New Mexico State Income Tax Form

New Mexico State Income Tax Form - If you are a new mexico resident, you must file if you meet any of the following conditions: New mexico taxpayer access point (tap). Web your online tax center. Current new mexico income taxes can be. Complete, edit or print tax forms instantly. We last updated new mexico. Complete, edit or print tax forms instantly. It administers more than 35. File your taxes and manage your account online. New mexico usually releases forms for the current tax year between january and april.

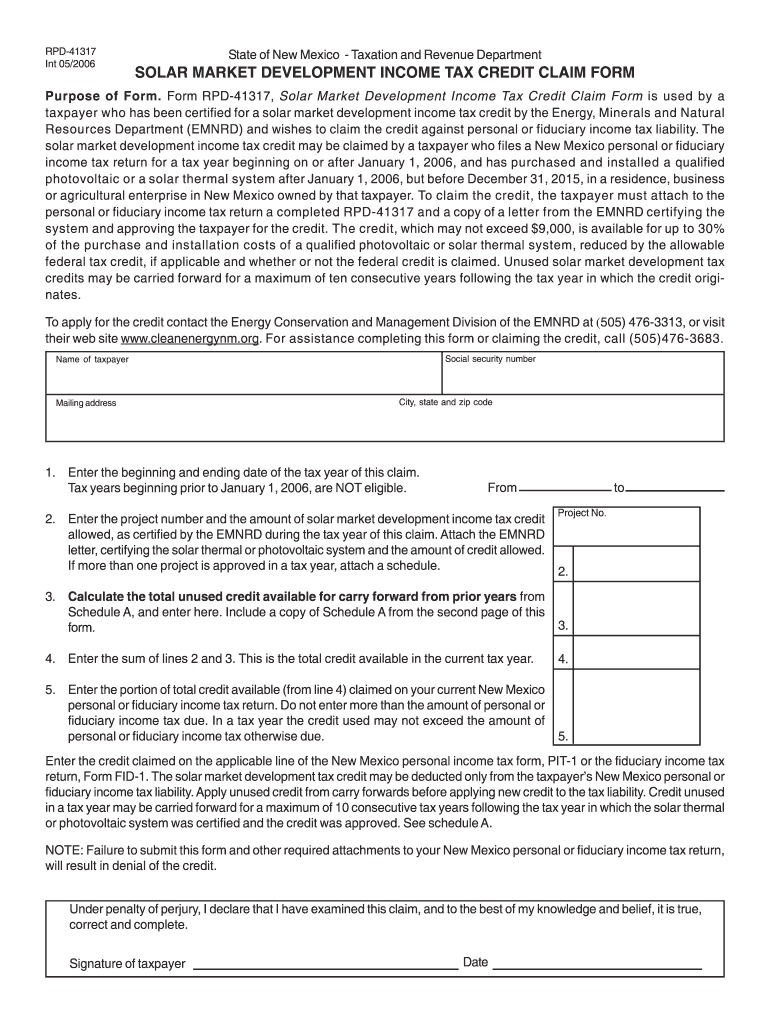

Web new mexico has a state income tax that ranges between 1.7% and 4.9%, which is administered by the new mexico taxation and revenue department.taxformfinder. New mexico usually releases forms for the current tax year between january and april. Web new mexico has a state income tax that ranges between 1.7% and 4.9%. Web 55 rows printable income tax forms. File your taxes and manage your account online. Complete, edit or print tax forms instantly. Web welcome to the taxation and revenue department’s online services page. Web your authorization submit this erb new mexico state tax withholding form specifying what deductions i authorize to be made from my erb retirement benefit for new mexico. If you file by paper or pay by check your filing due date is on or before april 18, 2023. Web apply to new retirees.

Web welcome to the taxation and revenue department’s online services page. If you file and pay your. Be sure to verify that the form you are downloading is for the correct. Filing due date paper filers: Web when required to submit a copy of this form to the department, mail the form and attachments to: New mexico taxation and revenue department, p.o. New mexico state income tax forms for current and previous tax years. New mexico has a state income tax that ranges between. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. We last updated new mexico.

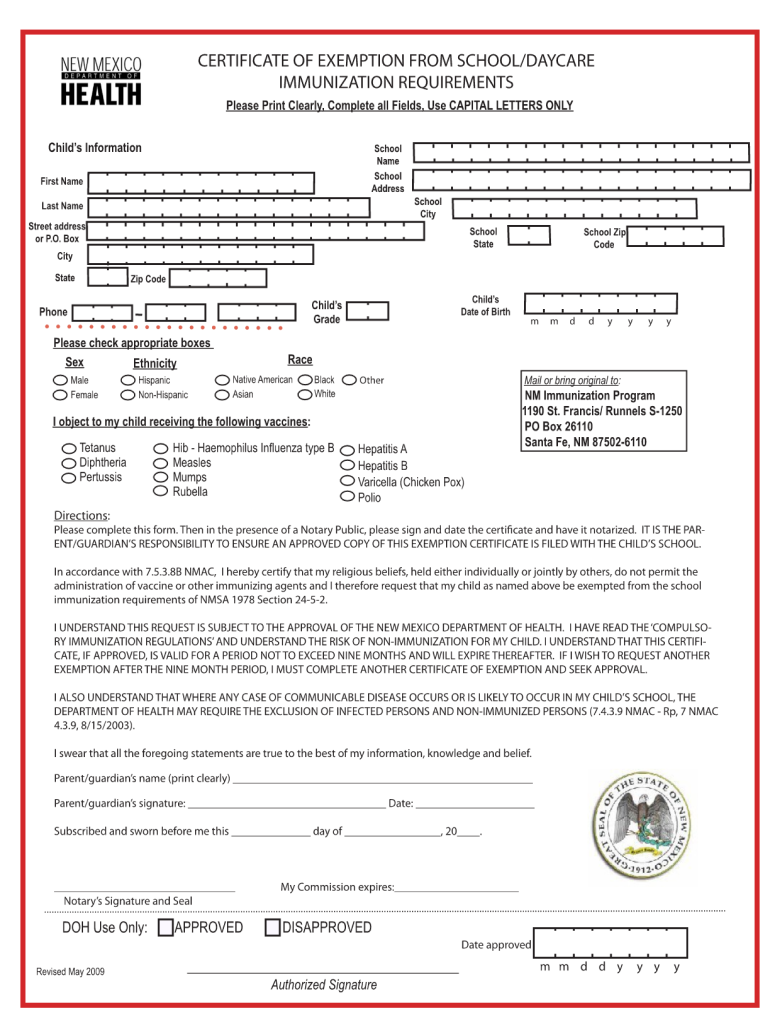

2009 Form NM Certificate of Exemption from School/Daycare Immunization

Be sure to verify that the form you are downloading is for the correct. New mexico has a state income tax that ranges between. If you are a new mexico resident, you must file if you meet any of the following conditions: It administers more than 35. Web the taxation and revenue department serves the state of new mexico by.

Printable New Mexico Tax Forms for Tax Year 2021

New mexico state income tax forms for current and previous tax years. Web apply to new retirees. Personal and business income taxes, gross receipts. New mexico state withholding election (right facing green column) box number one (1) new mexico income tax withholding status/ number of exemptions. Filing due date paper filers:

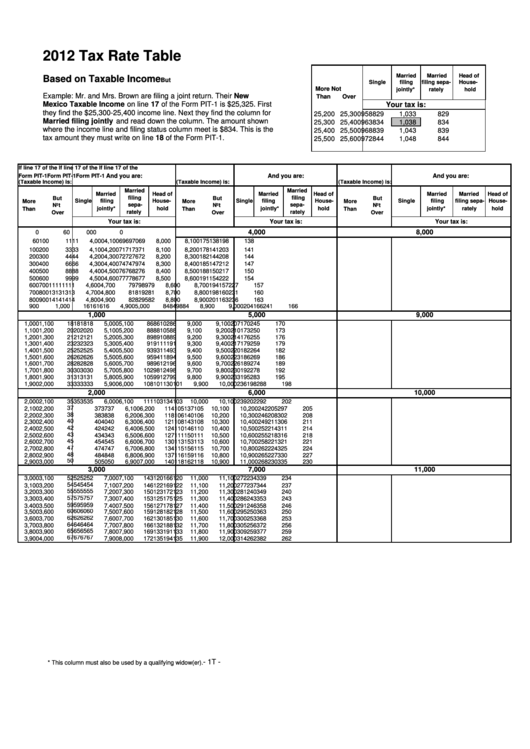

Tax Rate Table Form Based On Taxable State Of New Mexico

If you file by paper or pay by check your filing due date is on or before april 18, 2023. New mexico taxation and revenue department, p.o. Personal and business income taxes, gross receipts. Web 55 rows printable income tax forms. Web your online tax center.

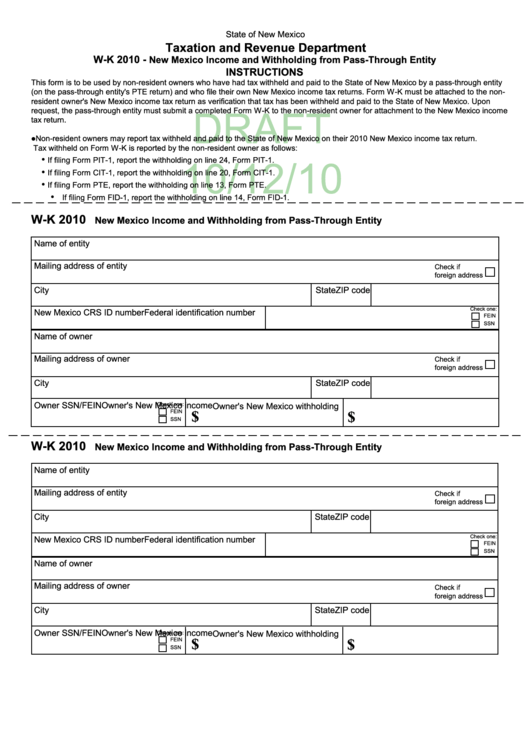

Form Wk New Mexico And Withholding From Passthrough Entity

All others must file by april 18, 2023. Filing due date paper filers: New mexico has a state income tax that ranges between. Web your authorization submit this erb new mexico state tax withholding form specifying what deductions i authorize to be made from my erb retirement benefit for new mexico. New mexico usually releases forms for the current tax.

New Mexico Personal Tax Spreadsheet Feel Free to Download!

Filing due date paper filers: All others must file by april 18, 2023. Web your online tax center. Web apply to new retirees. We last updated new mexico.

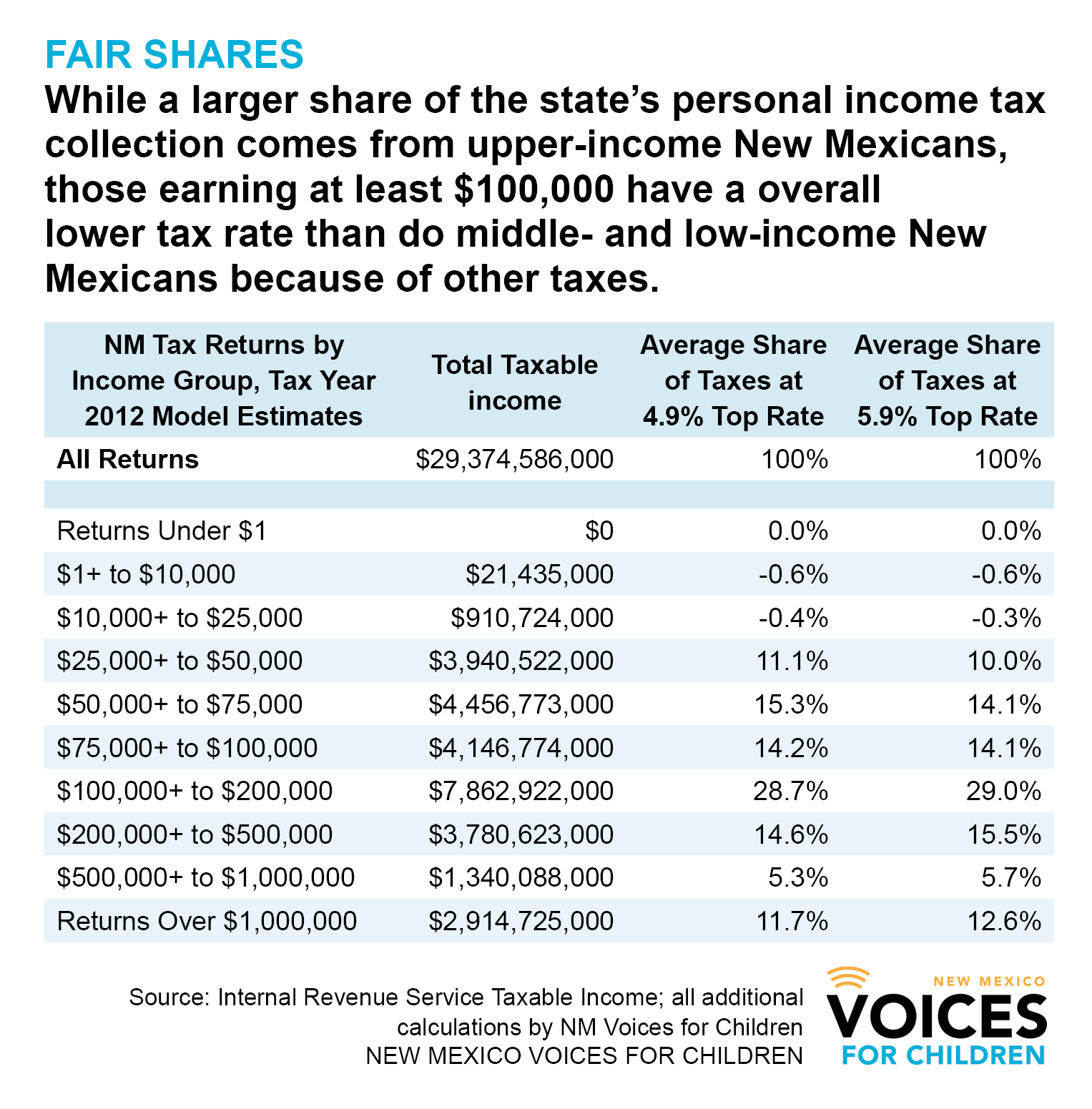

Why the poor pay the highest tax rate in New Mexico—and one step toward

If you file and pay your. Current new mexico income taxes can be. We last updated new mexico. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. New mexico has a state income tax that ranges between.

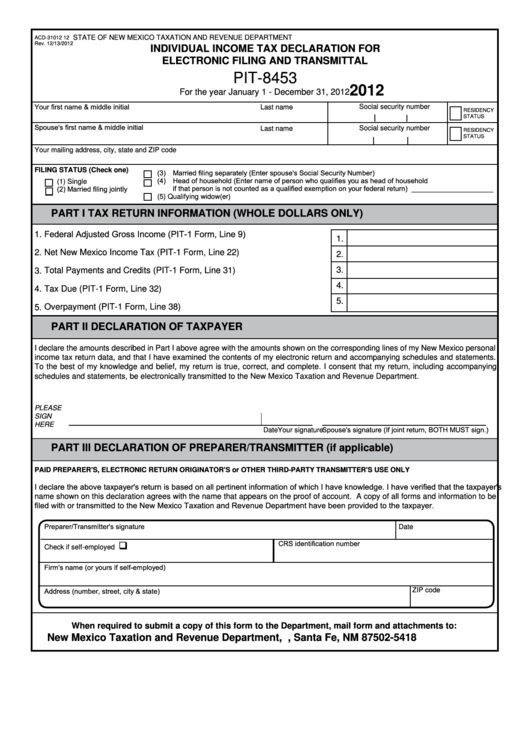

Form Pit8453 Individual Tax Declaration For Electronic Filing

New mexico has a state income tax that ranges between. Web the taxation and revenue department serves the state of new mexico by providing fair and efficient tax and motor vehicle services. All others must file by april 18, 2023. Web 55 rows printable income tax forms. Web view all 81 new mexico income tax forms form sources:

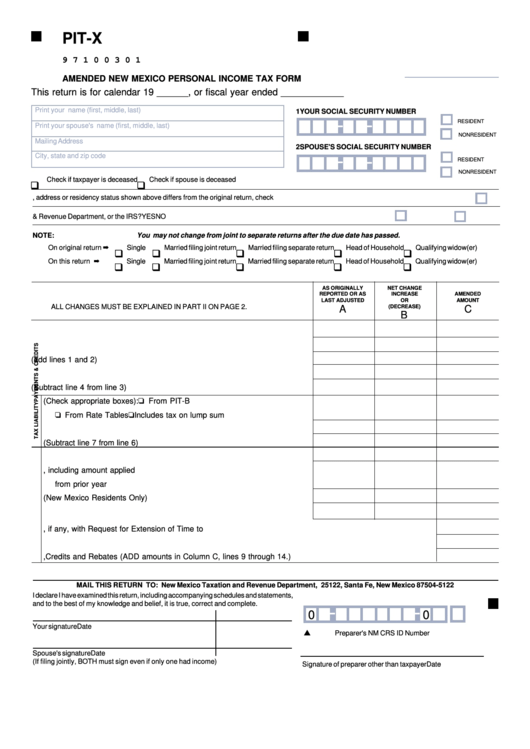

Fillable Form PitX Amended New Mexico Personal Tax Form

New mexico state income tax forms for current and previous tax years. Web your online tax center. Web welcome to the taxation and revenue department’s online services page. Current new mexico income taxes can be. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023.

New Mexico Tax Form Fill Out and Sign Printable PDF Template

If you file and pay your. Web your online tax center. We last updated new mexico. New mexico taxation and revenue department, p.o. Web view all 81 new mexico income tax forms form sources:

If You File Your New Mexico Personal Income Tax Return Online And Also Pay Tax Due Online, Your Due Date Is May 01, 2023.

New mexico state income tax forms for current and previous tax years. Web your online tax center. Filing due date paper filers: New mexico has a state income tax that ranges between.

If You Are A New Mexico Resident, You Must File If You Meet Any Of The Following Conditions:

Web 55 rows printable income tax forms. File your taxes and manage your account online. Web your authorization submit this erb new mexico state tax withholding form specifying what deductions i authorize to be made from my erb retirement benefit for new mexico. Web apply to new retirees.

All Others Must File By April 18, 2023.

Complete, edit or print tax forms instantly. Web new mexico has a state income tax that ranges between 1.7% and 4.9%. Web view all 81 new mexico income tax forms form sources: It administers more than 35.

Web The Taxation And Revenue Department Serves The State Of New Mexico By Providing Fair And Efficient Tax And Motor Vehicle Services.

Web when required to submit a copy of this form to the department, mail the form and attachments to: If you file by paper or pay by check your filing due date is on or before april 18, 2023. We last updated new mexico. New mexico state withholding election (right facing green column) box number one (1) new mexico income tax withholding status/ number of exemptions.