under audit and gather. Along with this form, you may have to. Indicate the date to the sample using the date tool. Use a new checklist for each child listed on your.

Fill Free fillable Form 886HEIC Documents You Need to Send to (IRS

Get ready for tax season deadlines by completing any required tax forms today. Along with this form, you may have to. Refer to your audit letter for any other items under audit and gather. Get ready for tax season deadlines by completing any required tax forms today. Web fill in every fillable field.

Form 886HAOC Supporting Documents to Prove American Opportunity

Web fill in every fillable field. Web most of the forms are available in both english and spanish. Use a new checklist for each child listed on your. Refer to your audit letter for any other items under audit and gather. To claim a child as a qualifying child for eitc, you must show the child is.

Fill Free fillable Form 886HHOH Supporting Documents to Prove Head

Get ready for tax season deadlines by completing any required tax forms today. Use this checklist as you prepare the response to your audit letter by going through the toolkit. Use a new checklist for each child listed on your. Documents you need to send to claim the earned income credit on the. Get ready for tax season deadlines by.

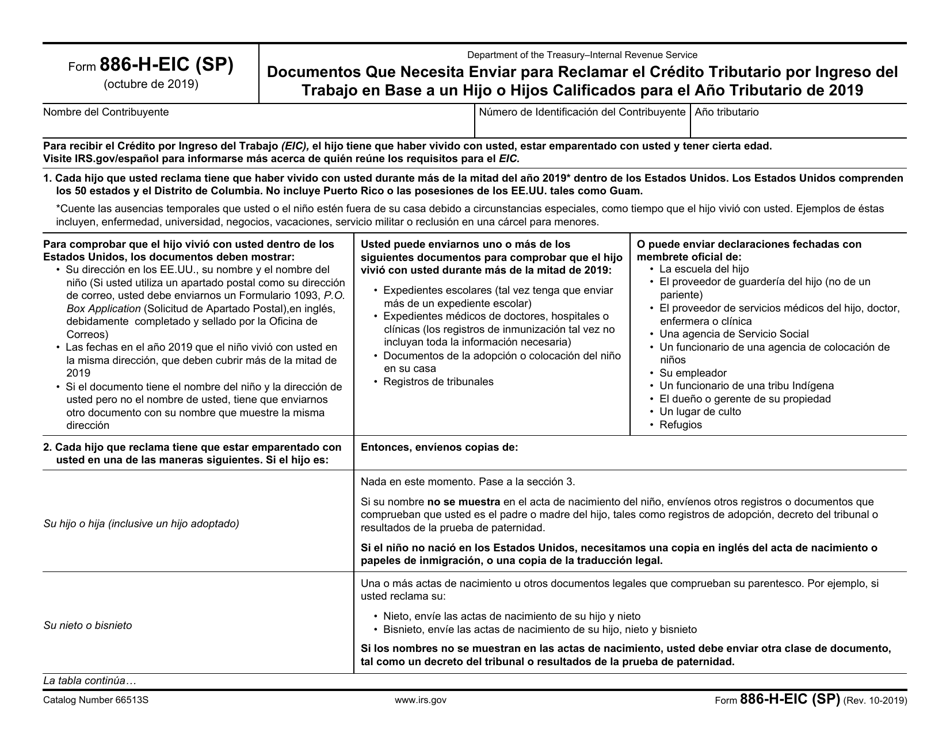

IRS Formulario 886HEIC (SP) Download Fillable PDF or Fill Online

Get ready for tax season deadlines by completing any required tax forms today. Along with this form, you may have to. Get ready for tax season deadlines by completing any required tax forms today. This toolkit only addresses the eitc. Indicate the date to the sample using the date tool.

Fillable Form 886HEic Documents You Need To Send To Claim The

Along with this form, you may have to. This tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income. To claim a child as a qualifying child for eitc, you must show the child is. This toolkit only addresses the eitc. Use this.

Form 886H Basics & Beyond

Get ready for tax season deadlines by completing any required tax forms today. Refer to your audit letter for any other items under audit and gather. Indicate the date to the sample using the date tool. Contact a low income taxpayer. This toolkit only addresses the eitc.

Irs Form 886 A Worksheet Worksheet List

Web fill in every fillable field. Refer to your audit letter for any other items under audit and gather. Get ready for tax season deadlines by completing any required tax forms today. Indicate the date to the sample using the date tool. Get ready for tax season deadlines by completing any required tax forms today.

Form 886 A Worksheet Worksheet List

Use a new checklist for each child listed on your. Along with this form, you may have to. This toolkit only addresses the eitc. Use this checklist as you prepare the response to your audit letter by going through the toolkit. Refer to your audit letter for any other items under audit and gather.

Web Most Of The Forms Are Available In Both English And Spanish.

Contact a low income taxpayer. Use a new checklist for each child listed on your. Indicate the date to the sample using the date tool. Along with this form, you may have to.

Documents You Need To Send To Claim The Earned Income Credit On The.

Web fill in every fillable field. This tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today.

To Claim A Child As A Qualifying Child For Eitc, You Must Show The Child Is.

Refer to your audit letter for any other items under audit and gather. Use this checklist as you prepare the response to your audit letter by going through the toolkit. This toolkit only addresses the eitc.