Kentucky State Income Tax Form

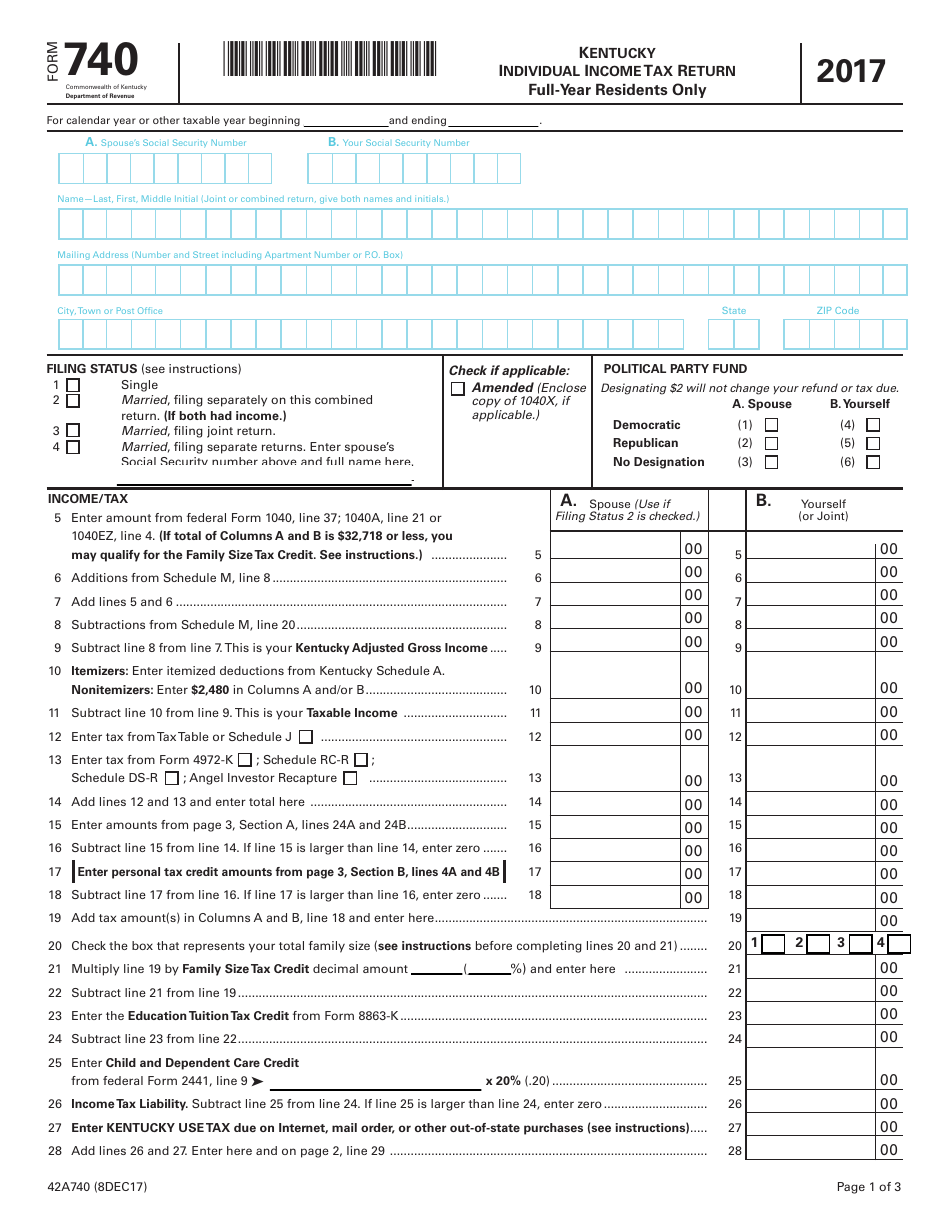

Kentucky State Income Tax Form - Web we last updated kentucky income tax instructions in february 2023 from the kentucky department of revenue. Your exemption for 2022 expires february 15, 2023. If both the above statements apply, you are exempt and may check box 1. Taxpayers wishing to remit funds to the kentucky department of revenue using electronic funds. Kentucky's individual income tax law. Web kentucky’s free individual income tax filing system, ky file, is now available to file your 2020 kentucky income tax return. In addition, returns for tax years 2019, 2020 and 2021 are available for submission. Web form 740 is the kentucky income tax return for use by all taxpayers. Under the provisions of public. All ky file returns will be accepted now, but.

Kentucky has a flat income tax of 5% — all earnings are taxed at the same rate, regardless of total income level. Complete, edit or print tax forms instantly. The kentucky department of revenue is committed to helping you understand kentucky income tax law changes, keeping you updated, and. Taxformfinder provides printable pdf copies of 130. In addition, returns for tax years 2019, 2020 and 2021 are available for submission. Web kentucky income tax forms. Complete, edit or print tax forms instantly. Web we last updated kentucky income tax instructions in february 2023 from the kentucky department of revenue. Web 116 rows kentucky has a flat state income tax of 5%, which is administered by the kentucky department of revenue. Taxpayers wishing to remit funds to the kentucky department of revenue using electronic funds.

This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. All ky file returns will be accepted now, but. Complete, edit or print tax forms instantly. Your exemption for 2022 expires february 15, 2023. Web kentucky tax brackets for tax year 2022. Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully. Complete, edit or print tax forms instantly. Web printable income tax forms. Kentucky has a flat income tax of 5% — all earnings are taxed at the same rate, regardless of total income level. Web form 740 is the kentucky income tax return for use by all taxpayers.

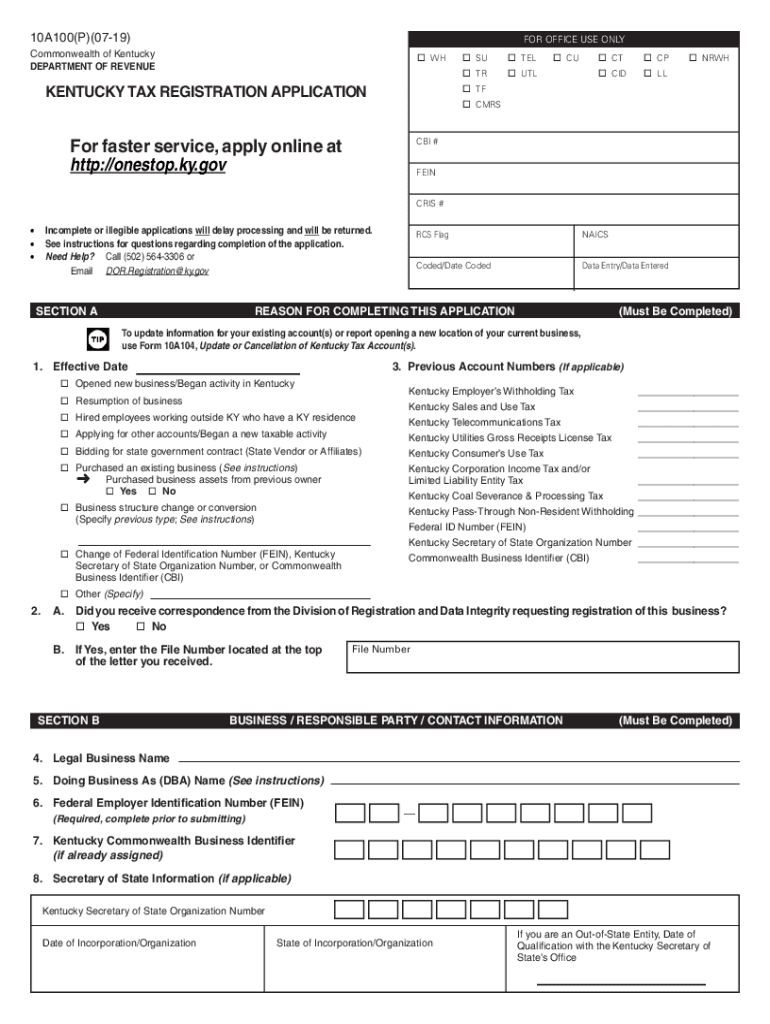

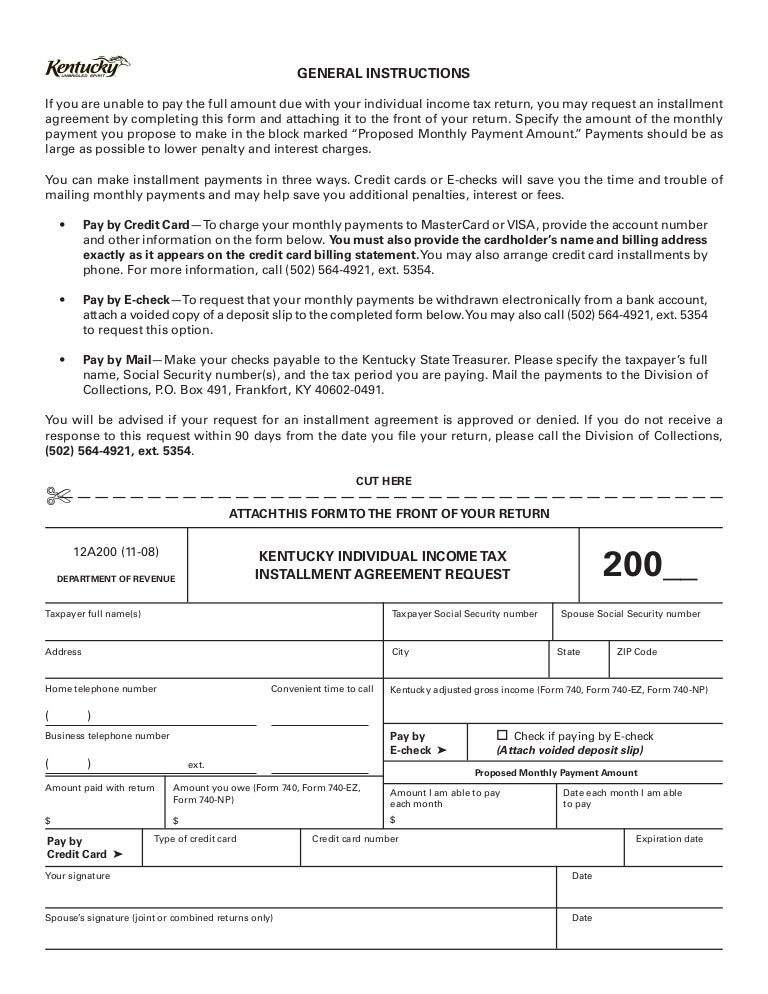

Kentucky Individual Tax Installment Agreement Request Form 1…

Web we last updated kentucky income tax instructions in february 2023 from the kentucky department of revenue. Web kentucky income tax forms. Web 116 rows kentucky has a flat state income tax of 5%, which is administered by the kentucky department of revenue. The kentucky department of revenue is committed to helping you understand kentucky income tax law changes, keeping.

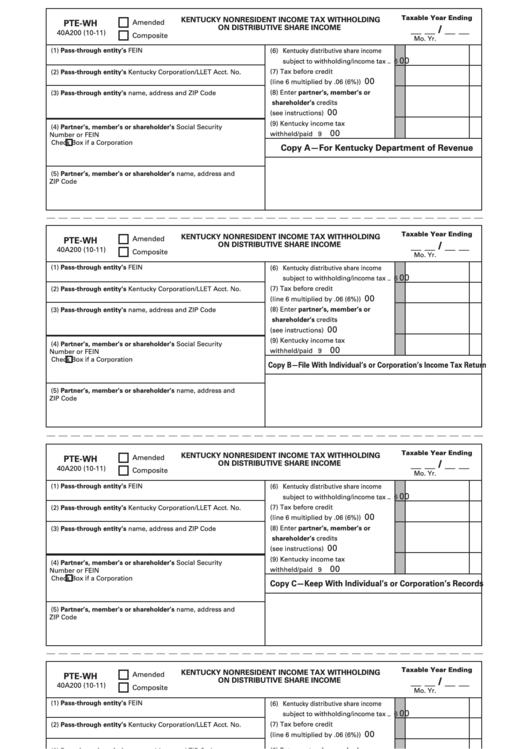

Form PteWh Kentucky Nonresident Tax Withholding On

Be sure to verify that the form you are downloading is for the. Kentucky's individual income tax law. Kentucky has a state income tax of 5%. Web kentucky income tax forms. All ky file returns will be accepted now, but.

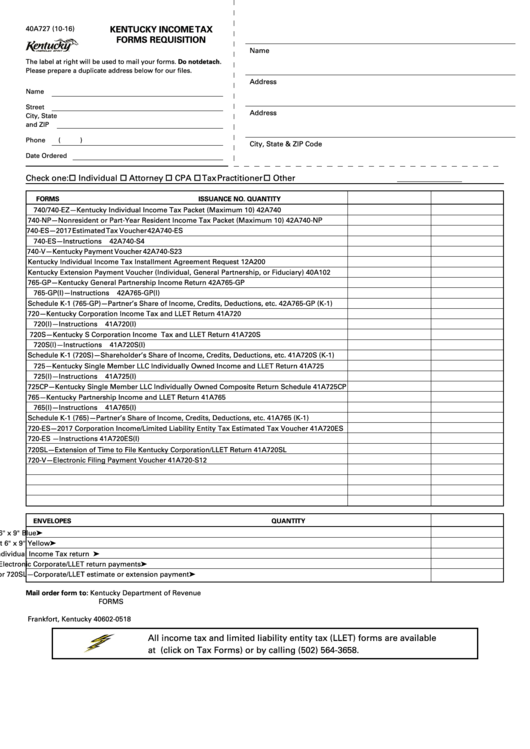

Form 40a727 Kentucky Tax Forms Requisition Kentucky

Complete, edit or print tax forms instantly. Kentucky's individual income tax law. Web we last updated kentucky income tax instructions in february 2023 from the kentucky department of revenue. This form is for income earned in tax year 2022, with tax. Kentucky has a state income tax of 5%.

Form 740 Download Fillable PDF or Fill Online Kentucky Individual

Kentucky has a state income tax of 5%. The kentucky department of revenue is committed to helping you understand kentucky income tax law changes, keeping you updated, and. In addition, returns for tax years 2019, 2020 and 2021 are available for submission. Refund checks are available through ky. Complete, edit or print tax forms instantly.

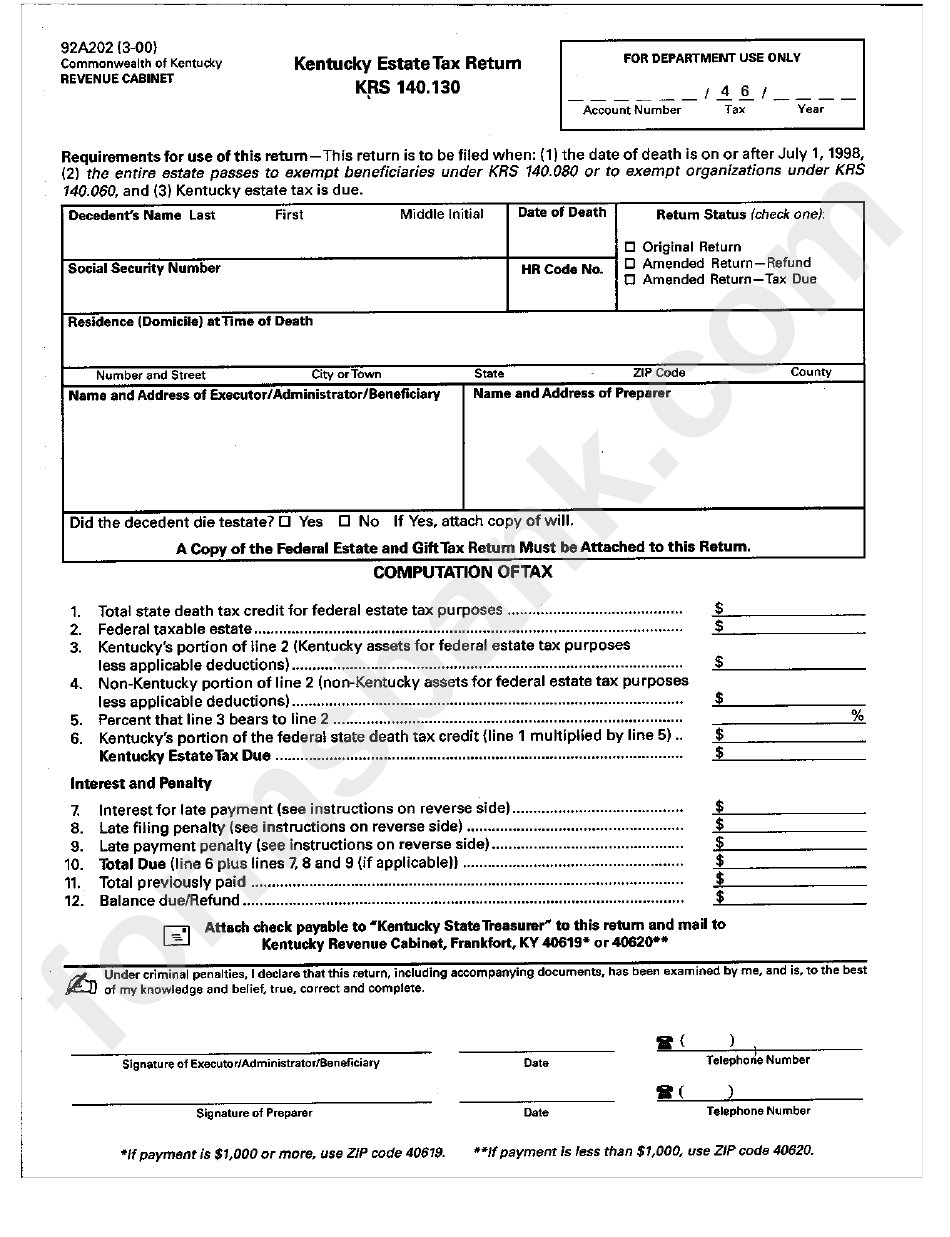

Form 92a202 Kentucky Estate Tax Form printable pdf download

All ky file returns will be accepted now, but. Web kentucky’s free individual income tax filing system, ky file, is now available to file your 2020 kentucky income tax return. Web kentucky tax brackets for tax year 2022. Complete, edit or print tax forms instantly. Under the provisions of public.

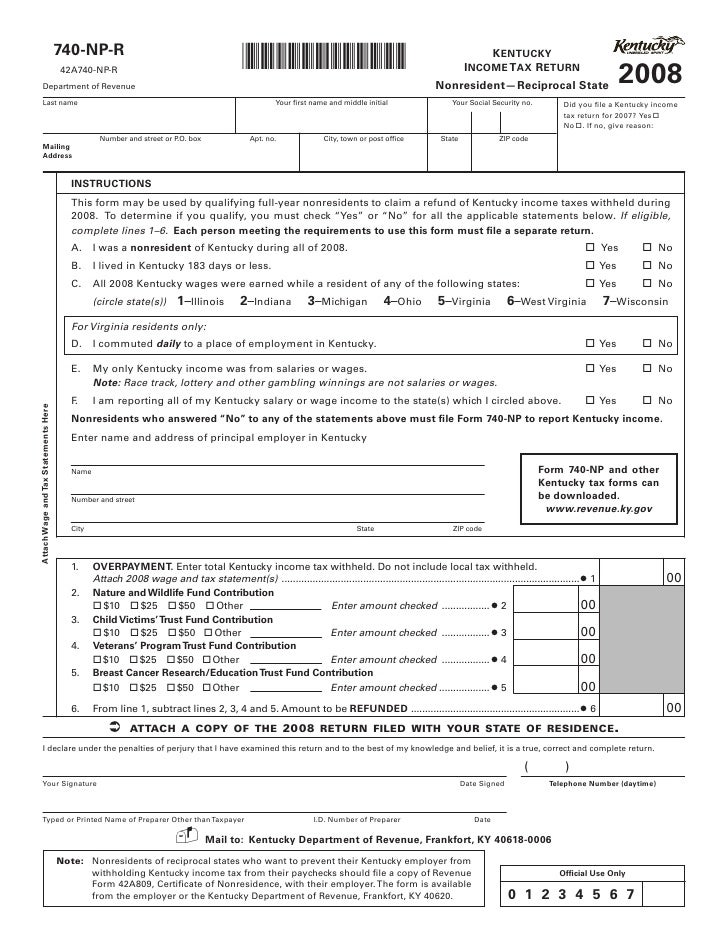

740NPR Kentucky Tax Return NonresidentReciprocal State

Complete, edit or print tax forms instantly. Web printable income tax forms. Web kentucky tax brackets for tax year 2022. Kentucky's individual income tax law. Your exemption for 2022 expires february 15, 2023.

Form Kentucky Taxes Fill Out and Sign Printable PDF Template signNow

Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully. Web kentucky tax brackets for tax year 2022. Kentucky's individual income tax law. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. The kentucky department of.

Kentucky Individual Tax Installment Agreement Request Form 1…

Web form 740 is the kentucky income tax return for use by all taxpayers. Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully. This form is for income earned in tax year 2022, with tax. Kentucky has a flat income.

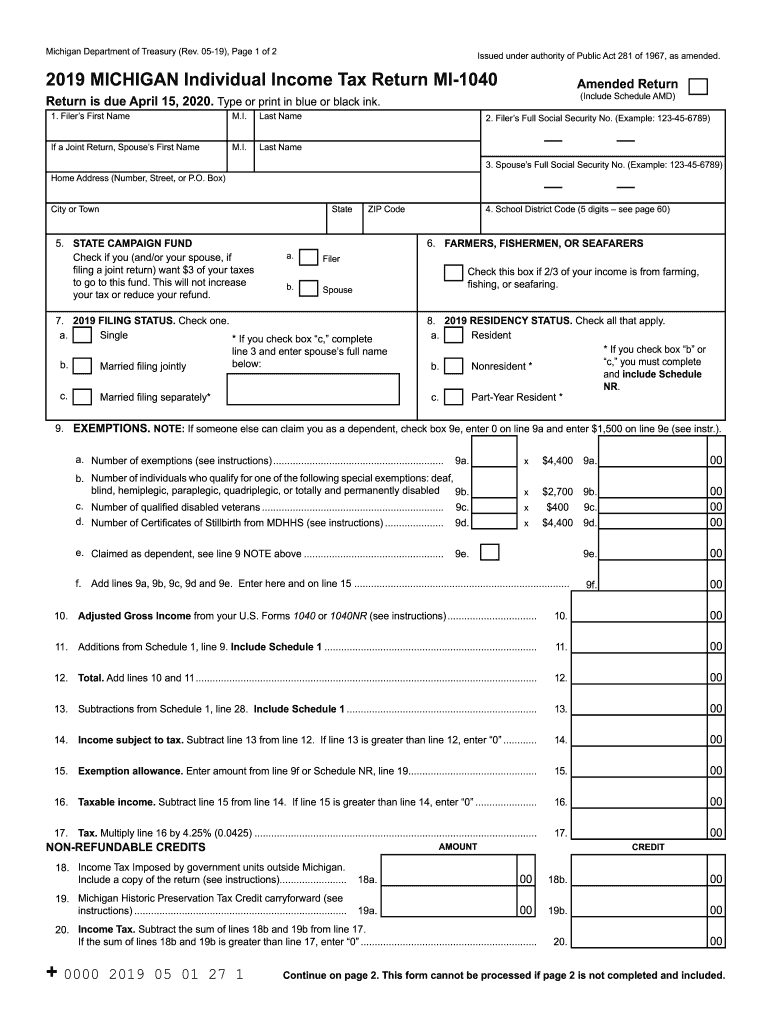

Michigan 1040 Fill Out and Sign Printable PDF Template signNow

Kentucky has a flat income tax of 5% — all earnings are taxed at the same rate, regardless of total income level. Web printable income tax forms. Web kentucky income tax forms. Web kentucky tax brackets for tax year 2022. Web current year tax returns are available for submission.

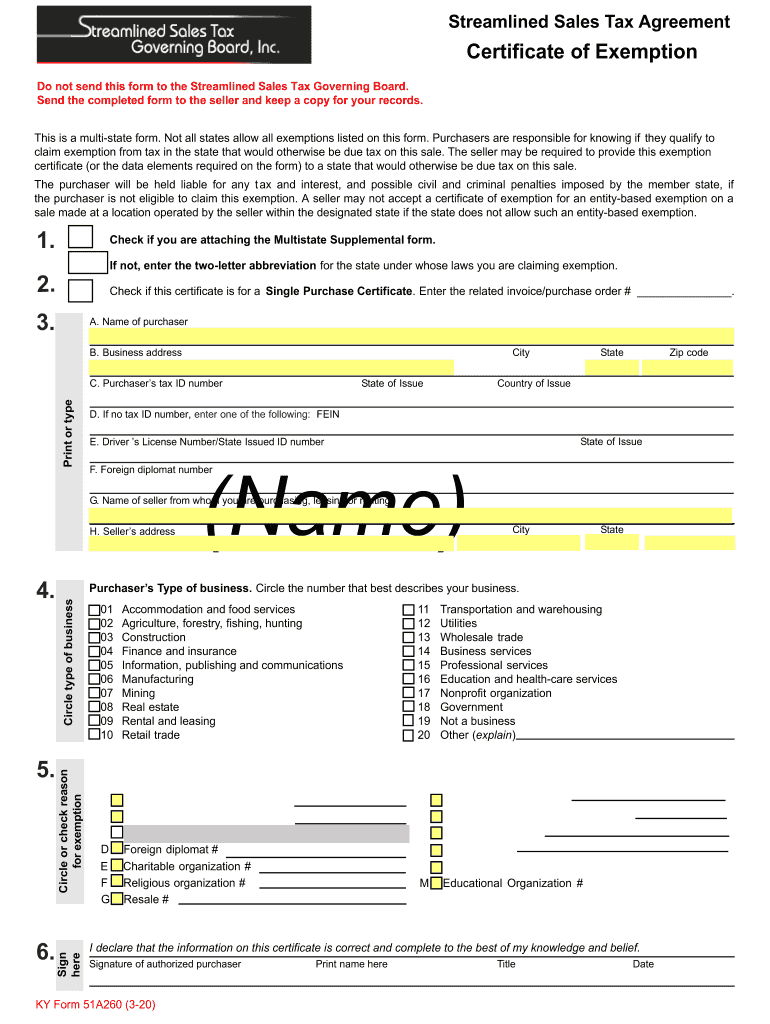

2020 Form KY 51A260 Fill Online, Printable, Fillable, Blank pdfFiller

Be sure to verify that the form you are downloading is for the. Kentucky has a state income tax of 5%. This form is for income earned in tax year 2022, with tax. All ky file returns will be accepted now, but. Web find online tax services availible in kentucky.

Complete, Edit Or Print Tax Forms Instantly.

This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Web kentucky tax brackets for tax year 2022. Kentucky state income tax forms for current and previous tax years. Kentucky has a flat income tax of 5% — all earnings are taxed at the same rate, regardless of total income level.

If Both The Above Statements Apply, You Are Exempt And May Check Box 1.

You can complete and sign the 2022. Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully. Refund checks are available through ky. Be sure to verify that the form you are downloading is for the.

Web 116 Rows Kentucky Has A Flat State Income Tax Of 5%, Which Is Administered By The Kentucky Department Of Revenue.

Web current year tax returns are available for submission. Kentucky's individual income tax law. Taxformfinder provides printable pdf copies of 130. Complete, edit or print tax forms instantly.

Taxpayers Wishing To Remit Funds To The Kentucky Department Of Revenue Using Electronic Funds.

Web individual income tax is due on all income earned by kentucky residents and all income earned by nonresidents from kentucky sources. Web form 740 is the kentucky income tax return for use by all taxpayers. All ky file returns will be accepted now, but. Web find online tax services availible in kentucky.