Should I Form An Llc For Rental Property

Should I Form An Llc For Rental Property - Web speaking of cost, the process of forming an llc can be fairly expensive. One of the main reasons that many property owners create an llc is that it limits their personal. It’s easy to set up, easy to use, and protects you from being exposed. We estimate that if a property rental business owner can pay themselves a reasonable salary and at least $10,000 in distributions each year, they could benefit from s corp status. Web to offset these costs, you'd need to be saving about $2,000 a year on taxes. Web should i create an llc for my rental property? This is an important distinction for both liability and taxation, as we’ll see shortly. Though it may cost exponentially more, some landlords prefer to set up a separate llc for each. Web benefits of an llc for rental properties personal liability. If you own your property as an individual and someone files a lawsuit against you,.

Web benefits of an llc for rental properties personal liability. Web should i create an llc for my rental property? Web setting up an llc for rental property may be the best choice if you are currently a property owner or are looking to start an airbnb. Web updated july 19, 2023 · 4min read pros cons how legalzoom can help you start an llc limited liability companies have become one of the most popular business entities for acquiring real estate. Still, most experienced landlords find that an llc creates peace of mind and a. Keep your rental properties separate from each other. Yes, you may have liability insurance, but if someone is seriously injured on your property, they can sue you personally for medical expenses and damages above and beyond the limits of your policy. However, if you were to incorporate in another state — say, california — it would cost you $800 per year. In the state of texas, the cost of filing for a texas llc certificate of formation is currently $300. Web the biggest benefit of creating an llc for your rental property is that it can insulate you from personal liability.

Though it may cost exponentially more, some landlords prefer to set up a separate llc for each. Web to offset these costs, you'd need to be saving about $2,000 a year on taxes. In the state of texas, the cost of filing for a texas llc certificate of formation is currently $300. Web benefits of an llc for rental properties personal liability. In addition to separating the rental property from. We estimate that if a property rental business owner can pay themselves a reasonable salary and at least $10,000 in distributions each year, they could benefit from s corp status. Web the biggest benefit of creating an llc for your rental property is that it can insulate you from personal liability. Keep your rental properties separate from each other. Web setting up an llc for rental property may be the best choice if you are currently a property owner or are looking to start an airbnb. Only you can make the final decision about whether or not to make an llc for managing rental properties.

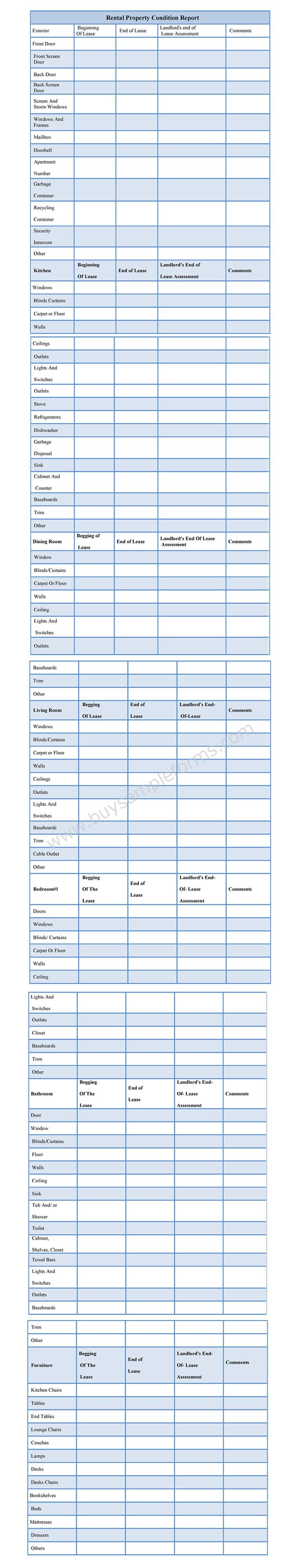

Rental Property Condition Report Form Sample Forms

In addition to separating the rental property from. Keep your rental properties separate from each other. Web should i create an llc for my rental property? Still, most experienced landlords find that an llc creates peace of mind and a. This is an important distinction for both liability and taxation, as we’ll see shortly.

Pin on Tellus Blog

Web updated july 19, 2023 · 4min read pros cons how legalzoom can help you start an llc limited liability companies have become one of the most popular business entities for acquiring real estate. However, if you were to incorporate in another state — say, california — it would cost you $800 per year. Web benefits of an llc for.

How to Form a LLC (Stepbystep Guide) Community Tax

Still, most experienced landlords find that an llc creates peace of mind and a. Only you can make the final decision about whether or not to make an llc for managing rental properties. Web speaking of cost, the process of forming an llc can be fairly expensive. Web what are the benefits of creating an llc for your rental property?.

Why You Should Form an LLC (Explained in 45 Seconds) Lawyers Rock

Keep your rental properties separate from each other. Yes, you may have liability insurance, but if someone is seriously injured on your property, they can sue you personally for medical expenses and damages above and beyond the limits of your policy. Web should i create an llc for my rental property? Still, most experienced landlords find that an llc creates.

Should You Form an LLC for Your Rental Property? Tellus Talk

It’s easy to set up, easy to use, and protects you from being exposed. Web to offset these costs, you'd need to be saving about $2,000 a year on taxes. Web updated july 19, 2023 · 4min read pros cons how legalzoom can help you start an llc limited liability companies have become one of the most popular business entities.

Should I Use an LLC for Rental Property 8 Key Questions & Answers

If you own your property as an individual and someone files a lawsuit against you,. Web setting up an llc for rental property may be the best choice if you are currently a property owner or are looking to start an airbnb. Still, most experienced landlords find that an llc creates peace of mind and a. One of the main.

Should You Create An LLC For Rental Property? Pros And Cons New Silver

One of the main reasons that many property owners create an llc is that it limits their personal. In addition to separating the rental property from. We estimate that if a property rental business owner can pay themselves a reasonable salary and at least $10,000 in distributions each year, they could benefit from s corp status. Yes, you may have.

Should I Form an LLC for Blog? (Lawyer Tips)

Though it may cost exponentially more, some landlords prefer to set up a separate llc for each. An llc works a lot like an umbrella: Web to offset these costs, you'd need to be saving about $2,000 a year on taxes. Web speaking of cost, the process of forming an llc can be fairly expensive. In the state of texas,.

Should I Form An LLC? 5 Reasons Why It's A Great Idea

Web speaking of cost, the process of forming an llc can be fairly expensive. Web to offset these costs, you'd need to be saving about $2,000 a year on taxes. In addition to separating the rental property from. An llc works a lot like an umbrella: Only you can make the final decision about whether or not to make an.

Why You Should Form an LLC (Explained in 45 Seconds)

If you own your property as an individual and someone files a lawsuit against you,. Keep your rental properties separate from each other. Web what are the benefits of creating an llc for your rental property? However, if you were to incorporate in another state — say, california — it would cost you $800 per year. Only you can make.

This Is An Important Distinction For Both Liability And Taxation, As We’ll See Shortly.

Only you can make the final decision about whether or not to make an llc for managing rental properties. Though it may cost exponentially more, some landlords prefer to set up a separate llc for each. However, if you were to incorporate in another state — say, california — it would cost you $800 per year. Yes, you may have liability insurance, but if someone is seriously injured on your property, they can sue you personally for medical expenses and damages above and beyond the limits of your policy.

You Can Start An S Corp When You Form Your Llc.

In addition to separating the rental property from. Web setting up an llc for rental property may be the best choice if you are currently a property owner or are looking to start an airbnb. In the state of texas, the cost of filing for a texas llc certificate of formation is currently $300. We estimate that if a property rental business owner can pay themselves a reasonable salary and at least $10,000 in distributions each year, they could benefit from s corp status.

Web The Biggest Benefit Of Creating An Llc For Your Rental Property Is That It Can Insulate You From Personal Liability.

If you own your property as an individual and someone files a lawsuit against you,. Web speaking of cost, the process of forming an llc can be fairly expensive. Web should i create an llc for my rental property? Web what are the benefits of creating an llc for your rental property?

Keep Your Rental Properties Separate From Each Other.

Web updated july 19, 2023 · 4min read pros cons how legalzoom can help you start an llc limited liability companies have become one of the most popular business entities for acquiring real estate. It’s easy to set up, easy to use, and protects you from being exposed. Web benefits of an llc for rental properties personal liability. An llc works a lot like an umbrella: