North Carolina Deed Of Trust Form

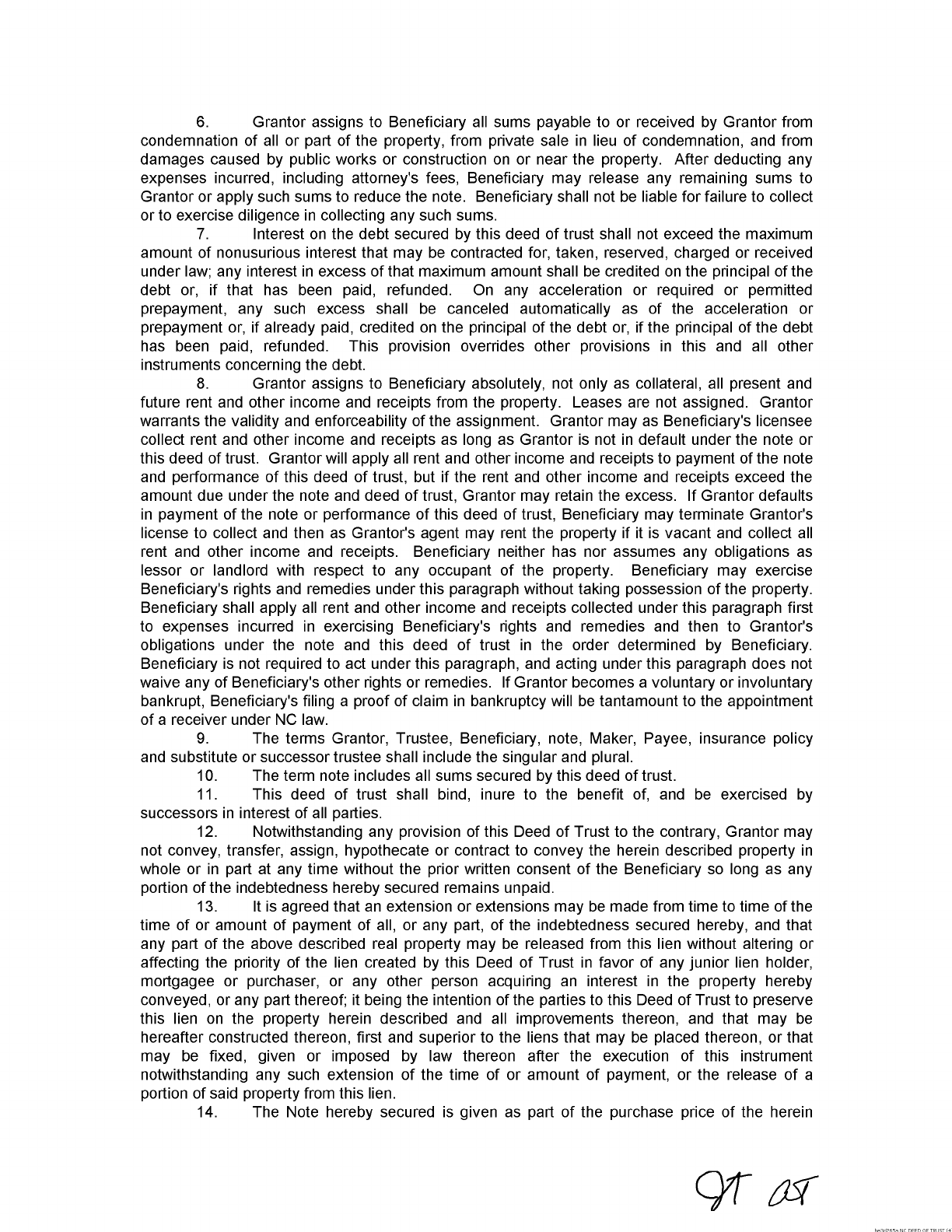

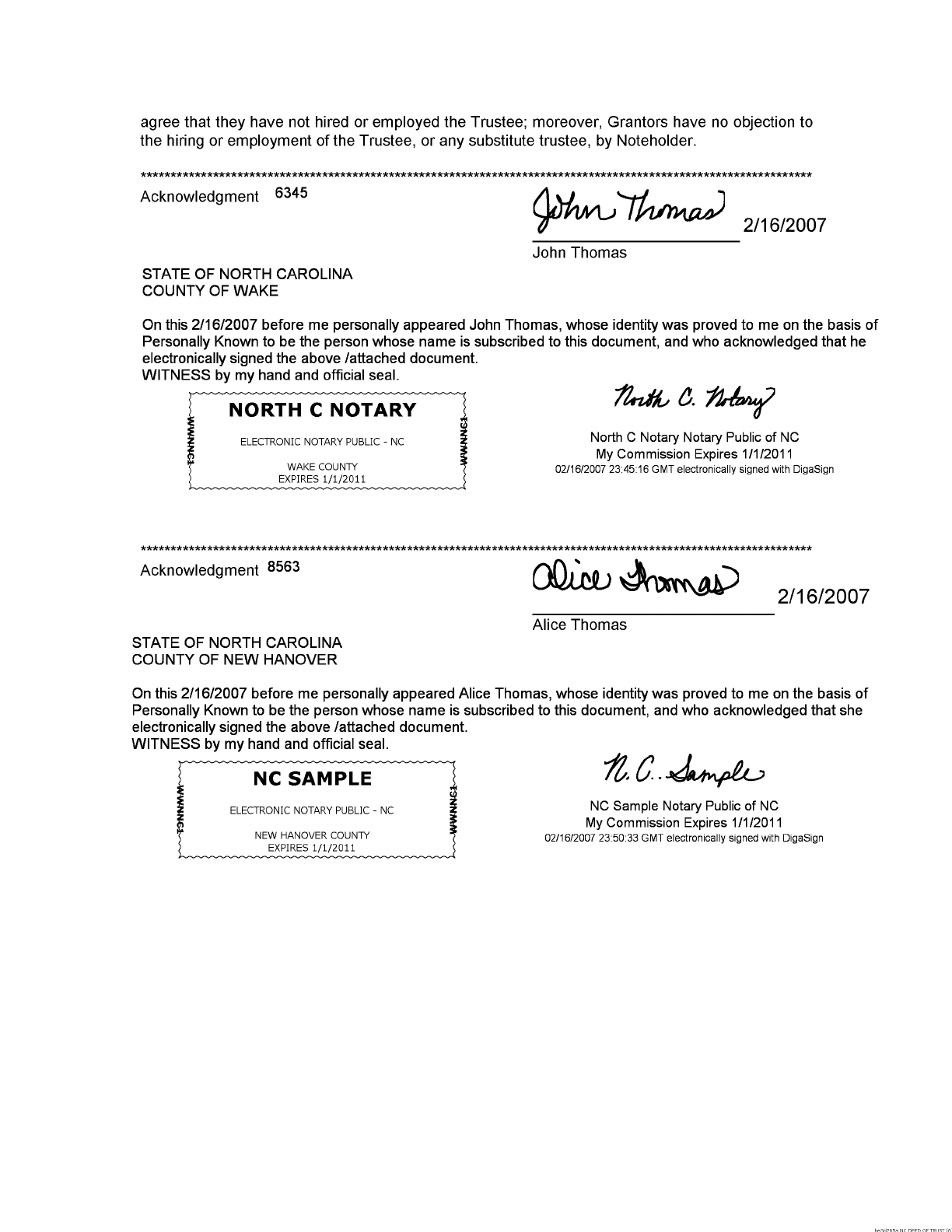

North Carolina Deed Of Trust Form - Web the drafting of legal instruments, such as a deed or deed of trust, which convey an interest in real property is the practice of law in north carolina (n.c.g.s. Recording is the act of putting the deed on record in the register of deeds in the county in which the real property is located. Estates and trusts income tax instructions. This form can be used by a party selling/financing their own house, rental, condominium or small office building. Web north carolina is a “race to record state.” this means that the first person or entity to record the deed is the true and lawful owner of the property. Personnel do not draft such legal instruments, but are often asked to assist in the recording of legal instruments and to provide standard forms. Warranty deed, quitclaim deed, special warranty deed, and deed of trust. Web north carolina deed of trust satisfaction: Deeds are required to have the name of the grantor, the name and address of the grantee, the name of the preparer and an acknowledgment by a notary. A trustee or beneficiary/lender can take an action against any person for damages.

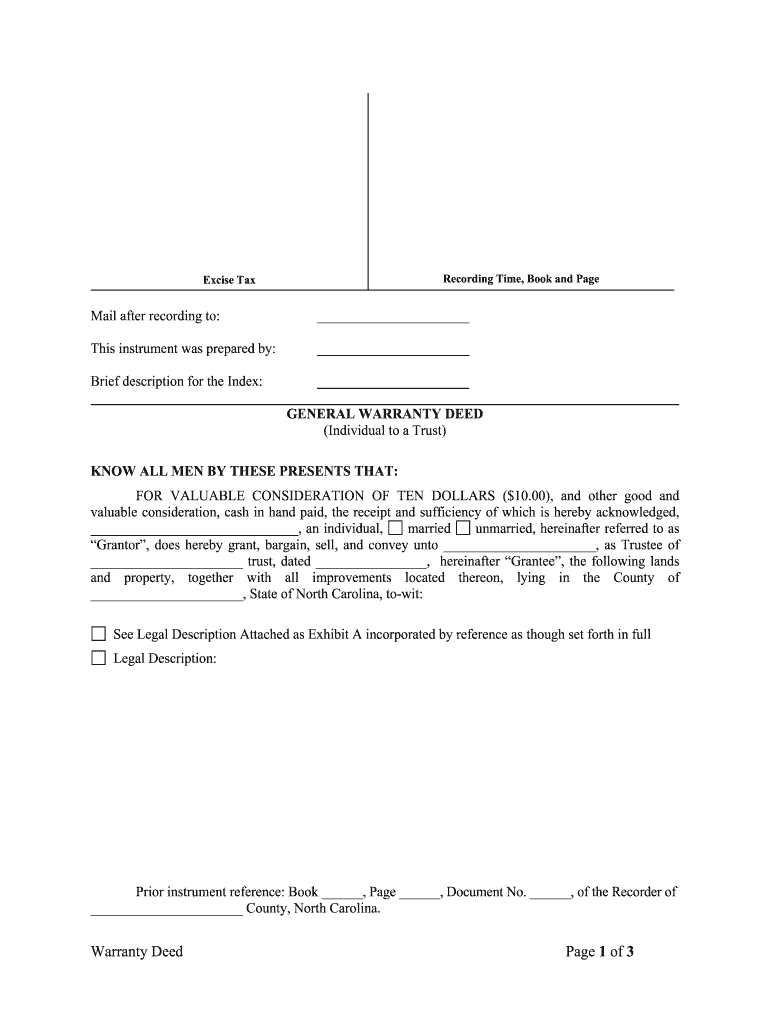

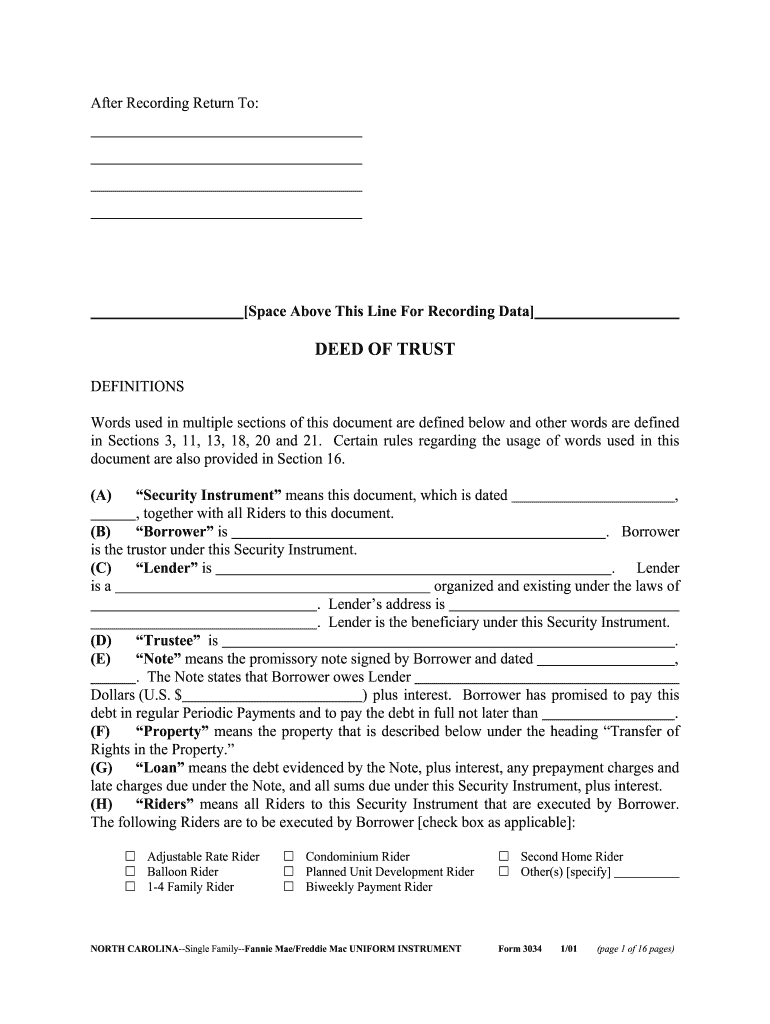

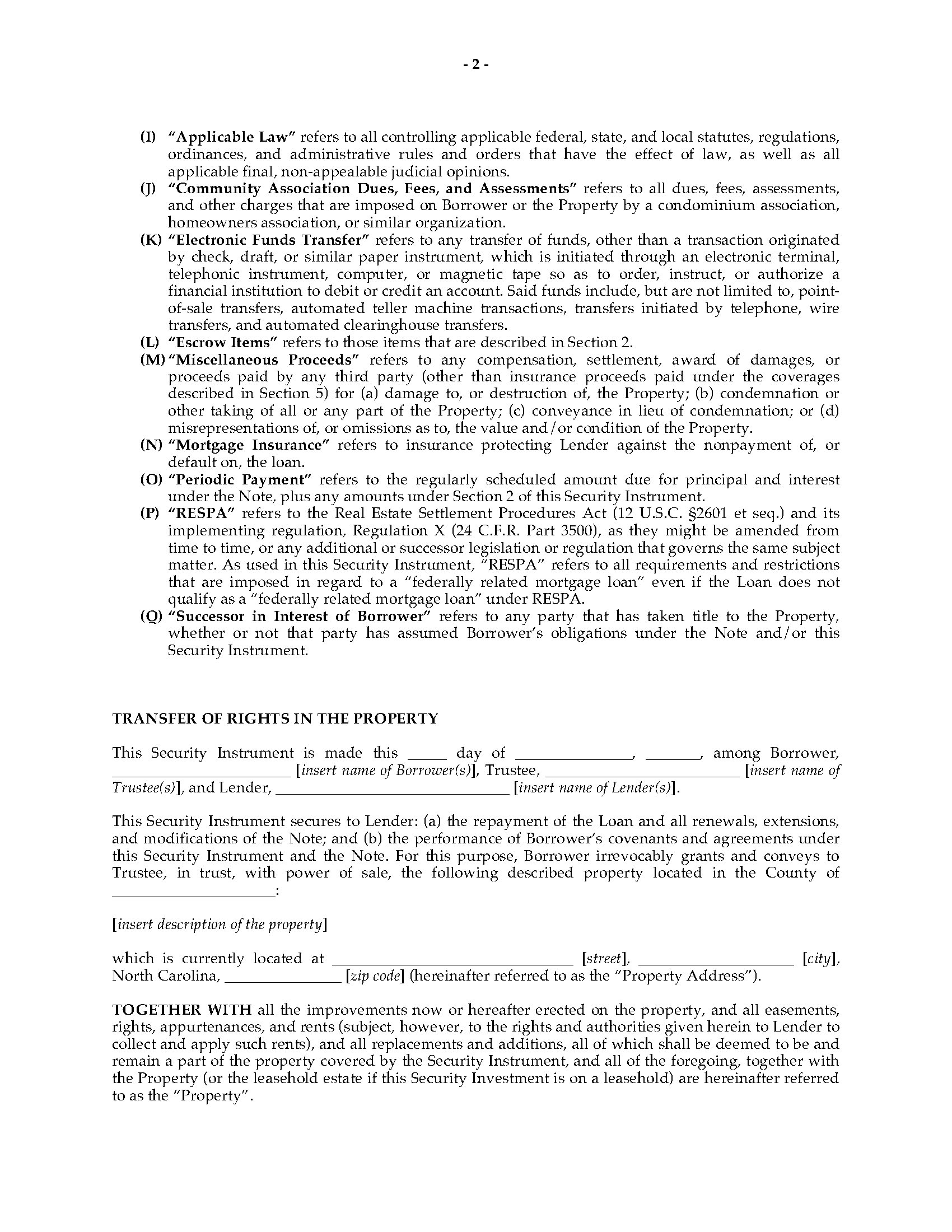

Estates and trusts income tax instructions. Web there are four main types of north carolina deeds we will be discussing: Web north carolina is a “race to record state.” this means that the first person or entity to record the deed is the true and lawful owner of the property. The north carolina real property marketable title act (nc general statutes chapter 47b) outlines all. Deeds are required to have the name of the grantor, the name and address of the grantee, the name of the preparer and an acknowledgment by a notary. A trustee or beneficiary/lender can take an action against any person for damages. Income tax return for estates and trusts. A north carolina deed of trust is a real estate transfer instrument between a lender, borrower, and a trustee whereby a property title is transferred as collateral for a loan to purchase real estate. Web the drafting of legal instruments, such as a deed or deed of trust, which convey an interest in real property is the practice of law in north carolina (n.c.g.s. The trustor (borrower) conveys property title to a trustee (neutral party).

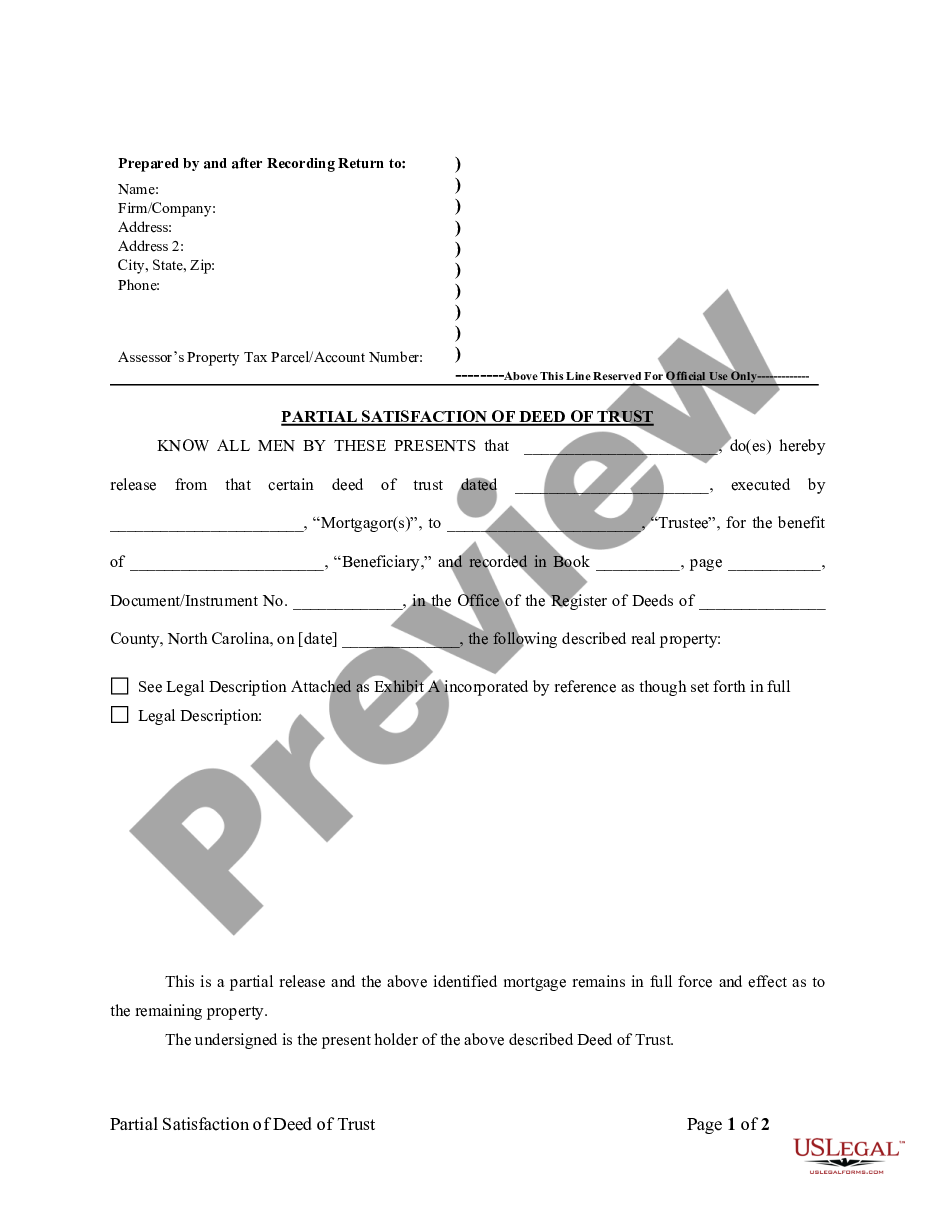

Estates and trusts income tax instructions. This form can be used by a party selling/financing their own house, rental, condominium or small office building. Warranty deed, quitclaim deed, special warranty deed, and deed of trust. The debt secured by the within deed of trust together with the note(s) secured thereby has been satisfied in full. The north carolina real property marketable title act (nc general statutes chapter 47b) outlines all. Web north carolina deed forms. The trustor (borrower) conveys property title to a trustee (neutral party). Income tax return for estates and trusts. Deeds are required to have the name of the grantor, the name and address of the grantee, the name of the preparer and an acknowledgment by a notary. Updated on september 1st, 2022.

North Carolina Deed Trust Form Fill Out and Sign Printable PDF

Web north carolina deed forms. The debt secured by the within deed of trust together with the note(s) secured thereby has been satisfied in full. The north carolina real property marketable title act (nc general statutes chapter 47b) outlines all. A north carolina deed of trust is a real estate transfer instrument between a lender, borrower, and a trustee whereby.

Deed Of Trust (real Estate) North Carolina Deed Of Trust

Personnel do not draft such legal instruments, but are often asked to assist in the recording of legal instruments and to provide standard forms. Web the drafting of legal instruments, such as a deed or deed of trust, which convey an interest in real property is the practice of law in north carolina (n.c.g.s. Web fill now click to fill,.

North Carolina Deed Of Trust Form Fill Out and Sign Printable PDF

Web north carolina is a “race to record state.” this means that the first person or entity to record the deed is the true and lawful owner of the property. A north carolina deed is used to convey real estate from one person to another in north carolina. Income tax return for estates and trusts. Recording is the act of.

North Carolina Partial Release of Property From Deed of Trust for

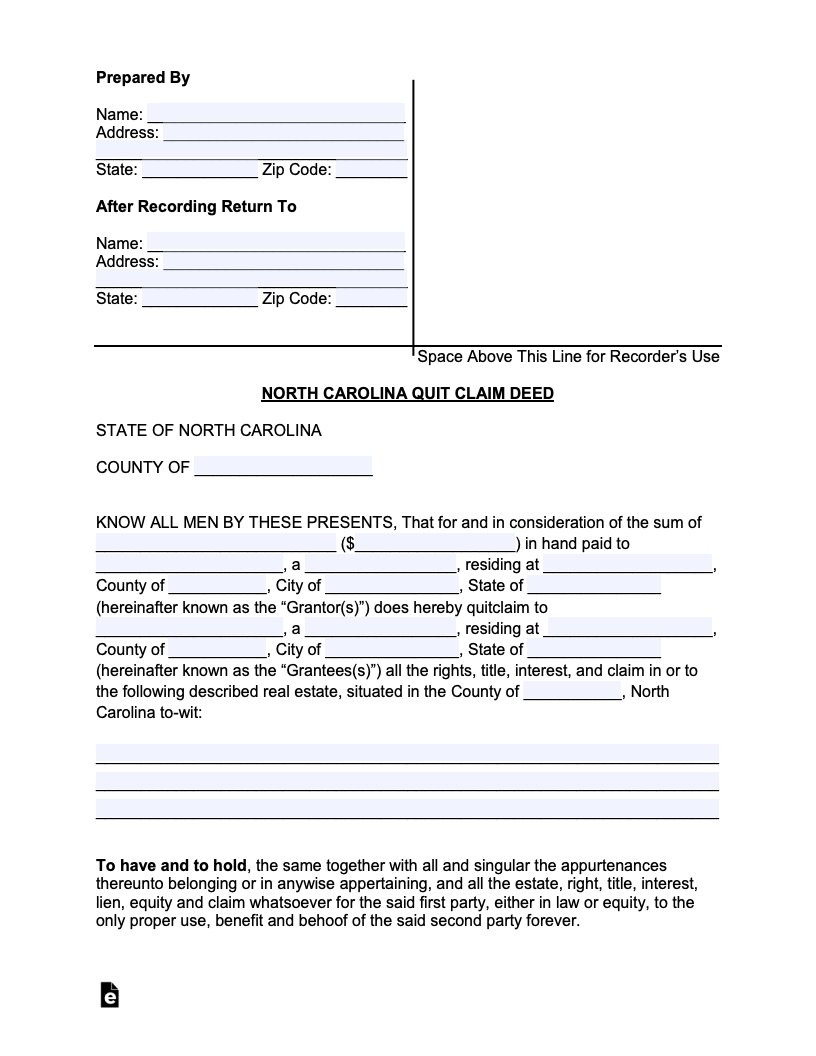

Warranty deed, quitclaim deed, special warranty deed, and deed of trust. Web there are four main types of north carolina deeds we will be discussing: Web the drafting of legal instruments, such as a deed or deed of trust, which convey an interest in real property is the practice of law in north carolina (n.c.g.s. A north carolina deed is.

Deed of Trust North Carolina Edit, Fill, Sign Online Handypdf

Web there are four main types of north carolina deeds we will be discussing: Web north carolina is a “race to record state.” this means that the first person or entity to record the deed is the true and lawful owner of the property. Recording is the act of putting the deed on record in the register of deeds in.

North Carolina Deed of Trust Legal Forms and Business Templates

Updated on september 1st, 2022. The trustor (borrower) conveys property title to a trustee (neutral party). Web the drafting of legal instruments, such as a deed or deed of trust, which convey an interest in real property is the practice of law in north carolina (n.c.g.s. Web there are four main types of north carolina deeds we will be discussing:.

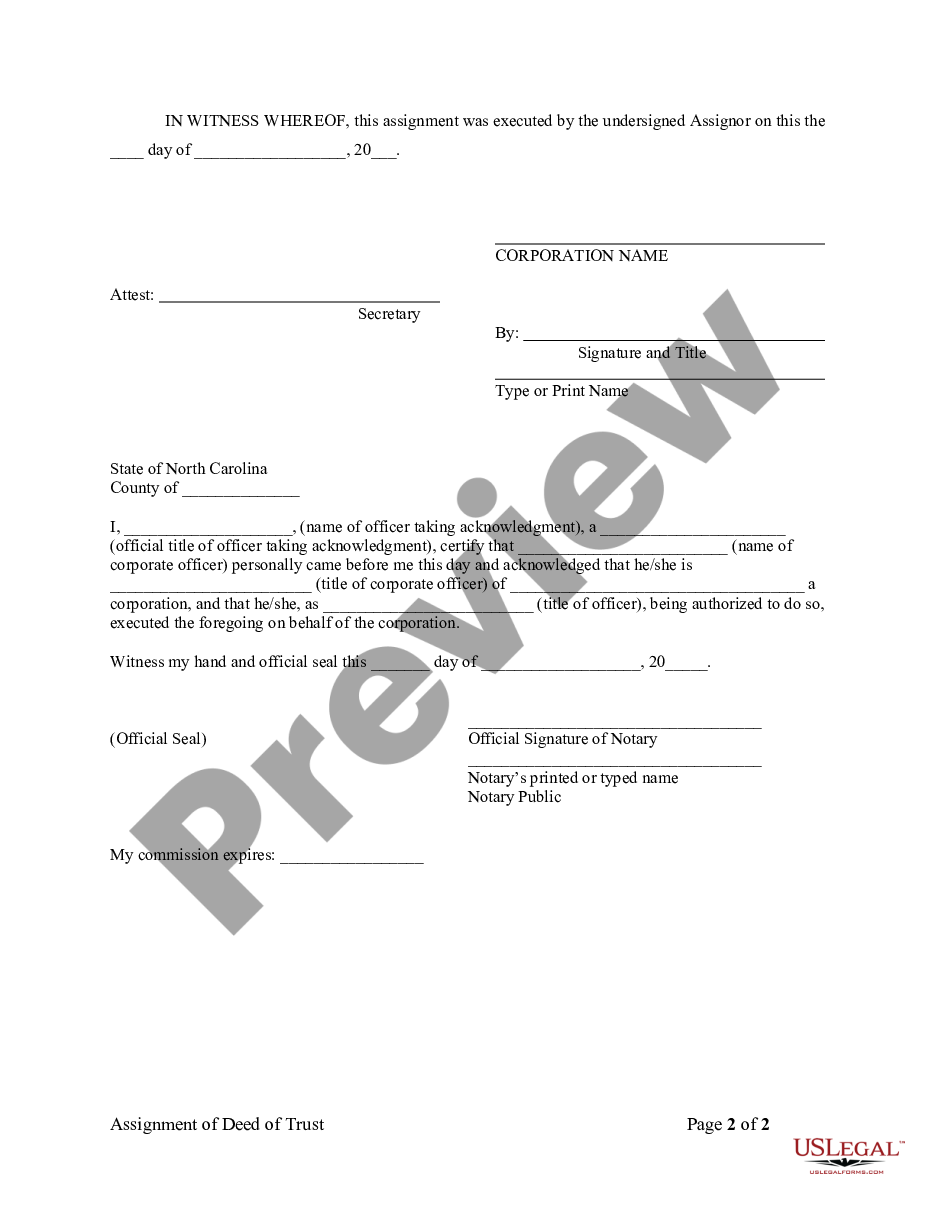

North Carolina Assignment of Deed of Trust by Corporate Mortgage Holder

Income tax return for estates and trusts. Web there are four main types of north carolina deeds we will be discussing: Web fill now click to fill, edit and sign this form now! This form can be used by a party selling/financing their own house, rental, condominium or small office building. Updated on september 1st, 2022.

Free North Carolina Quit Claim Deed Form PDF WORD

The trustor (borrower) conveys property title to a trustee (neutral party). Web north carolina deed forms. Web there are four main types of north carolina deeds we will be discussing: A north carolina deed of trust is a real estate transfer instrument between a lender, borrower, and a trustee whereby a property title is transferred as collateral for a loan.

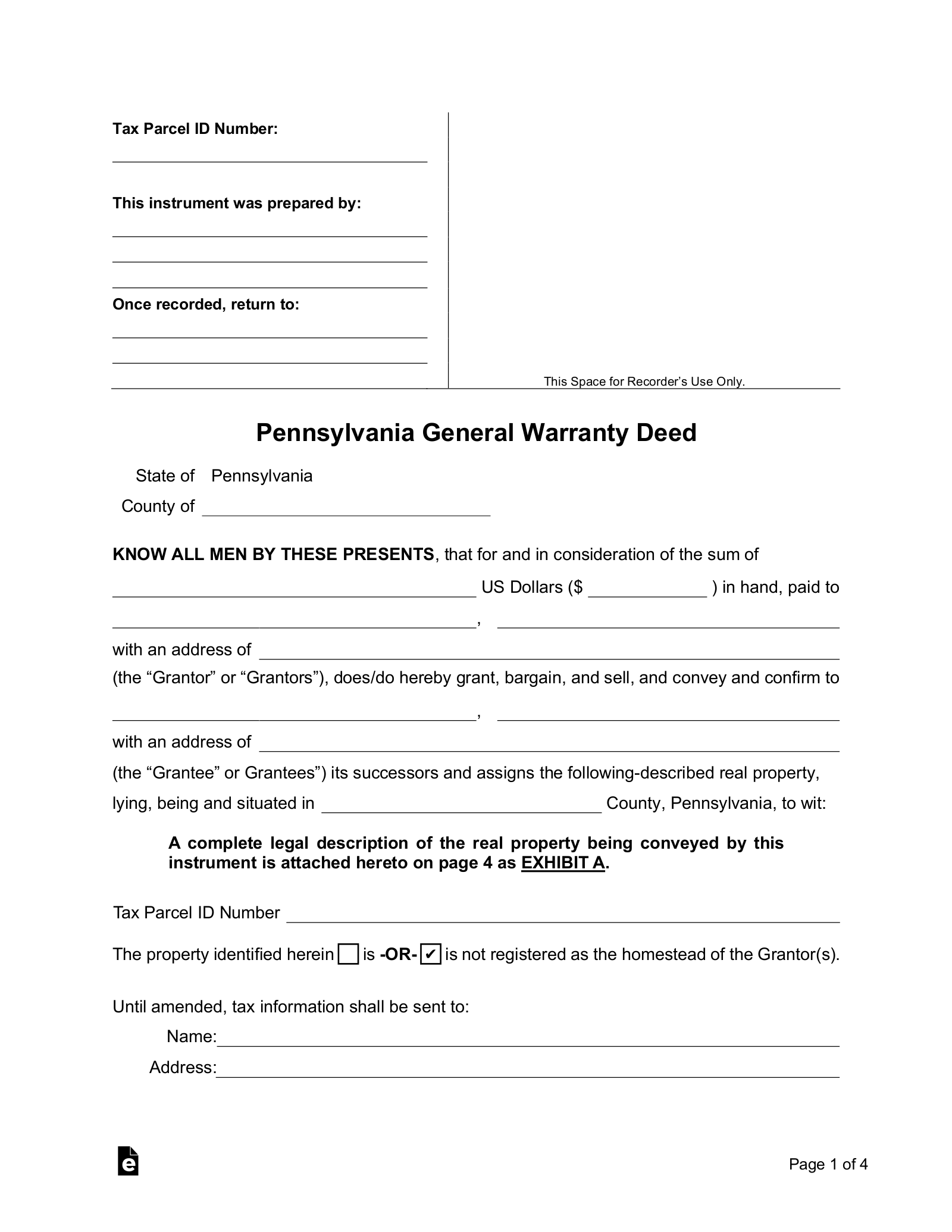

Free Pennsylvania General Warranty Deed Form Word PDF eForms

The trustor (borrower) conveys property title to a trustee (neutral party). A trustee or beneficiary/lender can take an action against any person for damages. A north carolina deed of trust is a real estate transfer instrument between a lender, borrower, and a trustee whereby a property title is transferred as collateral for a loan to purchase real estate. Estates and.

Deed of Trust North Carolina Edit, Fill, Sign Online Handypdf

A trustee or beneficiary/lender can take an action against any person for damages. Web north carolina deed forms. Warranty deed, quitclaim deed, special warranty deed, and deed of trust. Web there are four main types of north carolina deeds we will be discussing: Personnel do not draft such legal instruments, but are often asked to assist in the recording of.

Web North Carolina Is A “Race To Record State.” This Means That The First Person Or Entity To Record The Deed Is The True And Lawful Owner Of The Property.

Income tax return for estates and trusts. A north carolina deed is used to convey real estate from one person to another in north carolina. Estates and trusts income tax instructions. The debt secured by the within deed of trust together with the note(s) secured thereby has been satisfied in full.

A North Carolina Deed Of Trust Is A Real Estate Transfer Instrument Between A Lender, Borrower, And A Trustee Whereby A Property Title Is Transferred As Collateral For A Loan To Purchase Real Estate.

Warranty deed, quitclaim deed, special warranty deed, and deed of trust. Web the drafting of legal instruments, such as a deed or deed of trust, which convey an interest in real property is the practice of law in north carolina (n.c.g.s. Personnel do not draft such legal instruments, but are often asked to assist in the recording of legal instruments and to provide standard forms. The north carolina real property marketable title act (nc general statutes chapter 47b) outlines all.

The Trustor (Borrower) Conveys Property Title To A Trustee (Neutral Party).

Web fill now click to fill, edit and sign this form now! Web north carolina deed forms. Deeds are required to have the name of the grantor, the name and address of the grantee, the name of the preparer and an acknowledgment by a notary. Recording is the act of putting the deed on record in the register of deeds in the county in which the real property is located.

Updated On September 1St, 2022.

A trustee or beneficiary/lender can take an action against any person for damages. Web there are four main types of north carolina deeds we will be discussing: Web north carolina deed of trust satisfaction: This form can be used by a party selling/financing their own house, rental, condominium or small office building.