Form 941 Sb

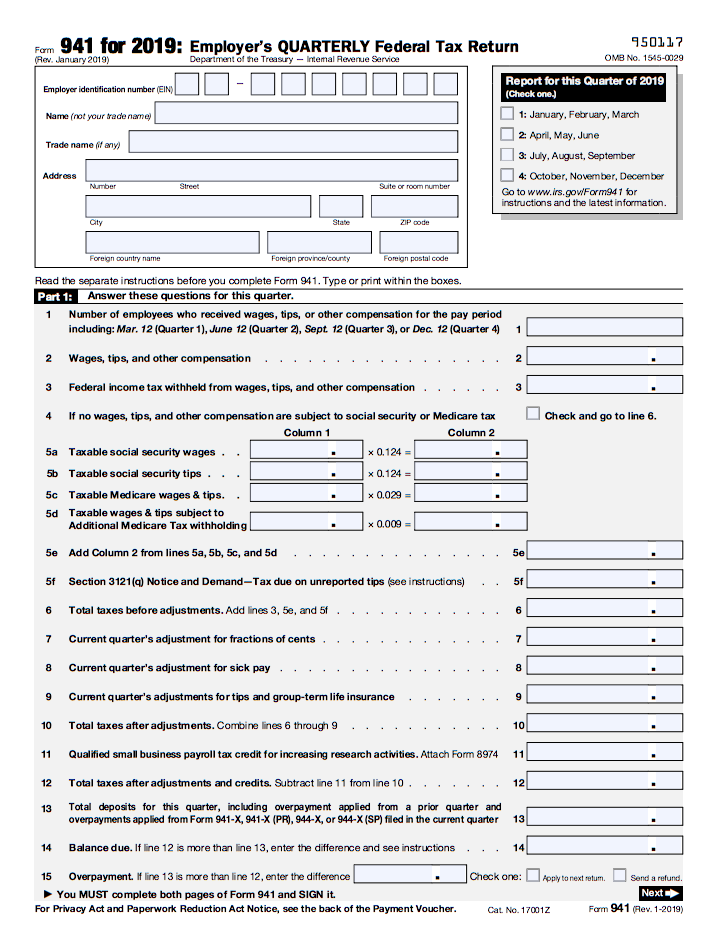

Form 941 Sb - See deposit penalties in section 11 of pub. Web about form 941, employer's quarterly federal tax return. Web form 8974, line 12 or, if applicable, line 17, is reported on line 11a. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. We need it to figure and collect the right amount of tax. Web (form 941) (rev. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Employers use form 941 to: July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name.

We need it to figure and collect the right amount of tax. 15 or section 8 of pub. Web general instructions purpose of form.—use schedule b (form 941) to report your tax liability (income tax withheld plus both employee and employer social security and. Report income taxes, social security tax, or medicare tax withheld from employee's. You must fill out this form and. Employers use form 941 to: Adjusting tax liability for nonrefundable credits claimed on form 941, lines 11a, 11b, and 11d. For more information about the payroll tax credit, see irs.gov/researchpayrolltc. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. June 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 951121.

Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Report income taxes, social security tax, or medicare tax withheld from employee's. Web form 8974, line 12 or, if applicable, line 17, is reported on line 11a. Web to complete your schedule b report, you are required to enter your tax liability in the numbered space that corresponds to the date that wages were paid. For more information about the payroll tax credit, see irs.gov/researchpayrolltc. We need it to figure and collect the right amount of tax. Web make the check or money order payable to “united states treasury.”. Web general instructions purpose of form.—use schedule b (form 941) to report your tax liability (income tax withheld plus both employee and employer social security and. March 2022) use with the january 2017 revision of schedule b (form 941) report of tax liability for semiweekly schedule depositors. Employers use form 941 to:

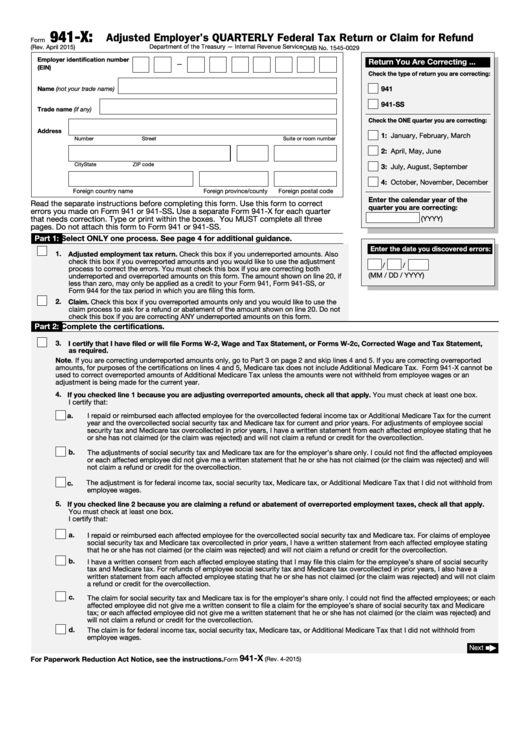

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

See deposit penalties in section 11 of pub. Web to complete your schedule b report, you are required to enter your tax liability in the numbered space that corresponds to the date that wages were paid. March 2022) use with the january 2017 revision of schedule b (form 941) report of tax liability for semiweekly schedule depositors. 15 or section.

Where to File Form 941 941 Forms

Report income taxes, social security tax, or medicare tax withheld from employee's. You must fill out this form and. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Web make the check or money order payable to “united states treasury.”. June 2021) employer’s quarterly federal tax.

Sage Releases 2011 941 Form Update Aries Technology Group LLCAries

March 2022) use with the january 2017 revision of schedule b (form 941) report of tax liability for semiweekly schedule depositors. See deposit penalties in section 11 of pub. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name. Web to complete your schedule b report, you are required to.

Form 941 Instructions & Info on Tax Form 941 (including Mailing Info)

Web form 8974, line 12 or, if applicable, line 17, is reported on line 11a. 15 or section 8 of pub. Employers use form 941 to: See deposit penalties in section 11 of pub. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states.

New 941 form for second quarter payroll reporting

Report income taxes, social security tax, or medicare tax withheld from employee's. October, november, december calendar year (also check quarter) use this schedule to show. You must fill out this form and. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. See deposit penalties in section 11 of pub.

Form 941 Instructions & How to File it Bench Accounting

Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name. 15 or section 8 of pub. You must fill out this form and. Web (form 941) (rev.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

We need it to figure and collect the right amount of tax. Web (form 941) (rev. We need it to figure and collect the right amount of tax. Report income taxes, social security tax, or medicare tax withheld from employee's. Employers use form 941 to:

What Is Form 941 and How Do I File It? Ask Gusto

Web form 941 for 2021: March 2022) use with the january 2017 revision of schedule b (form 941) report of tax liability for semiweekly schedule depositors. October, november, december calendar year (also check quarter) use this schedule to show. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in.

Tax Form 941 Line 11 Video YouTube

Employers use form 941 to: Web general instructions purpose of form.—use schedule b (form 941) to report your tax liability (income tax withheld plus both employee and employer social security and. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. You must fill out this form.

How to Complete Form 941 in 5 Simple Steps

You must fill out this form and. Employers use form 941 to: Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Report income taxes, social security tax, or medicare tax withheld from employee's. Web (form 941) (rev.

15 Or Section 8 Of Pub.

March 2022) use with the january 2017 revision of schedule b (form 941) report of tax liability for semiweekly schedule depositors. Employers use form 941 to: Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. June 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 951121.

We Need It To Figure And Collect The Right Amount Of Tax.

October, november, december calendar year (also check quarter) use this schedule to show. Web make the check or money order payable to “united states treasury.”. Web form 8974, line 12 or, if applicable, line 17, is reported on line 11a. Web (form 941) (rev.

You Must Fill Out This Form And.

Web form 941 for 2021: Adjusting tax liability for nonrefundable credits claimed on form 941, lines 11a, 11b, and 11d. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Web to complete your schedule b report, you are required to enter your tax liability in the numbered space that corresponds to the date that wages were paid.

Web About Form 941, Employer's Quarterly Federal Tax Return.

For more information about the payroll tax credit, see irs.gov/researchpayrolltc. Web general instructions purpose of form.—use schedule b (form 941) to report your tax liability (income tax withheld plus both employee and employer social security and. Web form 941 for 2021: Web we ask for the information on form 941 to carry out the internal revenue laws of the united states.