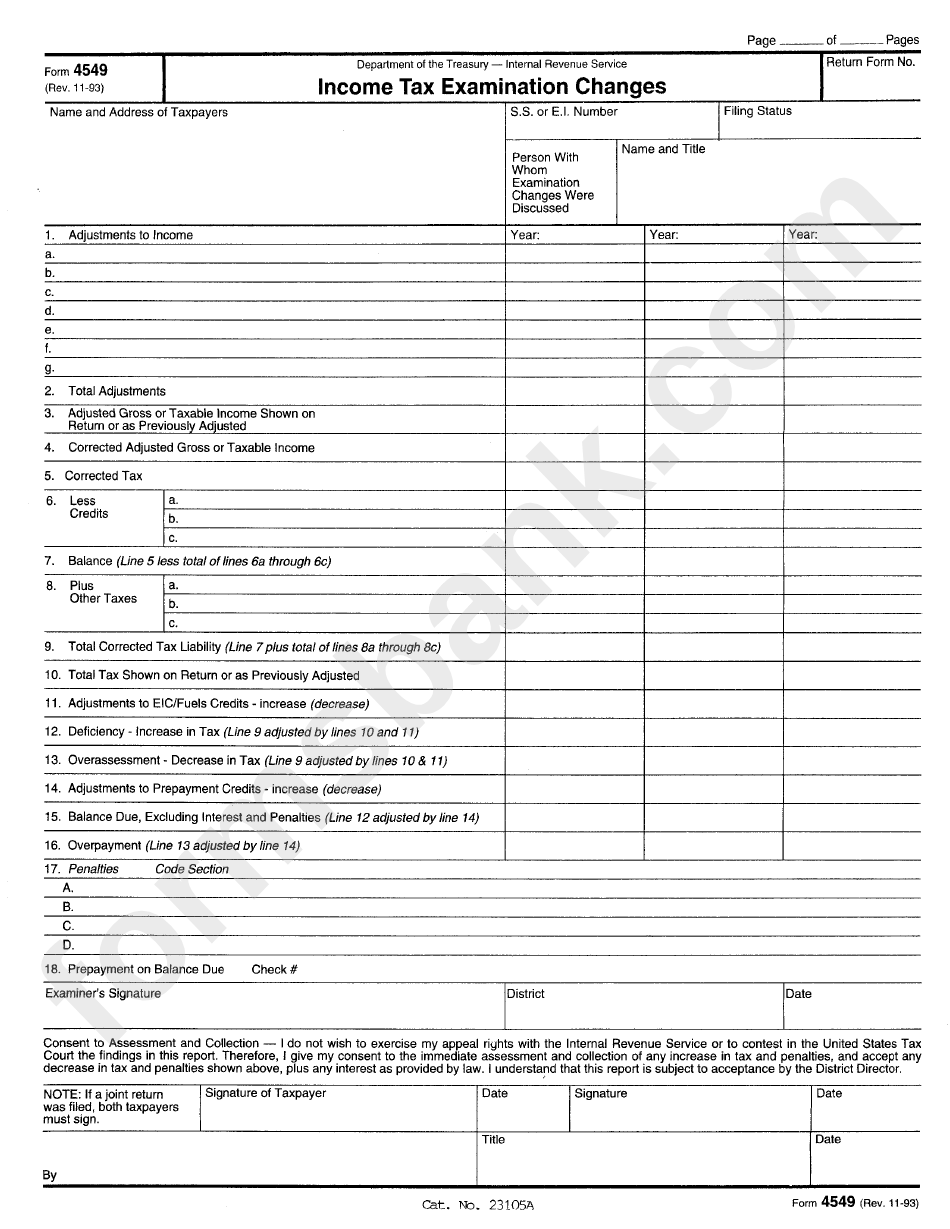

Tax Form 4549

Tax Form 4549 - Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. Web form 4549, report of income tax examination changes. Taxhelp believes the tax court is more fair to taxpayers than the other forums. Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate refund claim from that made on the form. Web following an audit, the irs will communicate with you about the results. Web form 4549, income tax examination changes, is sent by the irs at the end of an audit explaining proposed changes to your tax return. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. At this point, you have the options of: 1) presenting further evidence, 2) appealing to the agent's manager, 3) appealing to irs appeals, or 4) waiting for the irs notice of deficiency and petitioning tax court.

Web in chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund claim. Web a regular agreed report (form 4549) may contain up to three tax years. The irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a result of the audit. Web form 4549, income tax examination changes, is sent by the irs at the end of an audit explaining proposed changes to your tax return. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Web steps in response to form 4549: Web form 4549, report of income tax examination changes. Taxhelp believes the tax court is more fair to taxpayers than the other forums. It will include information, including: Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations.

Web in chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund claim. This form means the irs is questioning your tax return. The irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a result of the audit. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. At this point, you have the options of: 1) presenting further evidence, 2) appealing to the agent's manager, 3) appealing to irs appeals, or 4) waiting for the irs notice of deficiency and petitioning tax court. Taxhelp believes the tax court is more fair to taxpayers than the other forums. The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate refund claim from that made on the form. Web the irs form 4549 is the income tax examination changes letter.

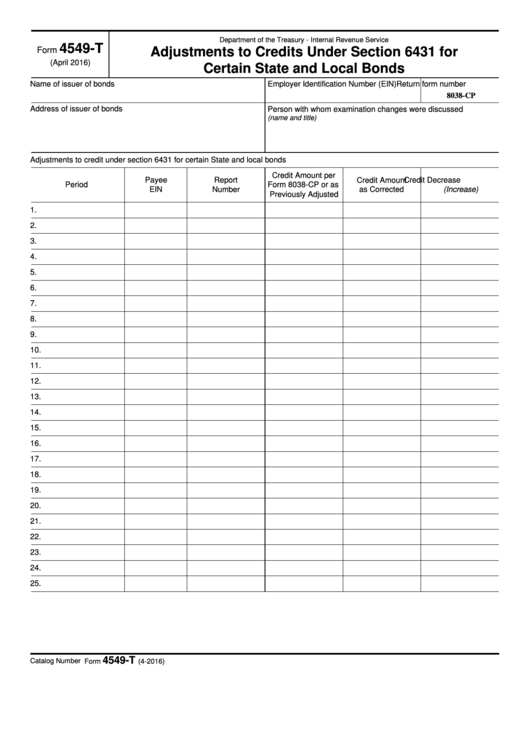

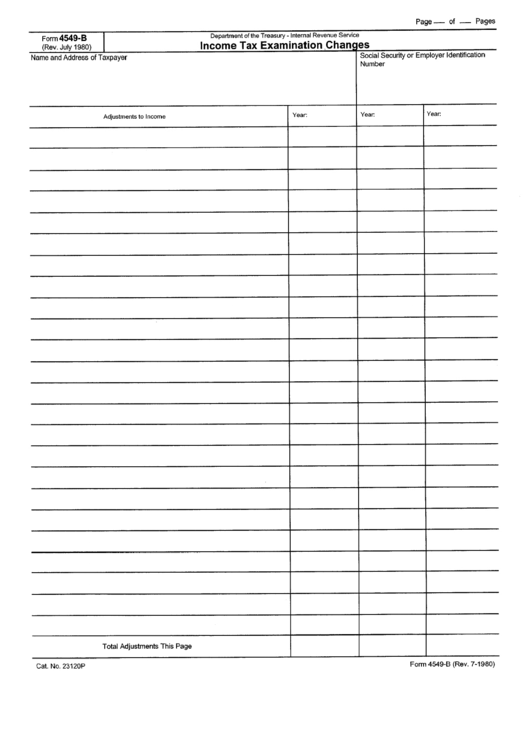

Top 9 Form 4549 Templates free to download in PDF format

Web in chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund claim. Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate refund claim from that made on.

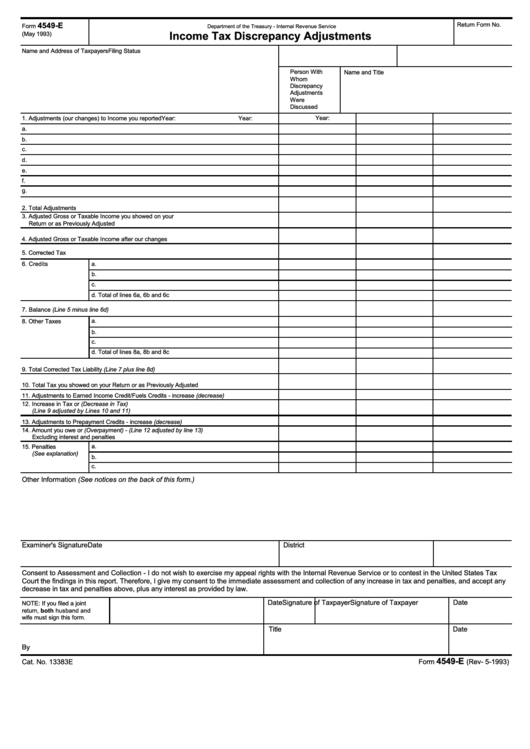

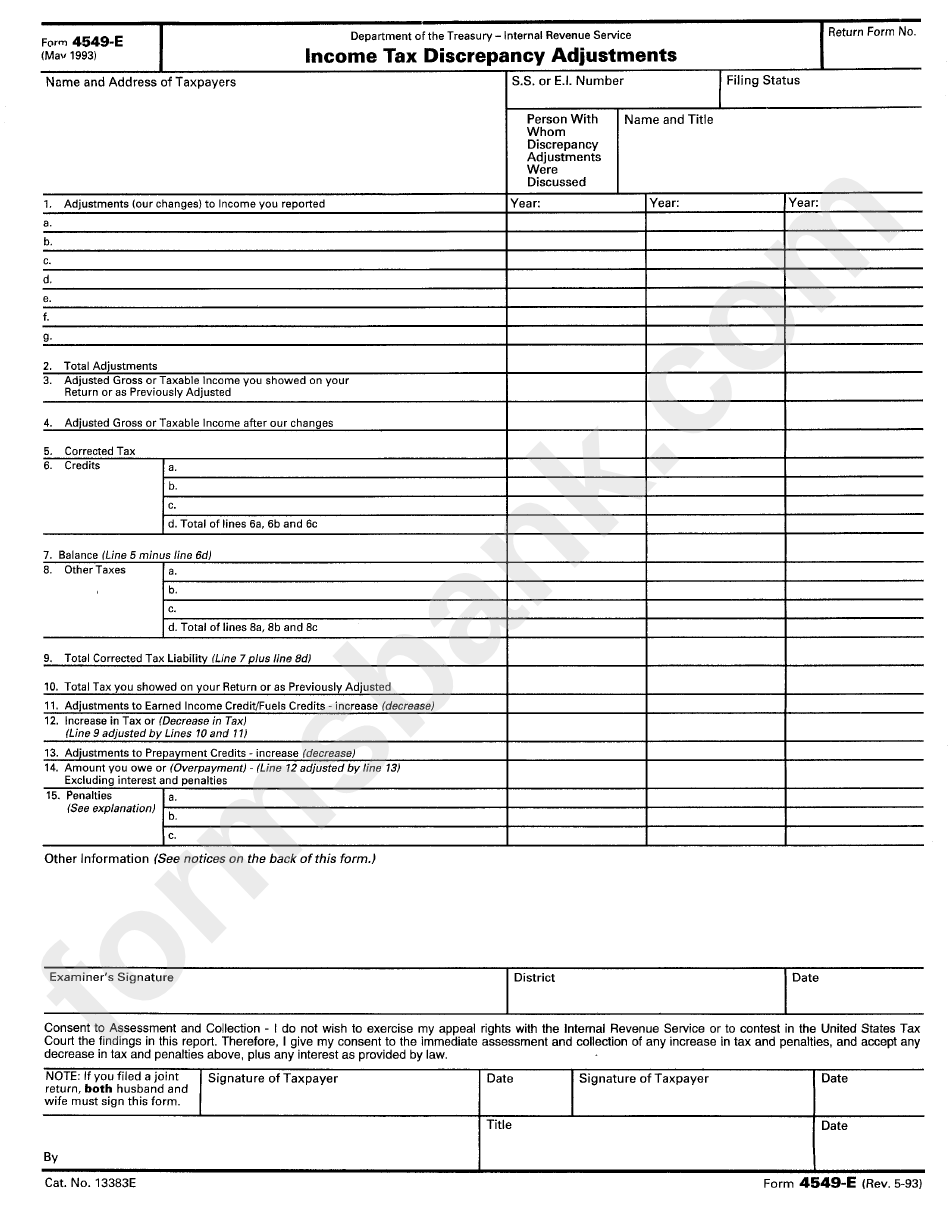

Fillable Form 4549E Tax Discrepancy Adjustments Form

Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. At this point, you have the options of: The irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a.

IRS Audit Letter 692 Sample 1

It will include information, including: Taxhelp believes the tax court is more fair to taxpayers than the other forums. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Web the irs form 4549 is the income tax examination changes letter. Web form 4549, income.

4.10.8 Report Writing Internal Revenue Service

At this point, you have the options of: Taxhelp believes the tax court is more fair to taxpayers than the other forums. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Web a regular agreed report (form 4549) may contain up to three tax.

Form 4549 Tax Examination Changes Internal Revenue Service

Web steps in response to form 4549: Taxhelp believes the tax court is more fair to taxpayers than the other forums. At this point, you have the options of: Web in chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund.

Form 4549B Tax Examitation Changes printable pdf download

At this point, you have the options of: Web following an audit, the irs will communicate with you about the results. 1) presenting further evidence, 2) appealing to the agent's manager, 3) appealing to irs appeals, or 4) waiting for the irs notice of deficiency and petitioning tax court. It will include information, including: Web form 4549, report of income.

Form 4549e Tax Dicrepancy Adjustments printable pdf download

The irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a result of the audit. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. The form will include a summary of the proposed changes to the.

Form 4549 IRS Audit Reconsideration The Full Guide Silver Tax Group

Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. The irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a.

36 Irs Form 886 A Worksheet support worksheet

Taxhelp believes the tax court is more fair to taxpayers than the other forums. This form means the irs is questioning your tax return. Web the irs form 4549 is the income tax examination changes letter. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person..

Tax Letters Washington Tax Services

Web in chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund claim. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Irs also ruled on.

Web Following An Audit, The Irs Will Communicate With You About The Results.

Taxhelp believes the tax court is more fair to taxpayers than the other forums. Web steps in response to form 4549: 1) presenting further evidence, 2) appealing to the agent's manager, 3) appealing to irs appeals, or 4) waiting for the irs notice of deficiency and petitioning tax court. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter.

This Form Means The Irs Is Questioning Your Tax Return.

Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Web form 4549, report of income tax examination changes. The irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a result of the audit. Web in chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund claim.

Web The Irs Form 4549 Is The Income Tax Examination Changes Letter.

The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Web a regular agreed report (form 4549) may contain up to three tax years. Web form 4549, income tax examination changes, is sent by the irs at the end of an audit explaining proposed changes to your tax return. Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate refund claim from that made on the form.

It Will Include Information, Including:

Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Learn more from the tax experts at h&r block. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes.