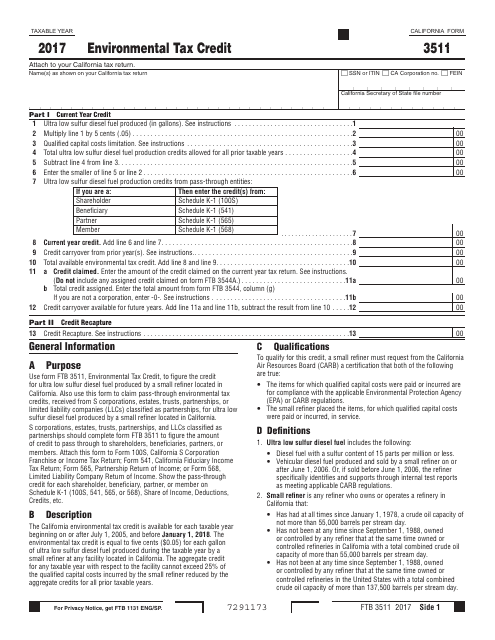

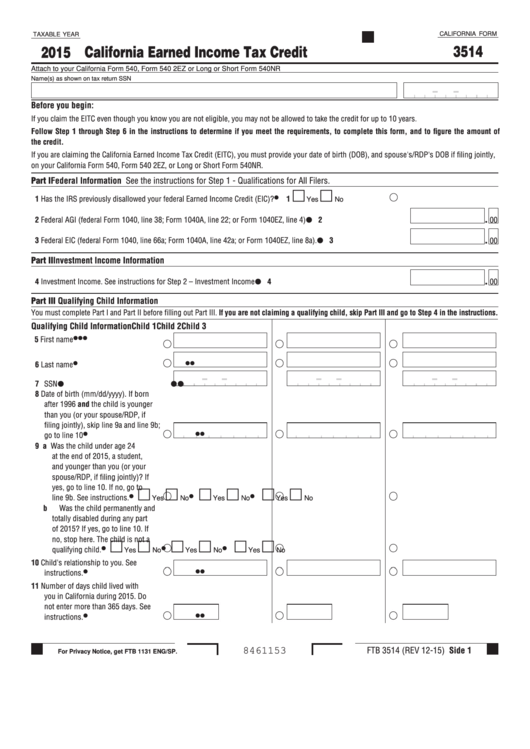

Tax Form 3514

Tax Form 3514 - More about the california form 3514 ins we last updated california form 3514 ins in. Employee's withholding certificate form 941; Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. Department of the treasury |. California usually releases forms for the current tax year between january and april. You do not need a child to qualify, but must file a california income tax return. You do not need a child to qualify, but must file a california income. For some of the western states, the following addresses were previously used: Web please use the link below to download , and you can print it directly from your computer. We last updated california form 3514 ins from the franchise tax board in.

Web the form 3514 requests a business code, business license number and sein. Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Department of the treasury |. Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023. Web form 3514 california — california earned income tax credit download this form print this form it appears you don't have a pdf plugin for this browser. Web please use the link below to download , and you can print it directly from your computer. Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? Employee's withholding certificate form 941;

You do not need a child to qualify, but must file a california income. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount. Web please use the link below to download , and you can print it directly from your computer. You do not need a child to qualify, but must file a california income tax return. California usually releases forms for the current tax year between january and april. If you don't have a sein or business license number, then you should be able to leave. For some of the western states, the following addresses were previously used: Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be eligible.

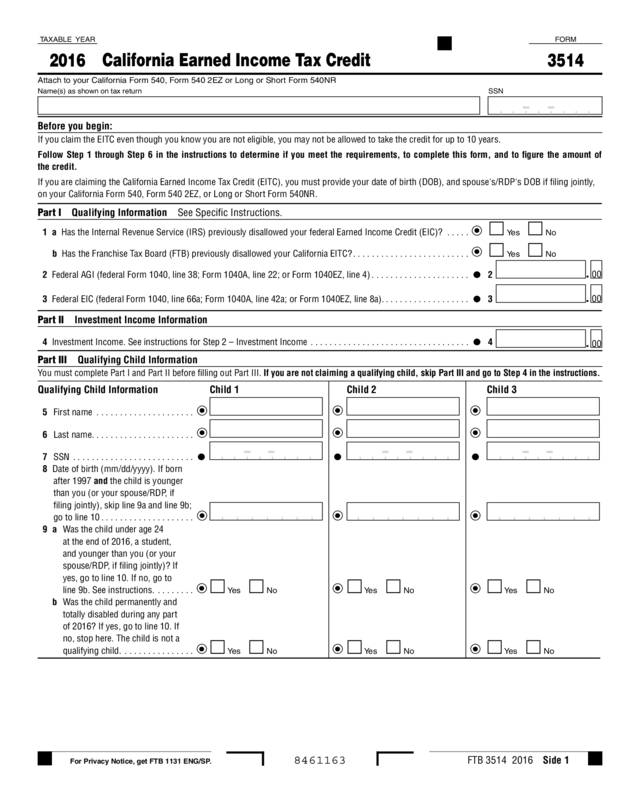

2016 Form 3514 California Earned Tax Credit Edit, Fill, Sign

You do not need a child to qualify, but must file a california income. Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. On a previous return i had some business income that might have. Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc,.

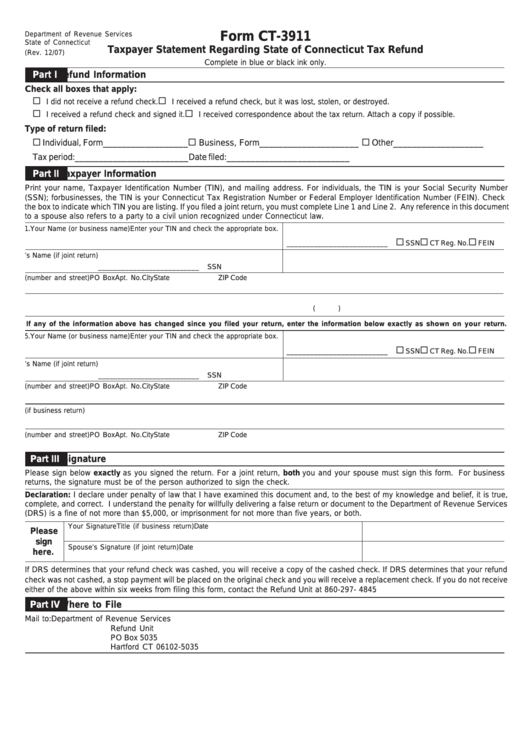

Fillable Form Ct3911 Taxpayer Statement Regarding State Of

California usually releases forms for the current tax year between january and april. Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. More about the california form 3514 ins we last updated california form 3514 ins in. Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc,.

공사계획(변경) 승인신청서 샘플, 양식 다운로드

You do not need a child to qualify, but must file a california income tax return. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023. For some of the western states, the following addresses were previously used: Web the ca eitc reduces.

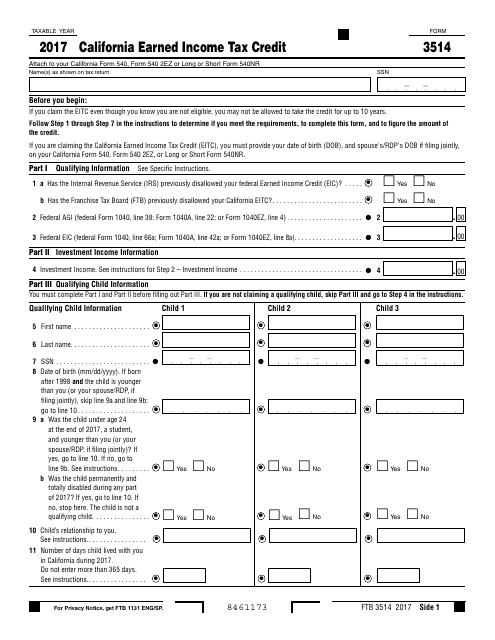

Form FTB 3514 Download Fillable PDF 2017, California Earned Tax

Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing jointly, on your california form. Web use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the amount. Web how do.

Tax Credits Aid Californians Now; Minimum Wage Hike Set

Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be eligible. Web eitc reduces your california tax obligation, or allows a refund if no california.

California Tax Table 540 2ez Review Home Decor

Employers engaged in a trade or business who. California usually releases forms for the current tax year between january and april. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023. Employee's withholding certificate form 941; Department of the treasury |.

how to remove form 3514 TurboTax Support

On a previous return i had some business income that might have. Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Employers engaged in a trade or business who. Web form 3514 california — california earned income tax credit download this form print this form it appears you.

California Earned Tax Credit Worksheet 2017

Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. You do not need a child to qualify, but must file a california income tax return. More about the california form 3514 ins we last updated california form 3514 ins in. For some of the western states, the following.

Form 3514 California Earned Tax Credit 2015 printable pdf

Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing jointly, on your california form. Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web these where to file addresses are to be used only by taxpayers.

2016 Form 3514 California Earned Tax Credit Edit, Fill, Sign

Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023. California usually releases forms for the current tax year between january and april. We last updated california form 3514 ins from the franchise tax board in. More about the california form 3514 ins.

You Do Not Need A Child To Qualify, But Must File A California Income.

Web the form 3514 requests a business code, business license number and sein. Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. Employee's withholding certificate form 941;

Web Use Form Ftb 3514 To Determine Whether You Qualify To Claim The Credit, Provide Information About Your Qualifying Children, If Applicable, And To Figure The Amount.

You do not need a child to qualify, but must file a california income tax return to. You do not need a child to qualify, but must file a california income tax return. Web please use the link below to download , and you can print it directly from your computer. Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due.

Department Of The Treasury |.

Employers engaged in a trade or business who. Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. We last updated california form 3514 ins from the franchise tax board in. California usually releases forms for the current tax year between january and april.

More About The California Form 3514 Ins We Last Updated California Form 3514 Ins In.

Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be eligible. Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? On a previous return i had some business income that might have.