Property Evaluation Form

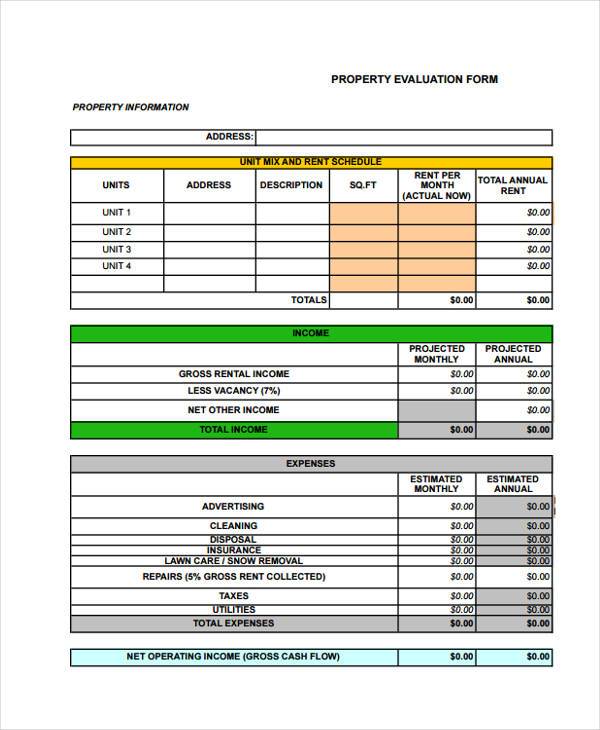

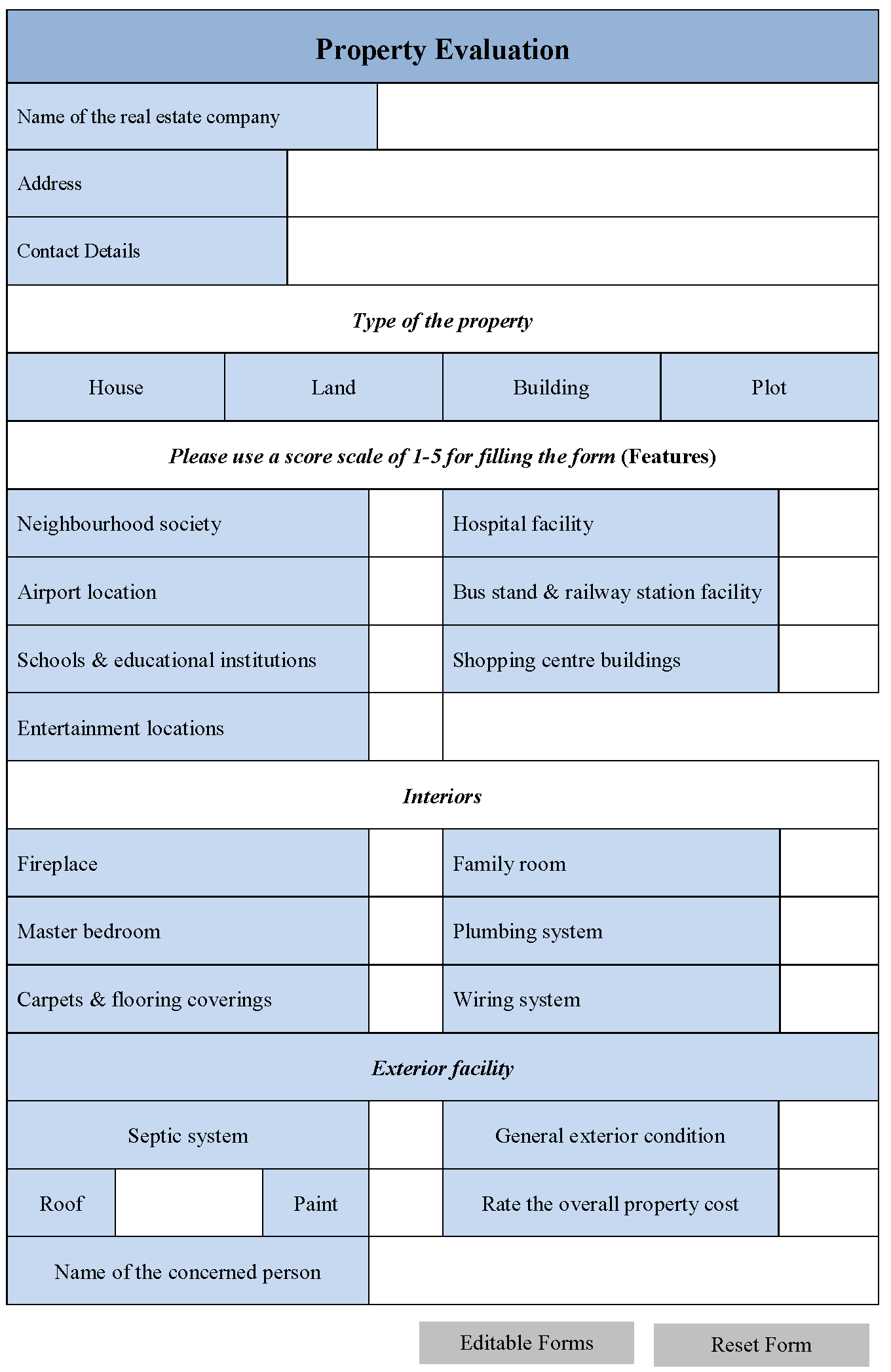

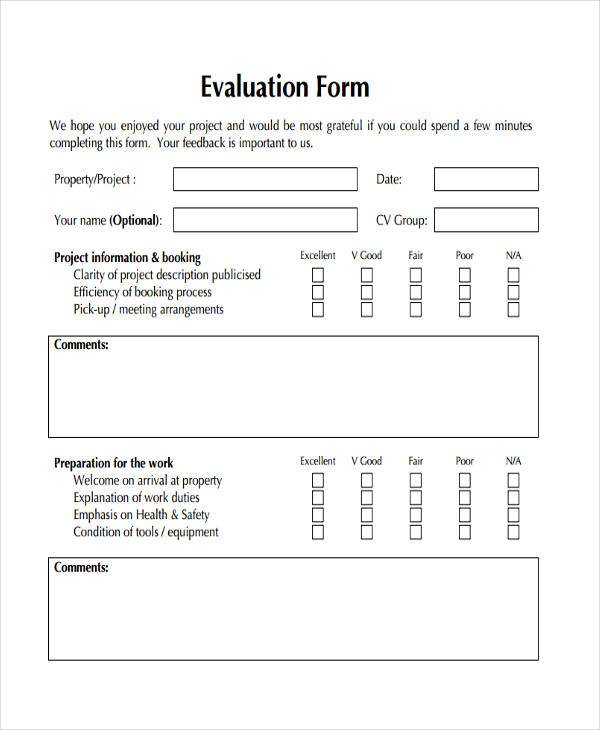

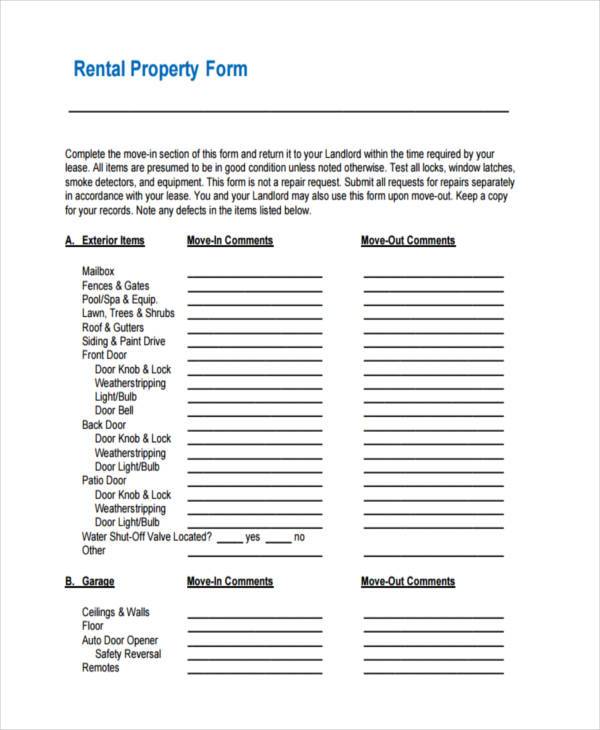

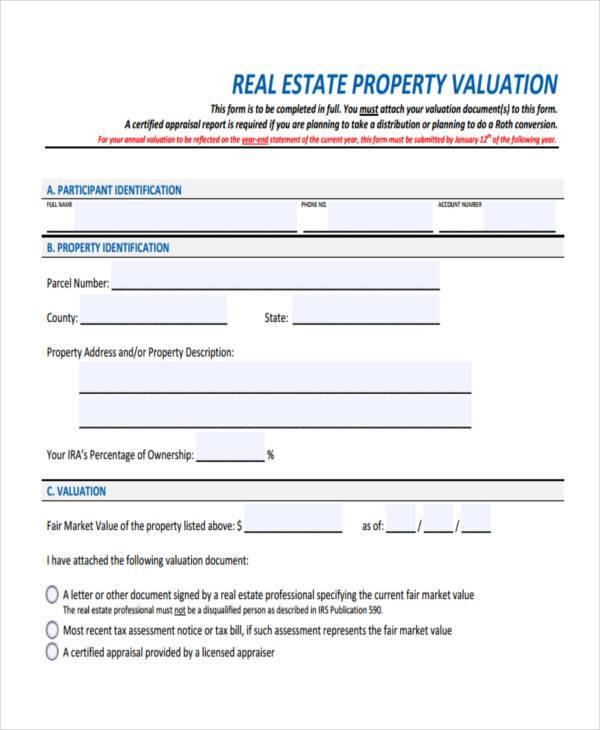

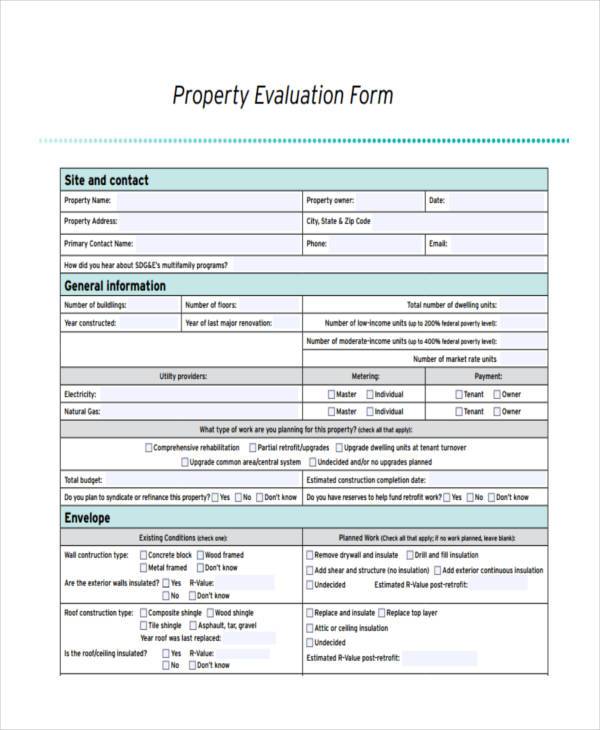

Property Evaluation Form - A property evaluation form plays a vital role in measuring the pros and cons of a particular property before buying or selling it. Web the form to request an flr is included with notices of proposed valuation. Web property tax assessments determine the property value, which is performed by a government assessor who then uses this assessment to calculate the amount of taxes due. 35 kb download rental property evaluation form seattle.gov details file format pdf size: Find the property evaluation form you need. While the taxes are paid in regular intervals depending on the county and state, they’re typically paid annually. Web forms and publications your personal. Whether you want to gather customer satisfaction, student progress, employee performance, or guest feedback, our free online evaluation forms will make it easier to collect and track evaluations. To determine the monthly taxes, multiply the estimated property value (usually the naca loan amount) by the tax rate and divide by 12. Web real estate property evaluation form iraservices.com details file format pdf size:

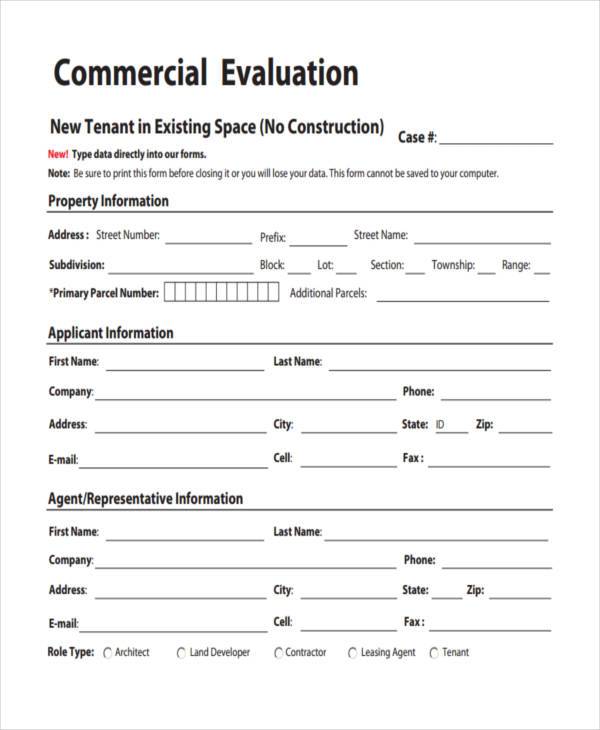

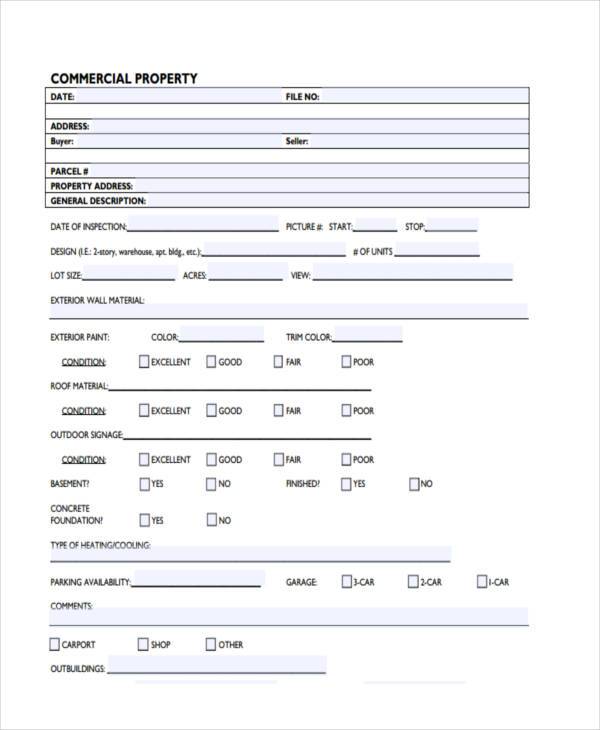

Web forms and publications your personal. Web evaluation forms are a great way to obtain valuable feedback and identify areas that need improvement. Property owners should wait until they receive the mailed notice of proposed valuation to file an flr. To determine the monthly taxes, multiply the estimated property value (usually the naca loan amount) by the tax rate and divide by 12. 224 kb download commercial property evaluation form pds.cityofboise.org details file format pdf size: 154 kb download property evaluation form in pdf. Web monthly real estate taxes are generally between 1% and 4% of the purchase price depending on where you purchase. Personal property assessment form ; 35 kb download rental property evaluation form seattle.gov details file format pdf size: Application for deferral (military) of real property taxes;

Personal property assessment form ; Web evaluation forms are a great way to obtain valuable feedback and identify areas that need improvement. Application for deferral (military) of real property taxes; Find the property evaluation form you need. To determine the monthly taxes, multiply the estimated property value (usually the naca loan amount) by the tax rate and divide by 12. Web monthly real estate taxes are generally between 1% and 4% of the purchase price depending on where you purchase. 35 kb download rental property evaluation form seattle.gov details file format pdf size: Jefferson county ky pva | property valuation administration the jefferson county pva is responsible for applying a fair and equitable assessment to residential properties, commercial properties, and more. A property evaluation form plays a vital role in measuring the pros and cons of a particular property before buying or selling it. While the taxes are paid in regular intervals depending on the county and state, they’re typically paid annually.

Property Evaluation Form 4 Free Templates in PDF, Word, Excel Download

Such a form is widely used by the property dealers, real estate companies and individuals before buying or selling some property. Complete and submit the flr request form by december 2, 2022. 35 kb download rental property evaluation form seattle.gov details file format pdf size: Web monthly real estate taxes are generally between 1% and 4% of the purchase price.

FREE 8+ Sample Property Evaluation Forms in PDF MS Word

Web monthly real estate taxes are generally between 1% and 4% of the purchase price depending on where you purchase. Web real estate property evaluation form iraservices.com details file format pdf size: Find the property evaluation form you need. Web the form to request an flr is included with notices of proposed valuation. Application for deferral (military) of real property.

FREE 8+ Property Evaluation Forms in PDF MS Word

Application for deferral (military) of real property taxes; 35 kb download rental property evaluation form seattle.gov details file format pdf size: A property evaluation form plays a vital role in measuring the pros and cons of a particular property before buying or selling it. Personal property assessment form ; Web monthly real estate taxes are generally between 1% and 4%.

Property Evaluation Form 4 Free Templates in PDF, Word, Excel Download

While the taxes are paid in regular intervals depending on the county and state, they’re typically paid annually. Jefferson county ky pva | property valuation administration the jefferson county pva is responsible for applying a fair and equitable assessment to residential properties, commercial properties, and more. Web monthly real estate taxes are generally between 1% and 4% of the purchase.

FREE 8+ Property Evaluation Forms in PDF MS Word

Web download property tax and exemption forms and learn about assessment processes. Property owners should wait until they receive the mailed notice of proposed valuation to file an flr. Web real estate property evaluation form iraservices.com details file format pdf size: Application for deferral (military) of real property taxes; Web forms and publications your personal.

Property Evaluation Form Editable Forms

Web monthly real estate taxes are generally between 1% and 4% of the purchase price depending on where you purchase. While the taxes are paid in regular intervals depending on the county and state, they’re typically paid annually. Property owners should wait until they receive the mailed notice of proposed valuation to file an flr. To determine the monthly taxes,.

FREE 8+ Property Evaluation Forms in PDF MS Word

A property evaluation form plays a vital role in measuring the pros and cons of a particular property before buying or selling it. Jefferson county ky pva | property valuation administration the jefferson county pva is responsible for applying a fair and equitable assessment to residential properties, commercial properties, and more. 224 kb download commercial property evaluation form pds.cityofboise.org details.

FREE 8+ Property Evaluation Forms in PDF MS Word

35 kb download rental property evaluation form seattle.gov details file format pdf size: Web real estate property evaluation form iraservices.com details file format pdf size: To determine the monthly taxes, multiply the estimated property value (usually the naca loan amount) by the tax rate and divide by 12. A property evaluation form plays a vital role in measuring the pros.

FREE 8+ Sample Property Evaluation Forms in PDF MS Word

224 kb download commercial property evaluation form pds.cityofboise.org details file format pdf size: To determine the monthly taxes, multiply the estimated property value (usually the naca loan amount) by the tax rate and divide by 12. Web evaluation forms are a great way to obtain valuable feedback and identify areas that need improvement. Web forms and publications your personal. Web.

FREE 8+ Sample Property Evaluation Forms in PDF MS Word

Personal property assessment form ; 154 kb download property evaluation form in pdf. Property owners should wait until they receive the mailed notice of proposed valuation to file an flr. Jefferson county ky pva | property valuation administration the jefferson county pva is responsible for applying a fair and equitable assessment to residential properties, commercial properties, and more. Web monthly.

Personal Property Assessment Form ;

To determine the monthly taxes, multiply the estimated property value (usually the naca loan amount) by the tax rate and divide by 12. While the taxes are paid in regular intervals depending on the county and state, they’re typically paid annually. 154 kb download property evaluation form in pdf. 224 kb download commercial property evaluation form pds.cityofboise.org details file format pdf size:

Find The Property Evaluation Form You Need.

Such a form is widely used by the property dealers, real estate companies and individuals before buying or selling some property. Web forms and publications your personal. Property owners should wait until they receive the mailed notice of proposed valuation to file an flr. Whether you want to gather customer satisfaction, student progress, employee performance, or guest feedback, our free online evaluation forms will make it easier to collect and track evaluations.

Application For Deferral (Military) Of Real Property Taxes;

Complete and submit the flr request form by december 2, 2022. A property evaluation form plays a vital role in measuring the pros and cons of a particular property before buying or selling it. Web monthly real estate taxes are generally between 1% and 4% of the purchase price depending on where you purchase. Web the form to request an flr is included with notices of proposed valuation.

35 Kb Download Rental Property Evaluation Form Seattle.gov Details File Format Pdf Size:

Web property tax assessments determine the property value, which is performed by a government assessor who then uses this assessment to calculate the amount of taxes due. Web download property tax and exemption forms and learn about assessment processes. Web evaluation forms are a great way to obtain valuable feedback and identify areas that need improvement. Jefferson county ky pva | property valuation administration the jefferson county pva is responsible for applying a fair and equitable assessment to residential properties, commercial properties, and more.