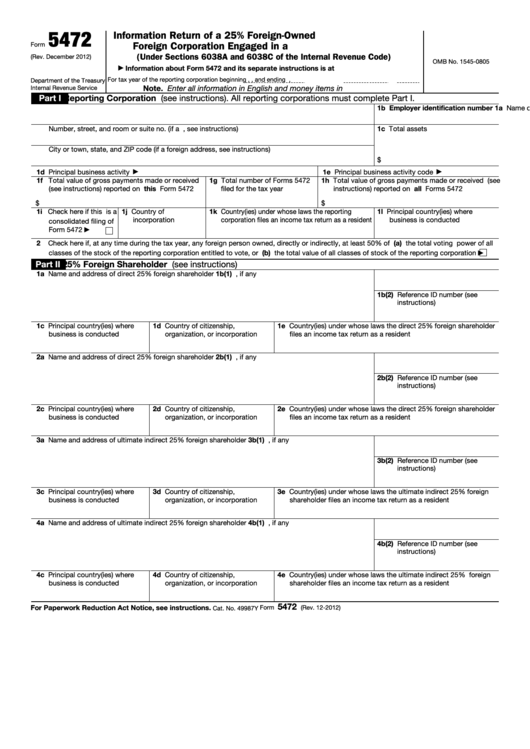

Tax Form 5472

Tax Form 5472 - A reporting corporation is either: De that fails to timely file form 5472 or files a substantially incomplete form 5472. Must ensure compliance with all applicable u.s. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. Trade or business (under sections 6038a and 6038c of the internal revenue code) go to. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of the. Corporation or a foreign corporation engaged in a u.s.

Web information about form 5472, including recent updates, related forms, and instructions on how to file. A reporting corporation is either: Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of the. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. For instructions and the latest information. De that fails to timely file form 5472 or files a substantially incomplete form 5472. Persons who own entities in the u.s. Trade or business (under sections 6038a and 6038c of the internal revenue code) go to. Web internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting corporation (the us taxpayer) with a foreign or domestic related party. Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions.

A reporting corporation is either: Persons who own entities in the u.s. These entities are required to file form 5472 annually and provide information about their ownership structures and transactions, including changes made to the ownership of the business. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. De that fails to timely file form 5472 or files a substantially incomplete form 5472. Web internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting corporation (the us taxpayer) with a foreign or domestic related party. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Person (which can include either individuals or businesses) that owns at least 25% of company stock, or Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions. December 2022) department of the treasury internal revenue service.

Tax Form 5472

Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting corporation (the us taxpayer) with a foreign or domestic related party. Trade or business (under sections 6038a and 6038c of the internal revenue.

Fill Free fillable IRS PDF forms

Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. These entities are required to file form 5472 annually and provide information about their ownership structures and transactions, including changes made to the ownership of the business. A.

Form 5472 2022 IRS Forms

Must ensure compliance with all applicable u.s. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. Web internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting corporation (the us taxpayer) with a foreign.

What Is Form 5472? Milikowsky Tax Law

Corporation or a foreign corporation engaged in a u.s. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. Must ensure compliance with all applicable u.s. Corporation or a foreign corporation engaged in a u.s. Web use form 5472 to provide information required under sections.

Saving Taxes and International Tax Plan Form 5472 YouTube

Corporation or a foreign corporation engaged in a u.s. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. De that fails to timely file form 5472 or files a substantially incomplete form 5472. Web information about form 5472, including recent updates, related forms, and.

IRS Form 5472 File taxes for offshore LLCs How To Guide

Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. A reporting corporation is either: Web information about form 5472, including recent updates, related forms, and instructions on how to file. Persons who own entities in the u.s..

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. Persons who own entities in the u.s. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign.

Fillable Form 5472 Information Return Of A 25 ForeignOwned U.s

Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. Web a failure.

Completing US Tax Forms Form 5472 ForeignOwned Disregarded Entities

Person (which can include either individuals or businesses) that owns at least 25% of company stock, or Corporation or a foreign corporation engaged in a u.s. Web internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting corporation (the us taxpayer) with a foreign or domestic related party. Web information.

Demystifying IRS Form 5472 SF Tax Counsel

December 2022) department of the treasury internal revenue service. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. Web what is form 5472? Web internal revenue service form 5472 is an informational form that discloses the transactions.

Web Use Form 5472 To Provide Information Required Under Sections 6038A And 6038C When Reportable Transactions Occur During The Tax Year Of A Reporting Corporation With A Foreign Or Domestic Related Party.

De that fails to timely file form 5472 or files a substantially incomplete form 5472. Must ensure compliance with all applicable u.s. A reporting corporation is either: Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions.

Person (Which Can Include Either Individuals Or Businesses) That Owns At Least 25% Of Company Stock, Or

Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of the. For instructions and the latest information. Persons who own entities in the u.s. December 2022) department of the treasury internal revenue service.

Trade Or Business (Under Sections 6038A And 6038C Of The Internal Revenue Code) Go To.

Web what is form 5472? Corporation or a foreign corporation engaged in a u.s. Corporation or a foreign corporation engaged in a u.s. Web information about form 5472, including recent updates, related forms, and instructions on how to file.

Web Internal Revenue Service Form 5472 Is An Informational Form That Discloses The Transactions During The Tax Year Of A Reporting Corporation (The Us Taxpayer) With A Foreign Or Domestic Related Party.

These entities are required to file form 5472 annually and provide information about their ownership structures and transactions, including changes made to the ownership of the business. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party.

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity.jpg)