T2200 Tax Form

T2200 Tax Form - There are many expenses that you can deduct. Employers engaged in a trade or business who. Web [anchor what can i deduct with the t2200 form? If you checked the box on line 2, send form 8822 to:. Employee information in part a of the t2200 is automatically completed. Web a t2200 form helps employees maximize their tax deductions for unreimbursed employment expenses. Web a new t2200 form for the recipient appears in the t2200 section in the prepare sidebar. Employee's withholding certificate form 941; Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. Web if you choose to mail your tax payment you should mail your payment to the address listed on the notice.

Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. Web if you choose to mail your tax payment you should mail your payment to the address listed on the notice. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. Web a t2200 form helps employees maximize their tax deductions for unreimbursed employment expenses. Things are a little different in the province of quebec. If you checked the box on line 2, send form 8822 to:. Web we applied your 2016 form 1040 overpayment to an unpaid balance refund due: What is on a t2200 form? Web t2200, also called the declaration of conditions of employment, is a form issued by an employer to employees claiming tax credits from expenses incurred during. Web for the 2020, 2021, and 2022 tax years, the cra will accept an electronic signature on form t2200s to reduce the need for employees and employers to meet in person.

Web for the 2020, 2021, and 2022 tax years, the cra will accept an electronic signature on form t2200s to reduce the need for employees and employers to meet in person. There are many expenses that you can deduct. Web t2200, also called the declaration of conditions of employment, is a form issued by an employer to employees claiming tax credits from expenses incurred during. Web a new t2200 form for the recipient appears in the t2200 section in the prepare sidebar. Web a t2200 form helps employees maximize their tax deductions for unreimbursed employment expenses. If you checked the box on line 2, send form 8822 to:. Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. Employee information in part a of the t2200 is automatically completed. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. Web the t2200 form is specifically designed for employees who are required to take on the financial burden of specific unreimbursed expenses through the course of.

A Guide to the Canadian T2200 Form for Tax Time FreshBooks Blog

Web for those with a history of working from home, the t2200 tax form is likely one that has become common practice to fill out. Web we applied your 2016 form 1040 overpayment to an unpaid balance refund due: Employee's withholding certificate form 941; Web [anchor what can i deduct with the t2200 form? Things are a little different in.

Everything You Need to Know about the T2200 Form

If you checked the box on line 2, send form 8822 to:. For those new to a work from the home arrangement. Web a new t2200 form for the recipient appears in the t2200 section in the prepare sidebar. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. Web for those with a.

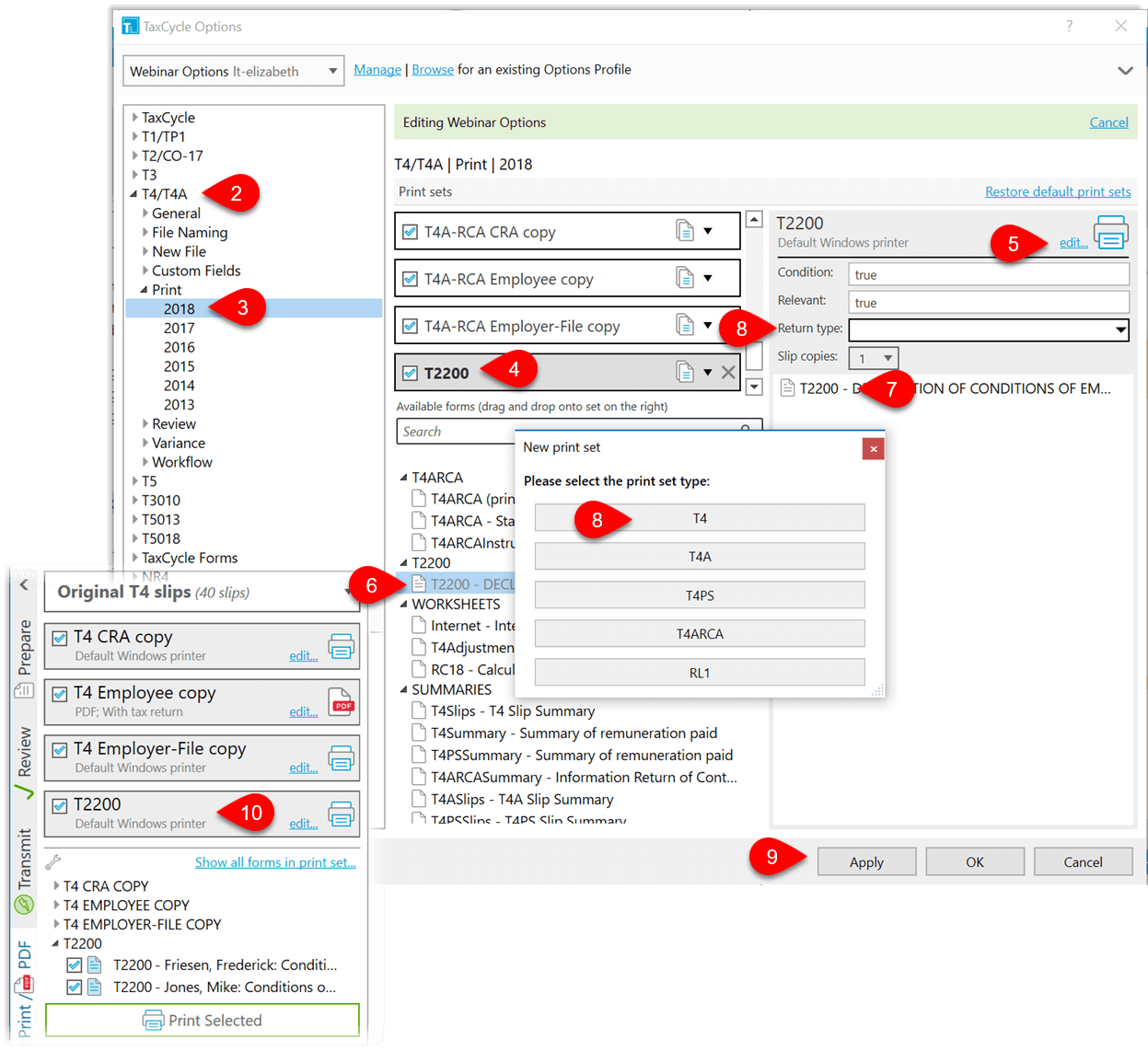

T2200 Conditions of Employment TaxCycle

Web t2200, also called the declaration of conditions of employment, is a form issued by an employer to employees claiming tax credits from expenses incurred during. $250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed for 2015. Things are a little different in the province of quebec. Employee information in part a of the t2200.

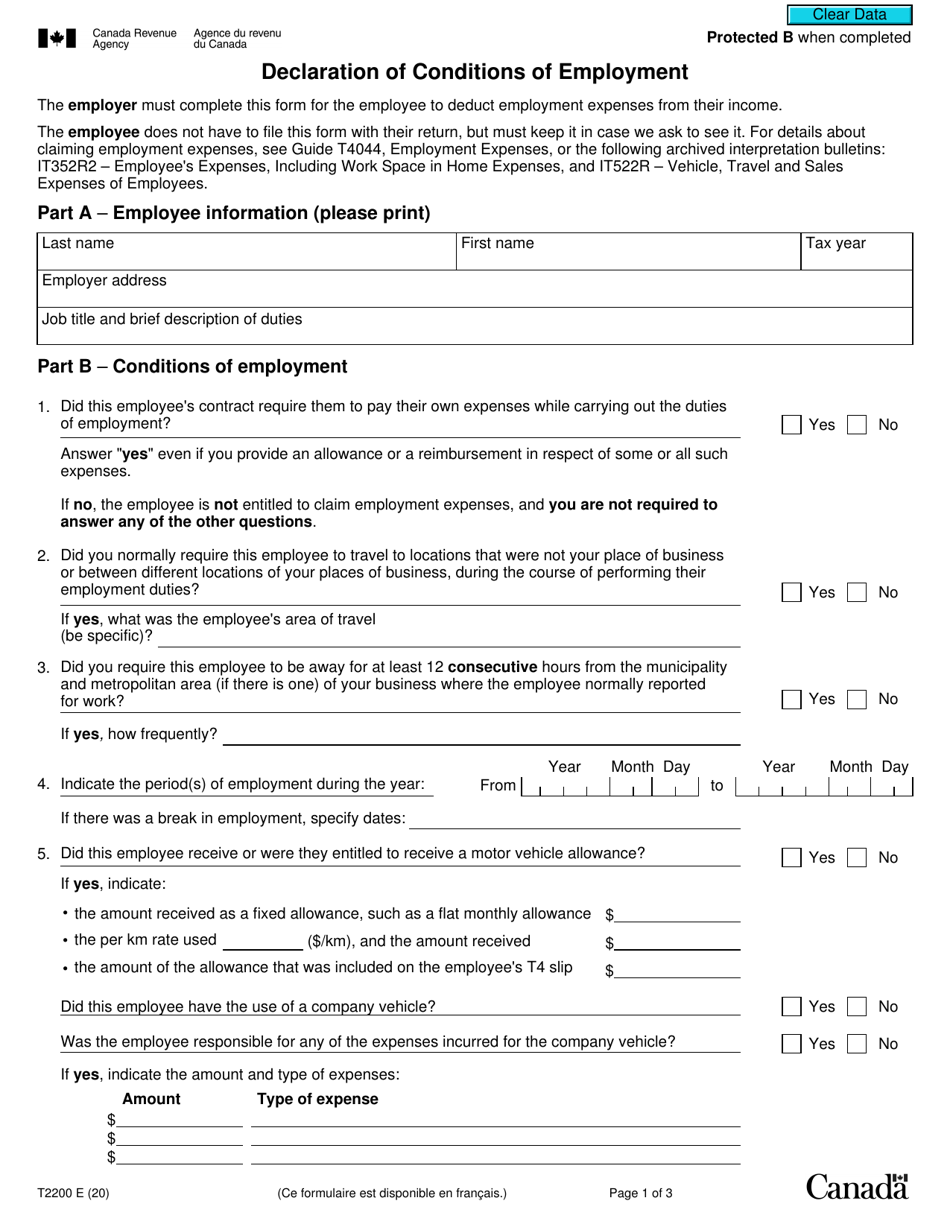

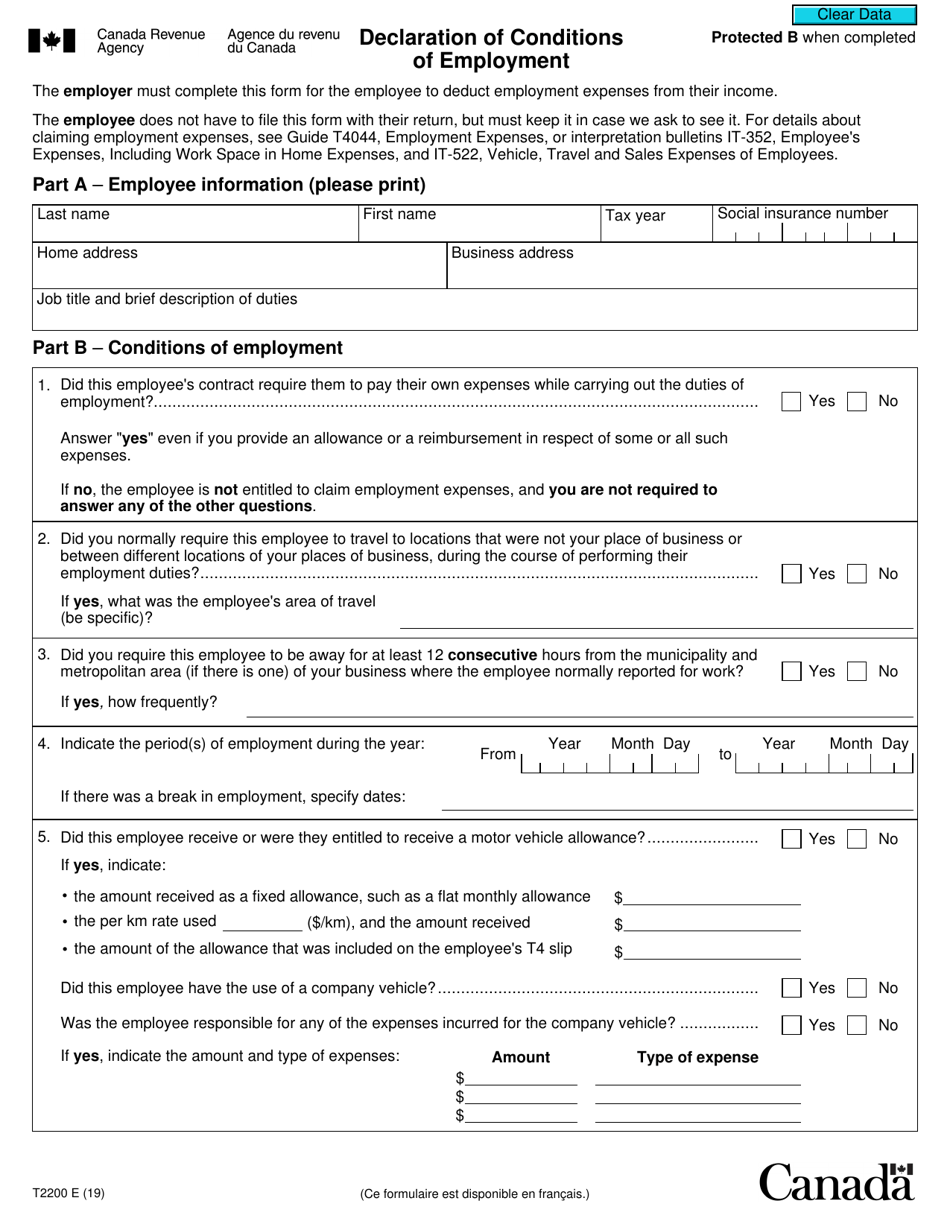

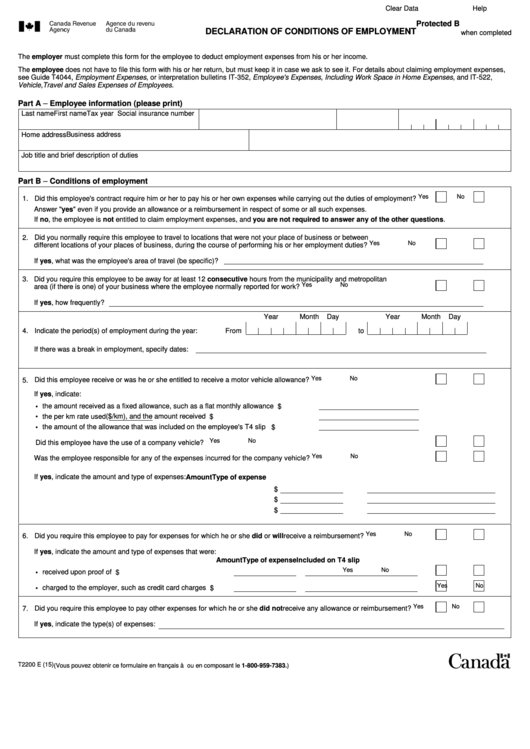

Form T2200 Download Fillable PDF or Fill Online Declaration of

Web for the 2020, 2021, and 2022 tax years, the cra will accept an electronic signature on form t2200s to reduce the need for employees and employers to meet in person. Web the t2200 form is specifically designed for employees who are required to take on the financial burden of specific unreimbursed expenses through the course of. If you checked.

Form T2200 Download Fillable PDF or Fill Online Declaration of

Things are a little different in the province of quebec. Web a new t2200 form for the recipient appears in the t2200 section in the prepare sidebar. The matters affected by this form. Web for those with a history of working from home, the t2200 tax form is likely one that has become common practice to fill out. To spare.

Fillable Form T2200 E Declaration Of Conditions Of Employment

Things are a little different in the province of quebec. If you checked the box on line 2, send form 8822 to:. Web t2200, also called the declaration of conditions of employment, is a form issued by an employer to employees claiming tax credits from expenses incurred during. For those new to a work from the home arrangement. $250.00 we.

T2200 Forms What You Need to Know — Avanti Blog

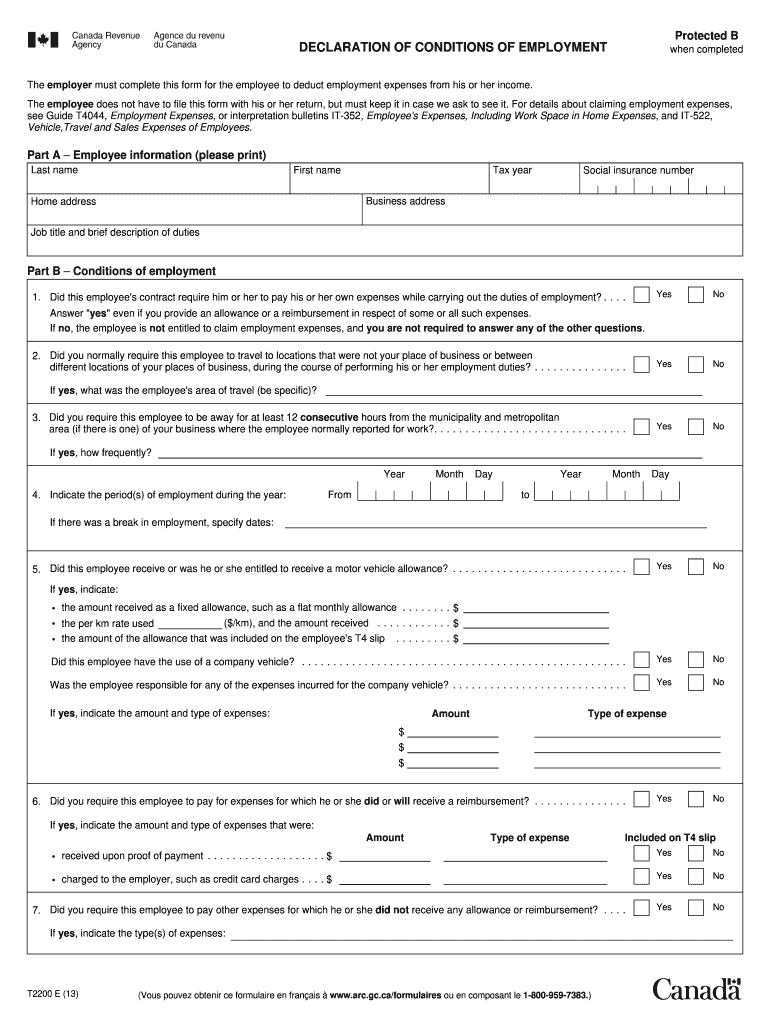

What is on a t2200 form? Web if you choose to mail your tax payment you should mail your payment to the address listed on the notice. Web you have to fill out and sign form t2200, declaration of conditions of employment, and give it to your employee so they can deduct employment expenses. Things are a little different in.

T2200 Form 2013 Fill Out and Sign Printable PDF Template signNow

It’s an abbreviated version of the. To spare you the long list, we've attached the actual form to give you a. There are many expenses that you can deduct. Web the t2200 form is specifically designed for employees who are required to take on the financial burden of specific unreimbursed expenses through the course of. If you checked the box.

T2200 Form Fillable Fill Out and Sign Printable PDF Template signNow

Web the t2200 form is specifically designed for employees who are required to take on the financial burden of specific unreimbursed expenses through the course of. The matters affected by this form. Web for those with a history of working from home, the t2200 tax form is likely one that has become common practice to fill out. Employers engaged in.

Form T 2200 Download Printable PDF, Declaration of Conditions of

Web for the 2020, 2021, and 2022 tax years, the cra will accept an electronic signature on form t2200s to reduce the need for employees and employers to meet in person. Employers engaged in a trade or business who. Web a new t2200 form for the recipient appears in the t2200 section in the prepare sidebar. Web [anchor what can.

Web The Following Replaces The “Where To File” Addresses On Page 2 Of Form 8822 (Rev.

Web we applied your 2016 form 1040 overpayment to an unpaid balance refund due: If you checked the box on line 2, send form 8822 to:. To spare you the long list, we've attached the actual form to give you a. Employee's withholding certificate form 941;

Web The T2200 Form Is Specifically Designed For Employees Who Are Required To Take On The Financial Burden Of Specific Unreimbursed Expenses Through The Course Of.

Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. Web [anchor what can i deduct with the t2200 form? Employee information in part a of the t2200 is automatically completed. Web for the 2020, 2021, and 2022 tax years, the cra will accept an electronic signature on form t2200s to reduce the need for employees and employers to meet in person.

What Is On A T2200 Form?

It’s an abbreviated version of the. Web if you choose to mail your tax payment you should mail your payment to the address listed on the notice. The matters affected by this form. Web for those with a history of working from home, the t2200 tax form is likely one that has become common practice to fill out.

Web You Have To Fill Out And Sign Form T2200, Declaration Of Conditions Of Employment, And Give It To Your Employee So They Can Deduct Employment Expenses.

For those new to a work from the home arrangement. There are many expenses that you can deduct. Employers engaged in a trade or business who. $250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed for 2015.