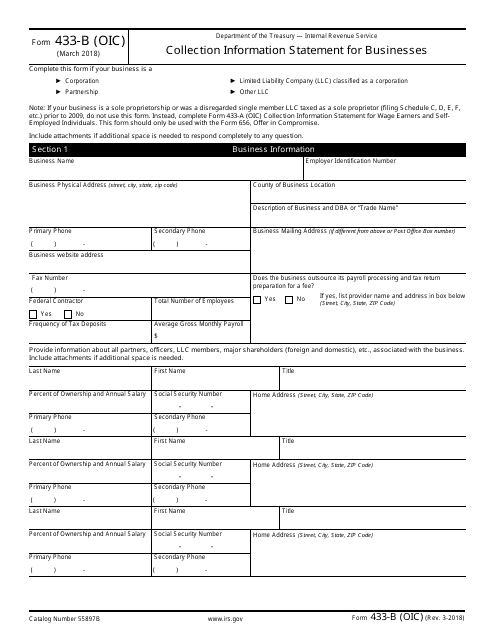

433B Irs Form

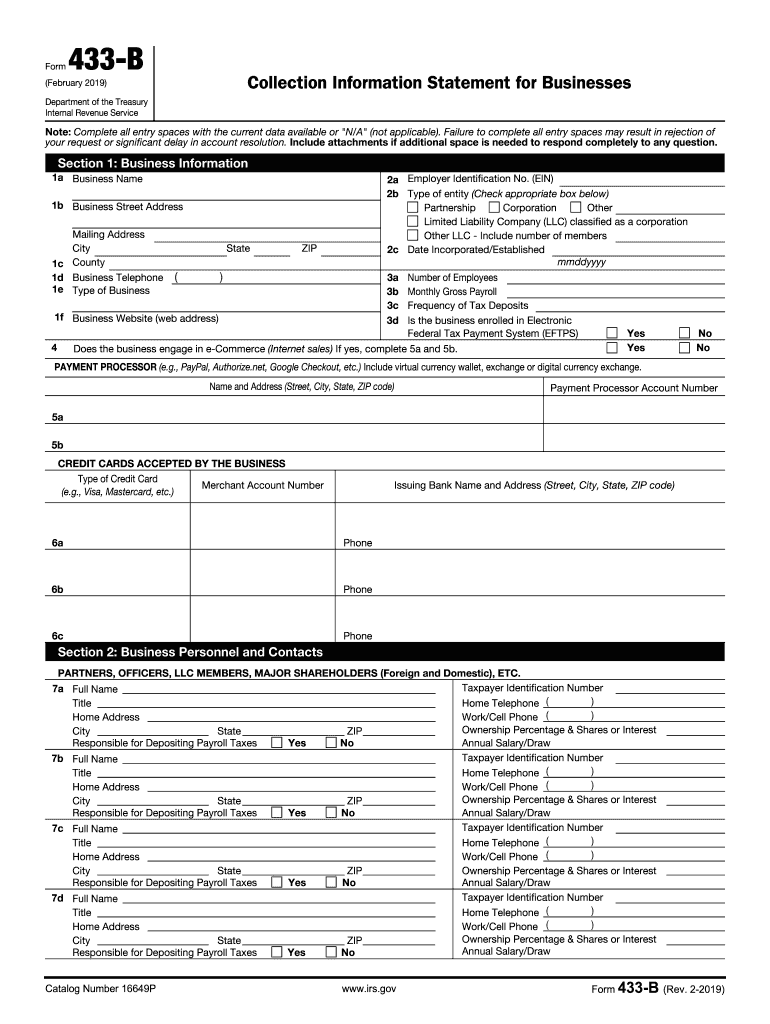

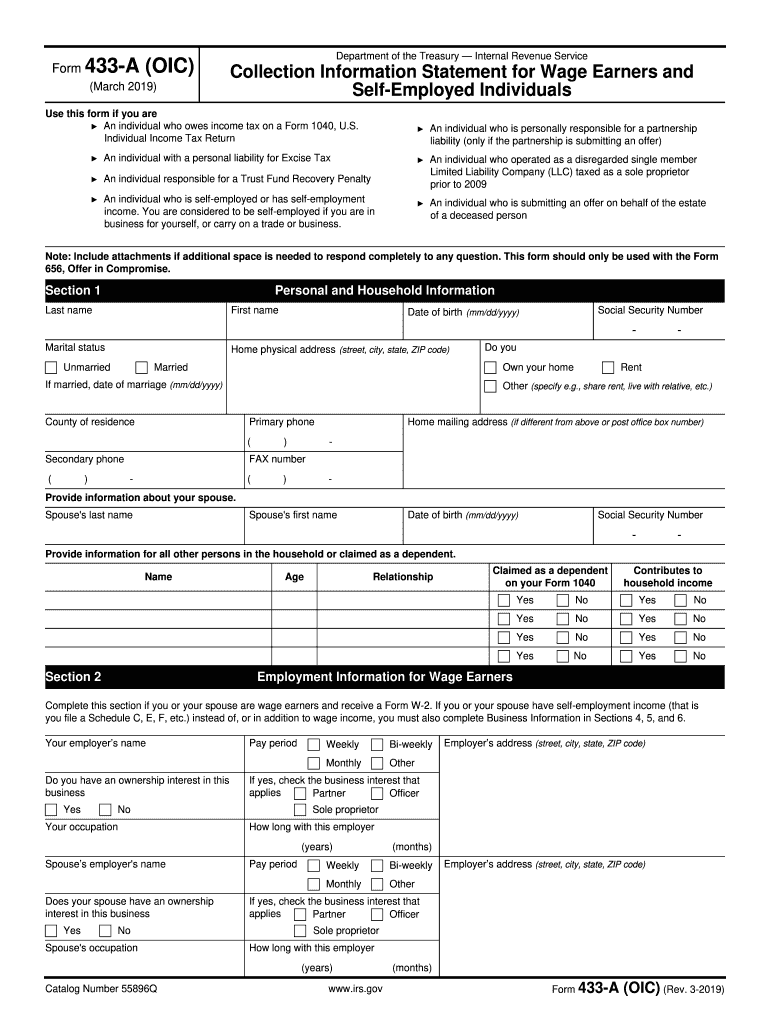

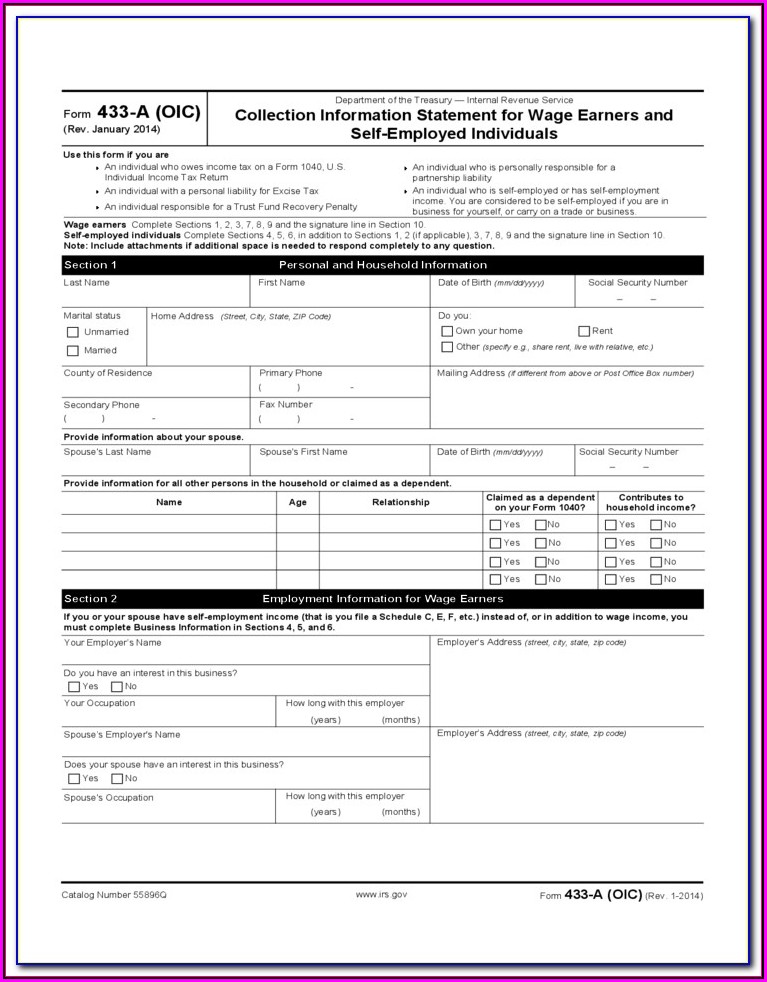

433B Irs Form - Answer all questions or write n/a if the question is not. The form should be completed as accurately as possible. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. If your business is a sole proprietorship do not use this form. • partnerships • corporations • exempt organizations Complete all entry spaces with the current data available or n/a (not applicable). The amount of the installment payments varies according to the business’s income and expenses, and the amount of the taxes owed. Use this form if you are an individual who owes income tax on a form 1040, u.s. Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution. Both forms are six pages long, but the sections.

Both forms are six pages long, but the sections. Complete all entry spaces with the current data available or n/a (not applicable). • partnerships • corporations • exempt organizations Web requesting non collectible status due to financial hardship, which delays your tax obligation. This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. The amount of the installment payments varies according to the business’s income and expenses, and the amount of the taxes owed. Use this form if you are an individual who owes income tax on a form 1040, u.s. If your business is a sole proprietorship do not use this form. Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution.

This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt. The amount of the installment payments varies according to the business’s income and expenses, and the amount of the taxes owed. Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution. Answer all questions or write n/a if the question is not. The form should be completed as accurately as possible. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Both forms are six pages long, but the sections. If your business is a sole proprietorship do not use this form. Use this form if you are an individual who owes income tax on a form 1040, u.s. Complete all entry spaces with the current data available or n/a (not applicable).

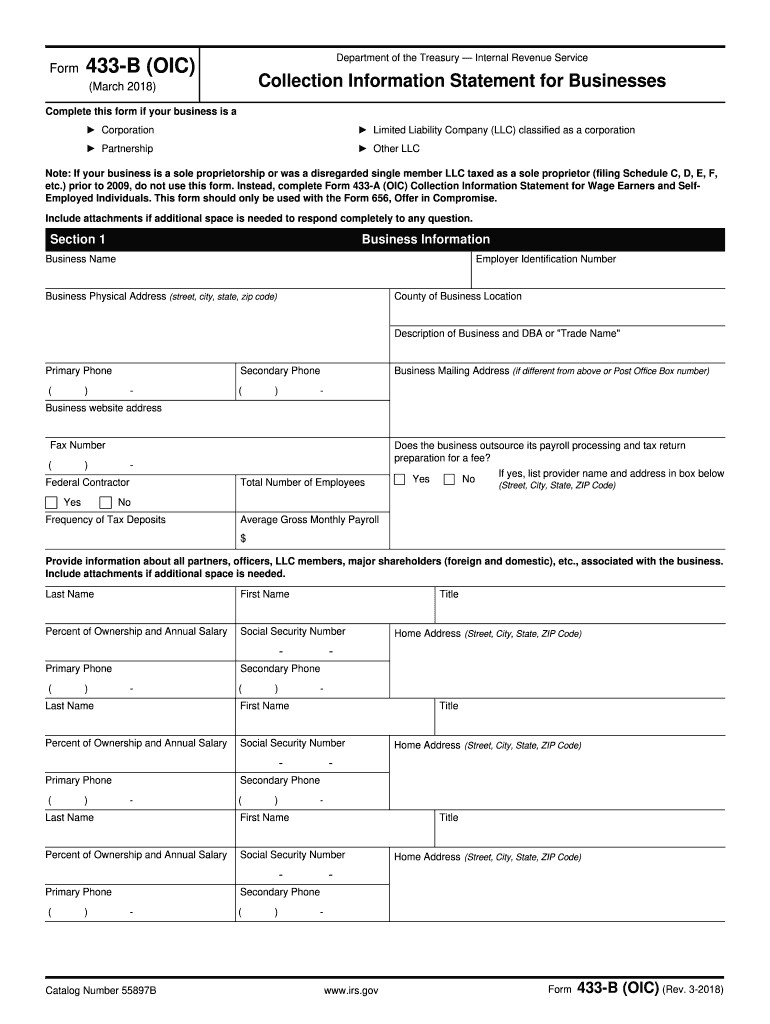

2018 Form IRS 433B (OIC) Fill Online, Printable, Fillable, Blank

Both forms are six pages long, but the sections. Answer all questions or write n/a if the question is not. This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt. If your business is a sole proprietorship do not use this form. • partnerships • corporations.

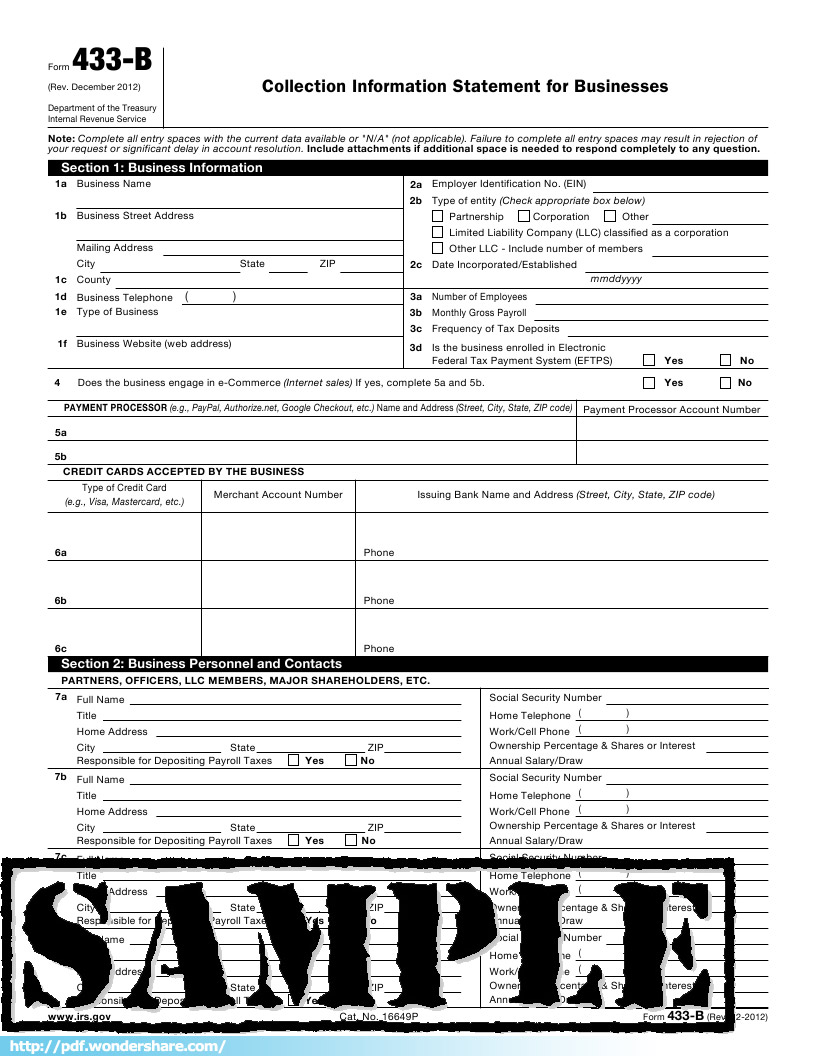

20192022 Form IRS 433B Fill Online, Printable, Fillable, Blank

Both forms are six pages long, but the sections. The amount of the installment payments varies according to the business’s income and expenses, and the amount of the taxes owed. • partnerships • corporations • exempt organizations Complete all entry spaces with the current data available or n/a (not applicable). The form should be completed as accurately as possible.

2019 Form IRS 433A (OIC) Fill Online, Printable, Fillable, Blank

This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution. • partnerships.

Fill Free fillable IRS Form 433B Collection Information Statement

• partnerships • corporations • exempt organizations This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt. Both forms are six pages long, but the sections. Use this form if you are an individual who owes income tax on a form 1040, u.s. The form should.

Irs Form 433 A Instructions Form Resume Examples emVKeel9rX

Both forms are six pages long, but the sections. Web requesting non collectible status due to financial hardship, which delays your tax obligation. This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt. • partnerships • corporations • exempt organizations The form should be completed as.

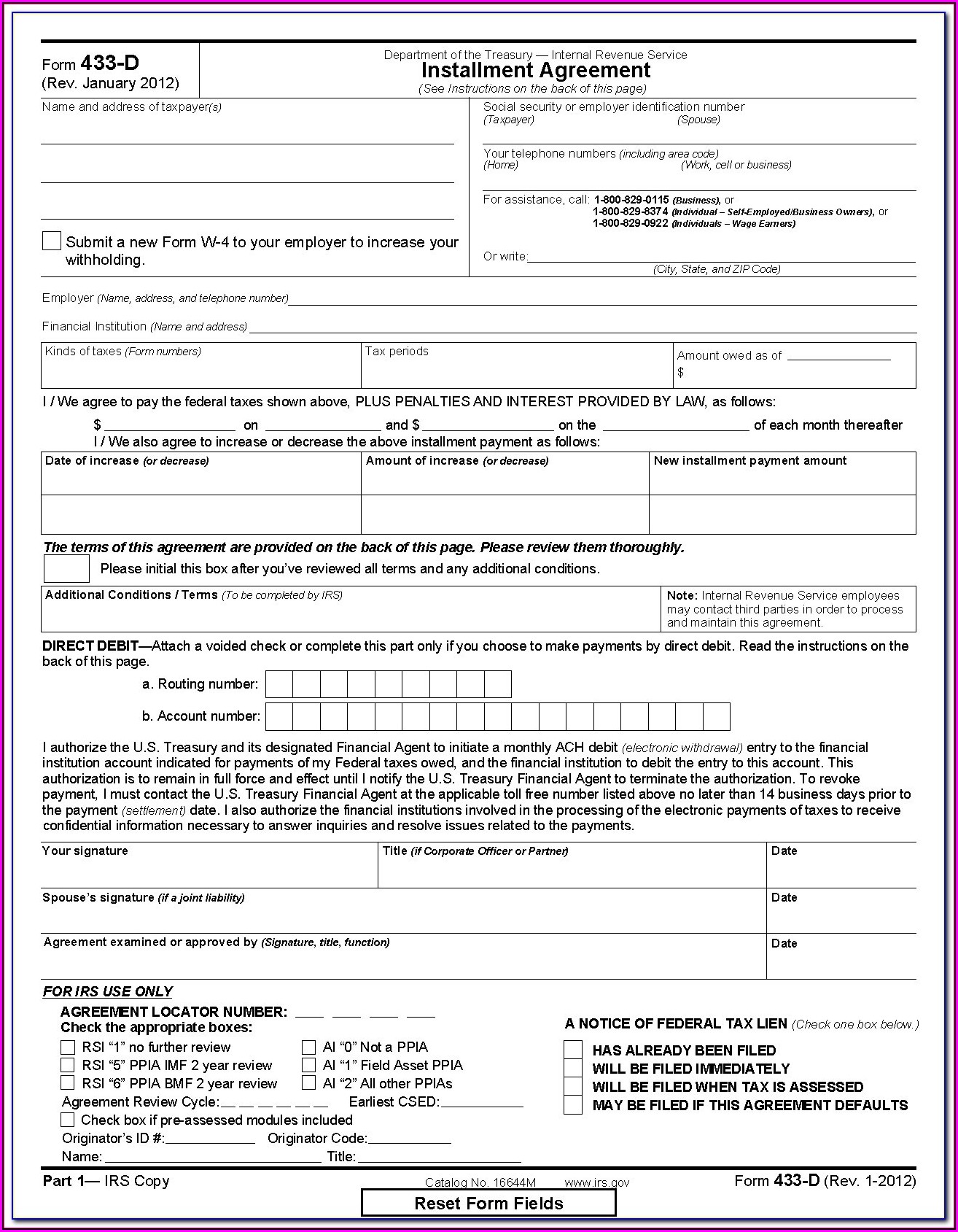

Steps & Forms To Prepare An Installment Agreement

Both forms are six pages long, but the sections. Use this form if you are an individual who owes income tax on a form 1040, u.s. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. This form is often used during a situation in which a business owes federal tax payments but cannot afford.

Irs Form 433 D Fillable Form Resume Examples YL5zejyDzV

Use this form if you are an individual who owes income tax on a form 1040, u.s. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. • partnerships • corporations • exempt organizations Both forms are six pages long, but the sections. The amount of the installment payments varies according to the business’s income.

IRS Form 433B (OIC) Download Fillable PDF or Fill Online Collection

Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution. Complete all entry spaces with the current data available or n/a (not applicable). This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt. • partnerships • corporations.

IRS Form 433B Free Download, Create, Edit, Fill and Print

If your business is a sole proprietorship do not use this form. Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution. Both forms are six pages long, but the sections. Answer all questions or write n/a if the question is not. Complete all entry spaces with the current data available.

Irs Form 433 D Fillable Form Resume Examples n49m1169Zz

The form should be completed as accurately as possible. Complete all entry spaces with the current data available or n/a (not applicable). Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total.

Complete Sections 1, 2, 3, 4, And 5 Including The Signature Line On Page 4.

The amount of the installment payments varies according to the business’s income and expenses, and the amount of the taxes owed. Use this form if you are an individual who owes income tax on a form 1040, u.s. Web requesting non collectible status due to financial hardship, which delays your tax obligation. If your business is a sole proprietorship do not use this form.

Answer All Questions Or Write N/A If The Question Is Not.

Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution. • partnerships • corporations • exempt organizations Both forms are six pages long, but the sections. Complete all entry spaces with the current data available or n/a (not applicable).

The Form Should Be Completed As Accurately As Possible.

This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt.