Poshmark 1099 K Form

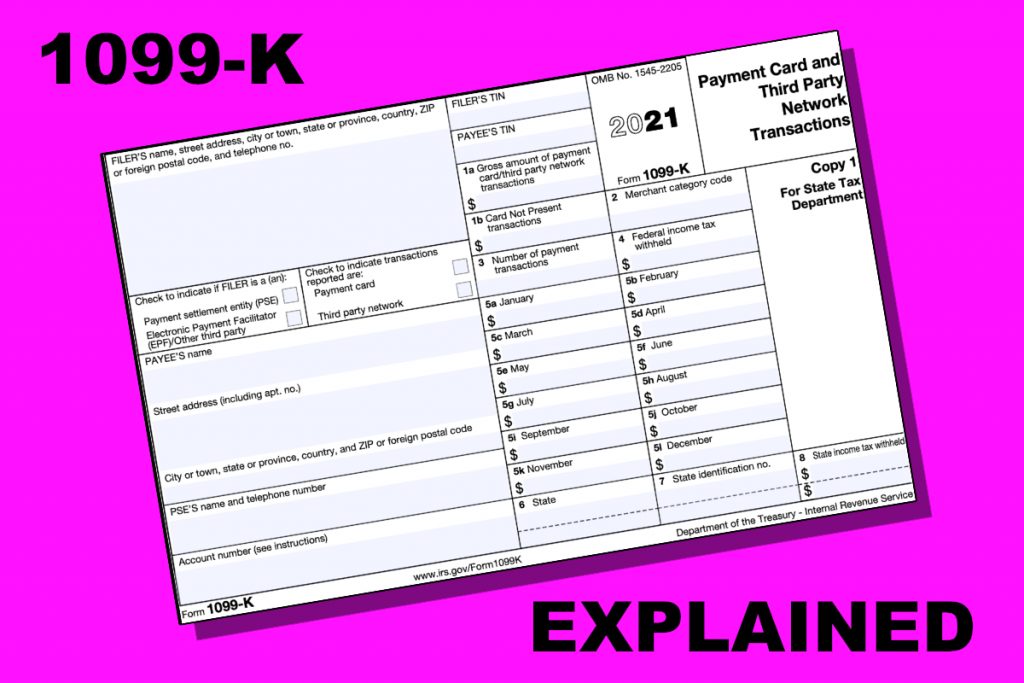

Poshmark 1099 K Form - Will we end up receiving. Payment card and third party network transactions. The irs link simply means that poshmark or other third party settlement organization (tpso), if the money goes through. Law, beginning in january 2023, poshmark is required to provide any seller with $600 or. The loss on the sale of a personal item is. I'm hoping someone could help me out here. As part of changes to u.s. Web beginning january 1, 2022, online marketplaces, such as poshmark, will be requiring all sellers who sell more than $600 in one tax year, to report all sales to the irs via a form. How to change my email. How to change my email address.

How to adjust my notifications. Web buy now like and save for later add to bundle 12/27/22. How to change my email. Web yes, it must be included in your tax return. Payment card and third party network transactions. Web learn how to access & receive your form 1099k here. Complete fillable and printable pdf blanks online in minutes. Download and send forms securely. I'm hoping someone could help me out here. How does poshmark comply with the ccpa?

How does poshmark comply with the ccpa? How to adjust my notifications. I understand that is someone makes over $600 selling on an online. I'm hoping someone could help me out here. Will we end up receiving. Get ready for this year's tax season quickly and safely with pdffiller! How to change my email address. Web beginning january 1, 2022, online marketplaces, such as poshmark, will be requiring all sellers who sell more than $600 in one tax year, to report all sales to the irs via a form. Web for the 2022 tax year, poshmark is required to provide any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the 2022 calendar year with a. Web yes, it must be included in your tax return.

Irs Form 1099 Contract Labor Form Resume Examples

Will we end up receiving. Complete fillable and printable pdf blanks online in minutes. How to change my email. The irs link simply means that poshmark or other third party settlement organization (tpso), if the money goes through. I understand that is someone makes over $600 selling on an online.

Spell Other Will We Receive 99k Forms From Poshmark Poshmark

Web yes, it must be included in your tax return. It has at least been postponed. How to change my email. As part of changes to u.s. How to change my email address.

1099K Payments United States Economic Policy

Get ready for this year's tax season quickly and safely with pdffiller! How does poshmark comply with the ccpa? Payment card and third party network transactions. $1,234 free shipping size os buy now like and save for later add to bundle i am keeping my eye on this. Complete fillable and printable pdf blanks online in minutes.

Understanding Your Form 1099K FAQs for Merchants Clearent

Get ready for this year's tax season quickly and safely with pdffiller! How to adjust my notifications. Web learn how to access & receive your form 1099k here. For internal revenue service center. $1,234 free shipping size os buy now like and save for later add to bundle i am keeping my eye on this.

eBay, Etsy, OfferUp, Poshmark, Mercari, Reverb, and Tradesy Form

Web buy now like and save for later add to bundle 12/27/22. Complete fillable and printable pdf blanks online in minutes. I'm hoping someone could help me out here. The loss on the sale of a personal item is. How to adjust my notifications.

Understanding the 1099K Gusto

Web beginning january 1, 2022, online marketplaces, such as poshmark, will be requiring all sellers who sell more than $600 in one tax year, to report all sales to the irs via a form. Will we end up receiving. Web for the 2022 tax year, poshmark is required to provide any seller with $20,000 or more in gross sales and.

1099 tax calculator AlbyHy

Web buy now like and save for later add to bundle 12/27/22. How does poshmark comply with the ccpa? Web yes, it must be included in your tax return. Download and send forms securely. Web learn how to access & receive your form 1099k here.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Get ready for this year's tax season quickly and safely with pdffiller! Payment card and third party network transactions. How does poshmark comply with the ccpa? How to change my email address. I'm hoping someone could help me out here.

1099K Forms What eBay, Etsy, and Online Sellers Need to Know

Download and send forms securely. The loss on the sale of a personal item is. Payment card and third party network transactions. Web for the 2022 tax year, poshmark is required to provide any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the 2022 calendar year with a. How does poshmark comply with.

FAQ What is a 1099 K? Pivotal Payments

Will we end up receiving. $1,234 free shipping size os buy now like and save for later add to bundle i am keeping my eye on this. The irs link simply means that poshmark or other third party settlement organization (tpso), if the money goes through. Get ready for this year's tax season quickly and safely with pdffiller! Complete fillable.

How To Change My Email Address.

Web beginning january 1, 2022, online marketplaces, such as poshmark, will be requiring all sellers who sell more than $600 in one tax year, to report all sales to the irs via a form. Payment card and third party network transactions. How does poshmark comply with the ccpa? The loss on the sale of a personal item is.

For Internal Revenue Service Center.

How to change my email. $1,234 free shipping size os buy now like and save for later add to bundle i am keeping my eye on this. The irs link simply means that poshmark or other third party settlement organization (tpso), if the money goes through. Get ready for this year's tax season quickly and safely with pdffiller!

Web Buy Now Like And Save For Later Add To Bundle 12/27/22.

Complete fillable and printable pdf blanks online in minutes. As part of changes to u.s. I'm hoping someone could help me out here. I understand that is someone makes over $600 selling on an online.

Web Learn How To Access & Receive Your Form 1099K Here.

Web for the 2022 tax year, poshmark is required to provide any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the 2022 calendar year with a. Law, beginning in january 2023, poshmark is required to provide any seller with $600 or. Download and send forms securely. Will we end up receiving.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553021637842-T52O55S3Z3ILYDIS44PS/ke17ZwdGBToddI8pDm48kCpGfv303rFPf_R2MmpjQDgUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcmomqGy8QKumd8_Xi9pibUHb-95JWteCRKkaNKL5Nmf61lF01BYr72PFdZDEdDuE_/what+is+a+1099-k)