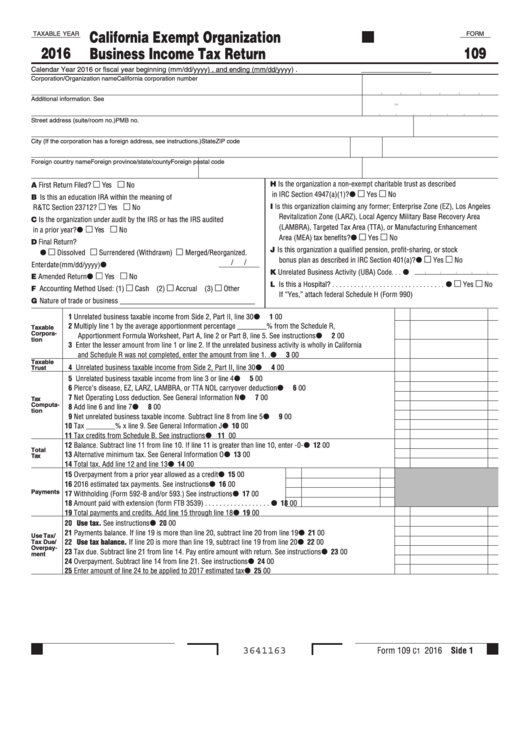

What Is Form 109

What Is Form 109 - The termination letter is required to be submitted to. Therefore, the number 22 is not a factor of 109. Web 109 ÷ 1 = 109 109 ÷ 109 = 1 the postive factors of 109 are therefore all the numbers we used to divide (divisors) above to get an even number. When we divide 109 by 22 it leaves a remainder. We will grant an automatic 6. 1unrelated business taxable income from side 2, part ii, line 30.• 1 00. Repeating details will be filled. Get ready for tax season deadlines by completing any required tax forms today. Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated business income of the organization. 2multiply line 1 by the average apportionment percentage.

This includes their name, address, employer identification number (ein),. Filing form 109 does not. Complete, edit or print tax forms instantly. Pdf versions of forms use adobe reader ™. 2multiply line 1 by the average apportionment percentage. When we divide 109 by 22 it leaves a remainder. 1unrelated business taxable income from side 2, part ii, line 30.• 1 00. Web generally, form 109 is due on or before the 15th day of the 5th month following the close of the taxable year. Web the secure way to pay u.s. Filing form 109 does not.

When we divide 109 by 22 it leaves a remainder. Filing form 109 does not. Complete, edit or print tax forms instantly. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Get ready for tax season deadlines by completing any required tax forms today. Filing form 109 does not. This includes their name, address, employer identification number (ein),. Ad access irs tax forms. Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated business income of the organization. January 1, 2023, mandatory form family code, §§ 242, 6320.5.

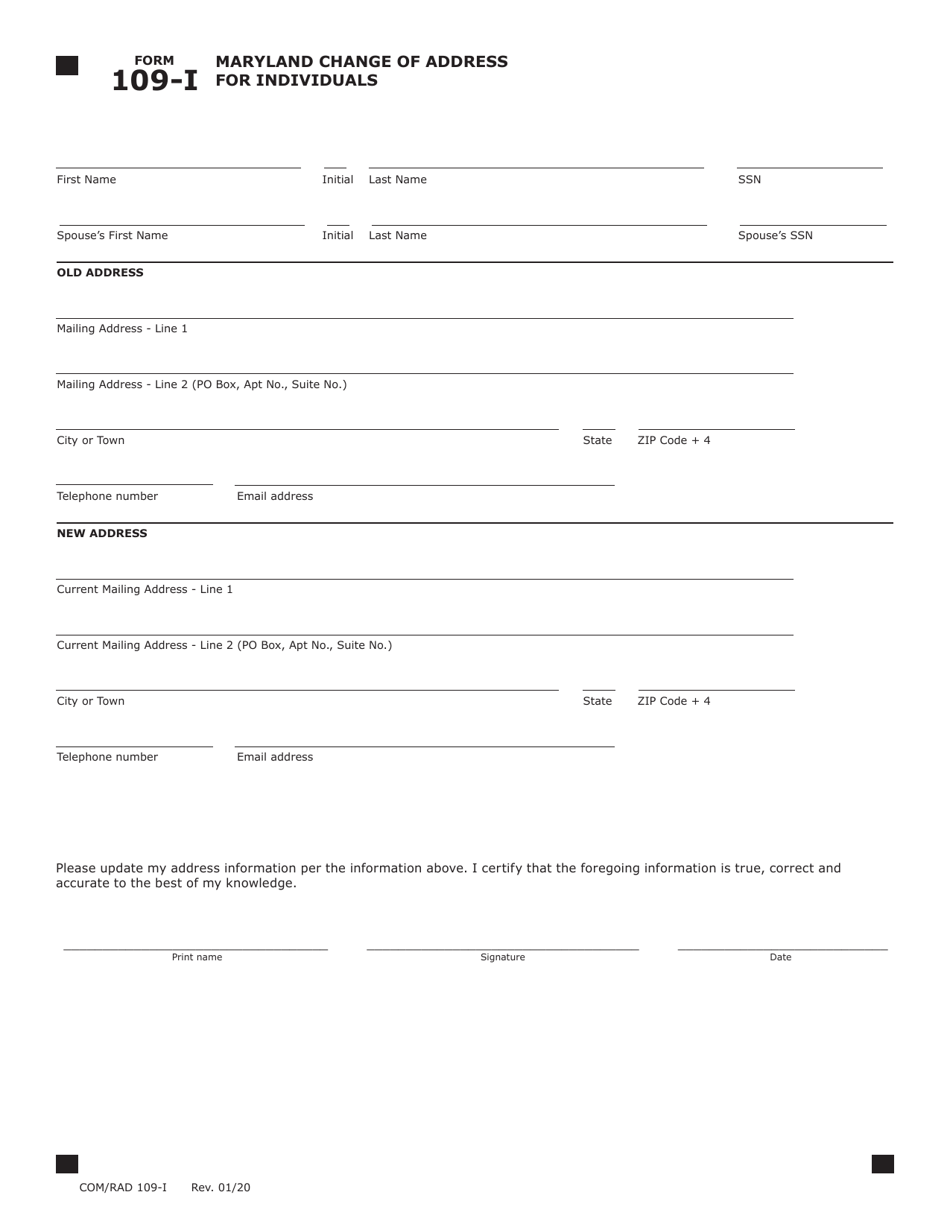

Form 109I Download Fillable PDF or Fill Online Maryland

Web satisfied 238 votes what makes the ca form 109 legally valid? Web the secure way to pay u.s. An extension allows you more time to file the return, not an extension of time to pay any taxes that may be due. Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated.

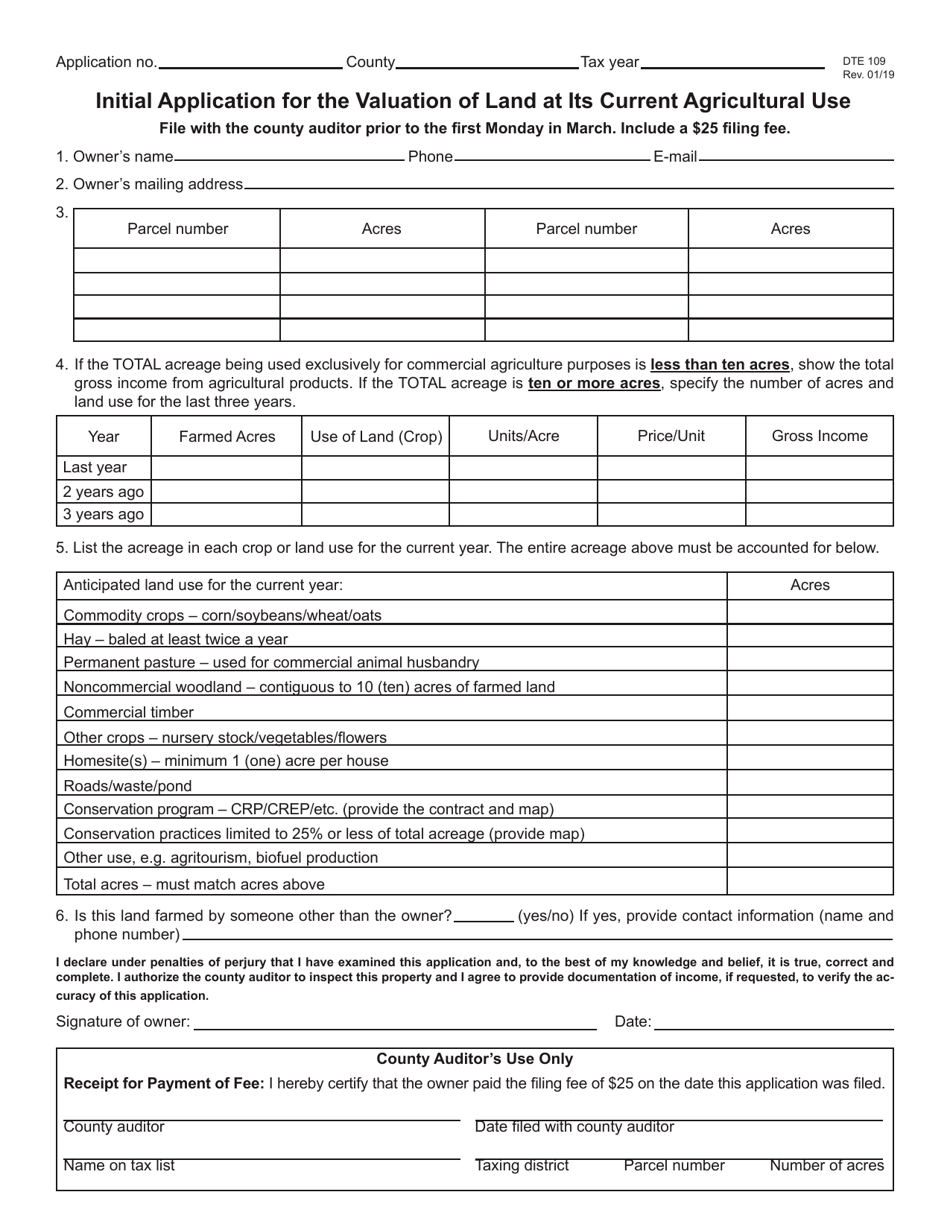

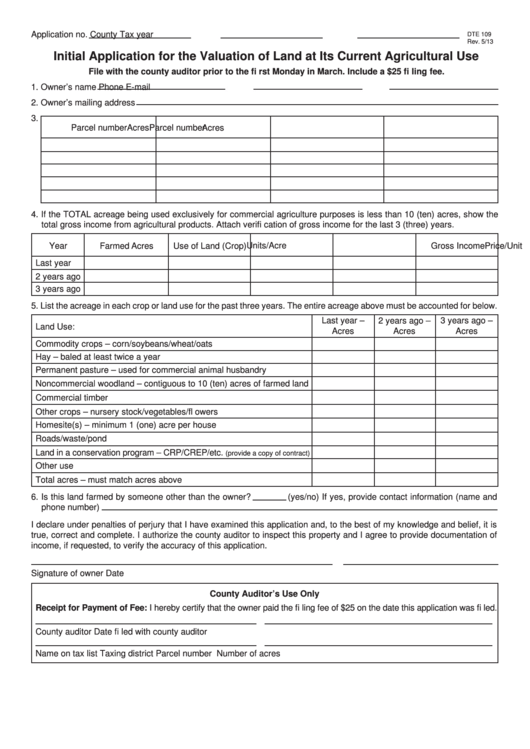

Form DTE109 Download Fillable PDF or Fill Online Initial Application

Web in order to take the transfer, the candidate has to fill form 109 issued by icai for the termination of articleship. Complete, edit or print tax forms instantly. We will grant an automatic 6. When we divide 109 by 22 it leaves a remainder. Web the secure way to pay u.s.

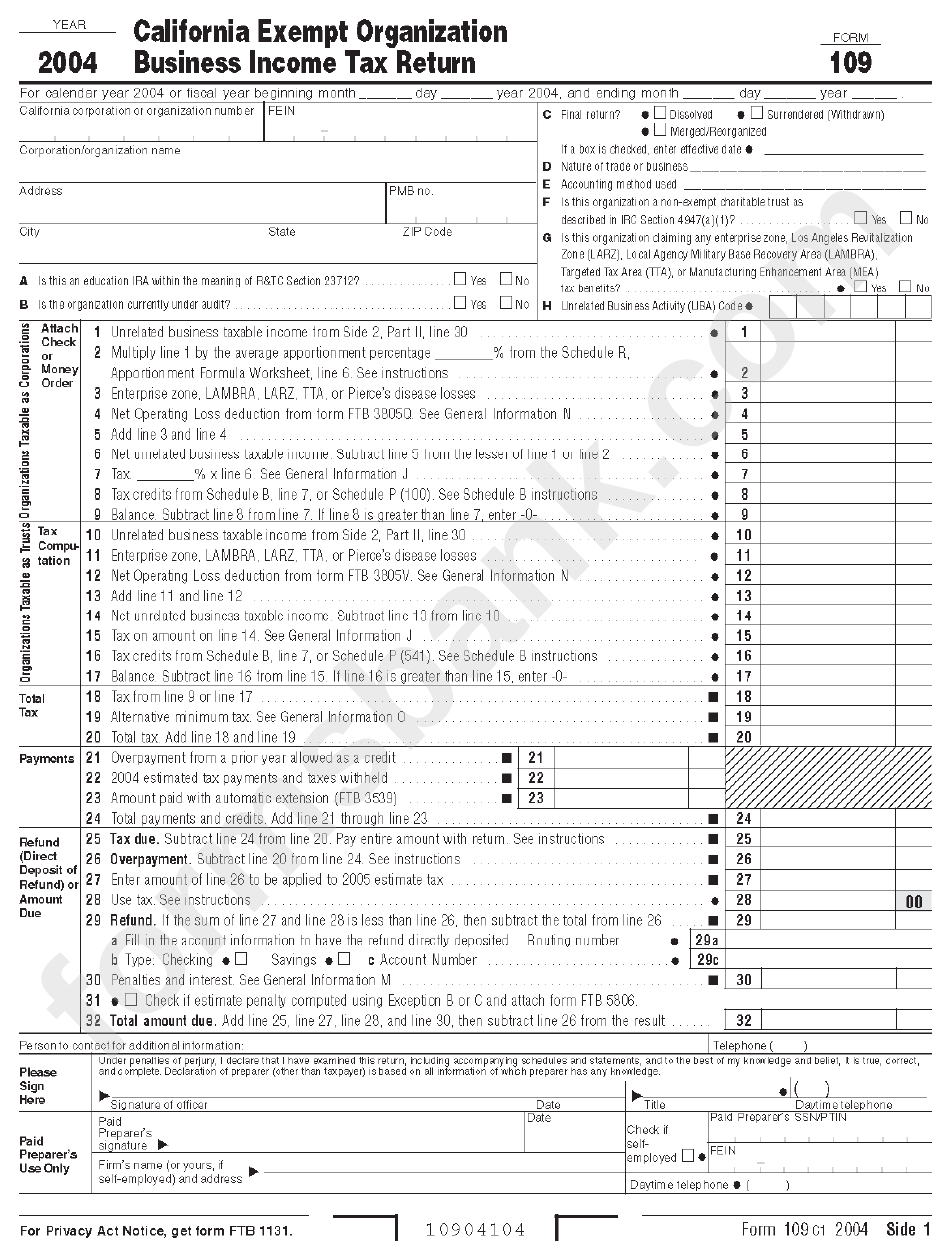

Form 109 California Exempt Organization Business Tax Return

1unrelated business taxable income from side 2, part ii, line 30.• 1 00. Download adobe reader ™ print page email page last. The termination letter is required to be submitted to. Get ready for tax season deadlines by completing any required tax forms today. Web use form 109, california exempt organization business income tax return, to figure the tax on.

Fillable Form Dte 109 Initial Application For The Valuation Of Land

Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. 2multiply line 1 by the average apportionment percentage. Web satisfied 238 votes what makes the ca form 109 legally valid? Web form 109 2022 side 1. Complete, edit or print tax forms.

Ch 109 Fill Out and Sign Printable PDF Template signNow

Web 109 ÷ 1 = 109 109 ÷ 109 = 1 the postive factors of 109 are therefore all the numbers we used to divide (divisors) above to get an even number. Web generally, form 109 is due on or before the 15th day of the 5th month following the close of the taxable year. Web form 109 is a.

Fillable Form 109 California Exempt Organization Business Tax

Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Get ready for tax season deadlines by completing any required tax forms today. Web form 109 2022 side 1. Here is the list of all postive. Web fincen form 109 march, 2011.

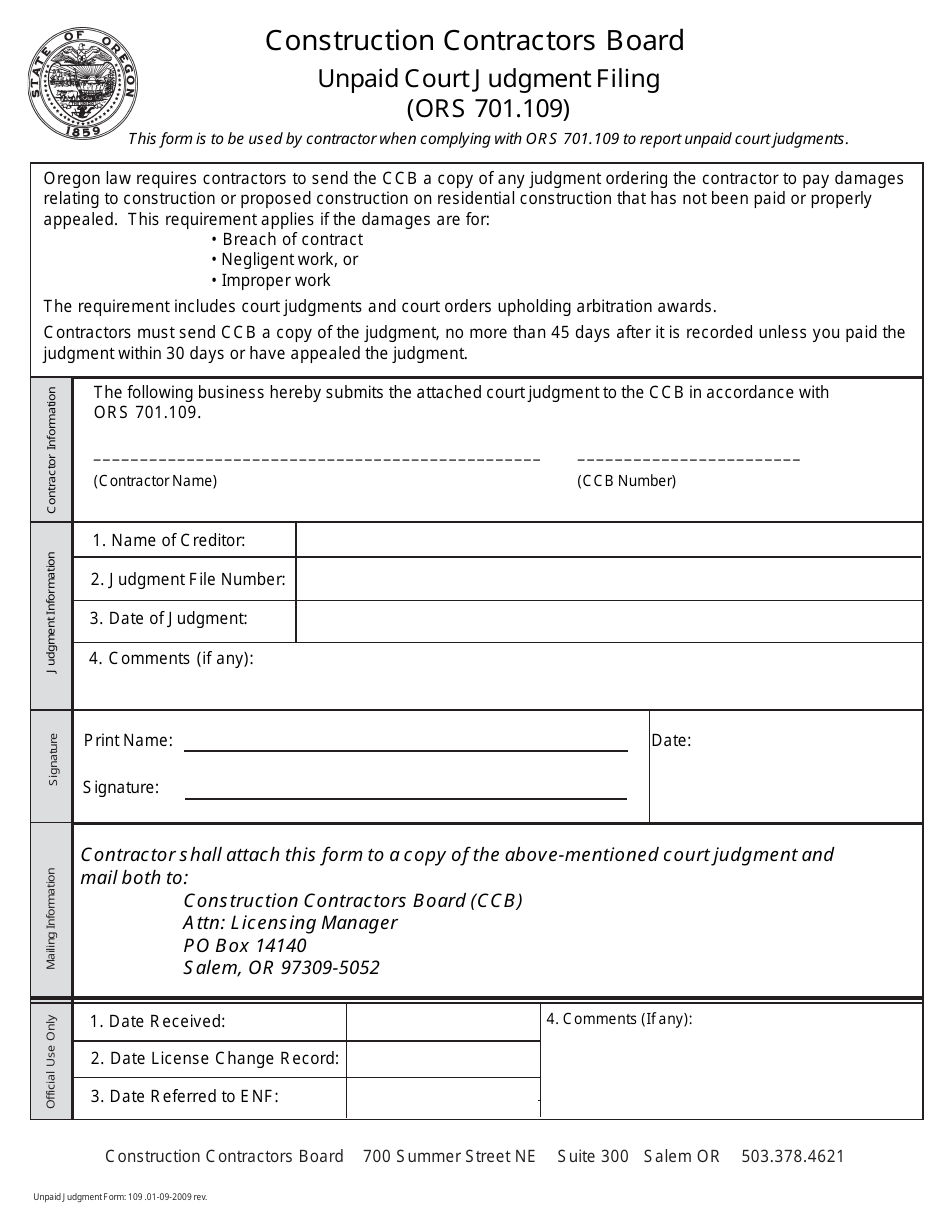

Form 109 Download Printable PDF or Fill Online Unpaid Court Judgment

Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. 1unrelated business taxable income from side 2, part ii, line 30.• 1 00. An employees’ trust defined in irc section 401(a) and an ira must file. Therefore, the number 22 is not.

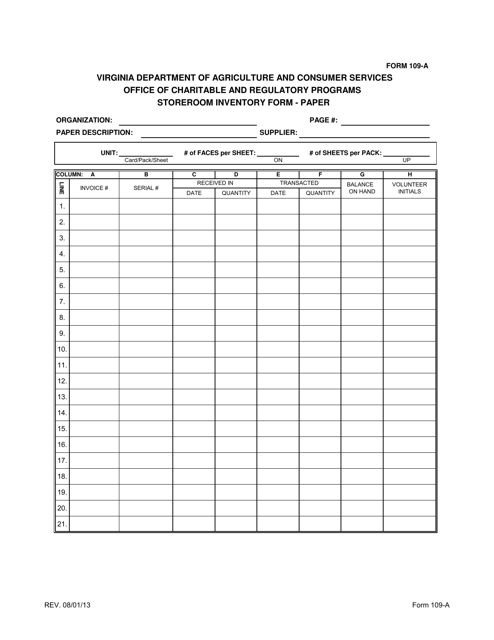

Form 109A Download Fillable PDF or Fill Online Storeroom Inventory

Here is the list of all postive. Repeating details will be filled. Ad access irs tax forms. Web the secure way to pay u.s. Filing form 109 does not.

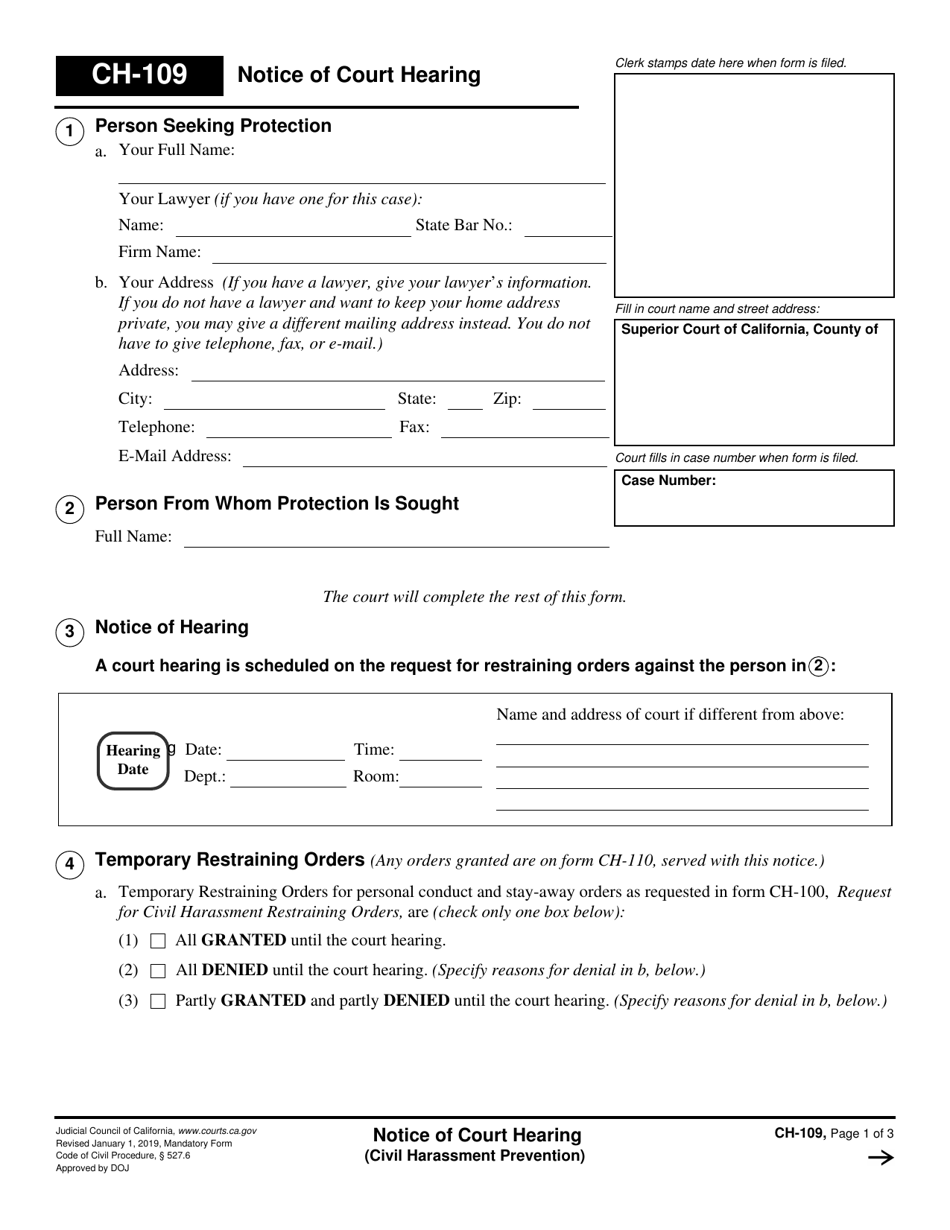

Form CH109 Download Fillable PDF or Fill Online Notice of Court

Ad access irs tax forms. At least $10 in royalties or broker. Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated business income of the organization. Find if 22 and 109 are factors of 109. This includes their name, address, employer identification number (ein),.

Top Fincen Form 109 Templates free to download in PDF, Word and Excel

Pdf versions of forms use adobe reader ™. Repeating details will be filled. An employees’ trust defined in irc section 401(a) and an ira must file. Find if 22 and 109 are factors of 109. Web satisfied 238 votes what makes the ca form 109 legally valid?

Web Fill In The Info Needed In Ca 109 Forms & Instructions, Utilizing Fillable Lines.

2multiply line 1 by the average apportionment percentage. Here is the list of all postive. Filing form 109 does not. Web the secure way to pay u.s.

When We Divide 109 By 22 It Leaves A Remainder.

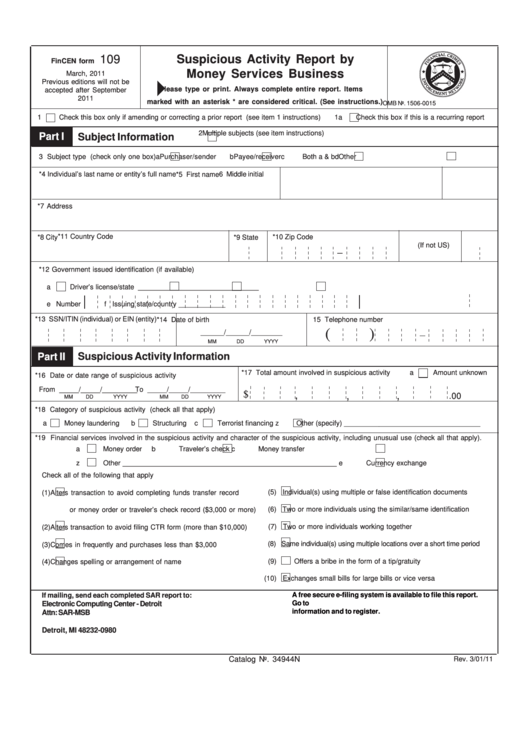

Download adobe reader ™ print page email page last. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Web fincen form 109 march, 2011 previous editions will not be accepted after september 2011 suspicious activity report by money services business please type or print. An employees’ trust defined in irc section 401(a) and an ira must file.

We Will Grant An Automatic 6.

This includes their name, address, employer identification number (ein),. Get ready for tax season deadlines by completing any required tax forms today. Web satisfied 238 votes what makes the ca form 109 legally valid? 1unrelated business taxable income from side 2, part ii, line 30.• 1 00.

Therefore, The Number 22 Is Not A Factor Of 109.

Find if 22 and 109 are factors of 109. Web form 109 is a california corporate income tax form. Web generally, form 109 is due on or before the 15th day of the 5th month following the close of the taxable year. Include pictures, crosses, check and text boxes, if it is supposed.